Last updated March 7th, 2024.

The basic concept of investing in almost anything is to “buy low, sell high.” It is an easy, straightforward strategy known by everyone grown enough to understand what making a profit is about.

Yet it’s truly surprising how many people seem to forget this mantra of value-seekers everywhere.

China’s real estate market was on a winning streak throughout most of the 2000s. In fact, local property buyers gained more than practically anyone else from the nation’s economic rise.

Homes in major Chinese cities saw the largest gains. Real estate prices in Shanghai, Shenzhen, Guangzhou, and Shanghai tripled between the new millennium and the 2008 Global Recession.

Something changed, though. Property transaction volume since the “boom years” have entered freefall – especially in China’s first and second-tier cities.

Meanwhile, Chinese real estate developers are cutting sales prices of their new projects – often by as much as 30%.

Rare signs of protest and public anger are showing as well. Would you be upset if you bought a condo but prices dropped six months later, giving new purchasers a better deal? That scenario is now a reality for some Chinese property owners.

You might think a website called “InvestAsian” would suggest buying real estate in China – Asia’s largest economy. But we don’t. Here are several reasons why you shouldn’t invest in China’s property market.

We’ll cover economic problems, the cost of Chinese real estate, if Americans and other foreigners can own land and more.

China’s Housing Oversupply Problem

Boasting the world’s biggest population with nearly 1.4 billion inhabitants (although India will take that title by 2030), there are still plenty of houses in China for sale.

Estimates place the number of unsold properties in China at over 50 million. That’s more than 1/5th of the entire country’s total private housing supply.

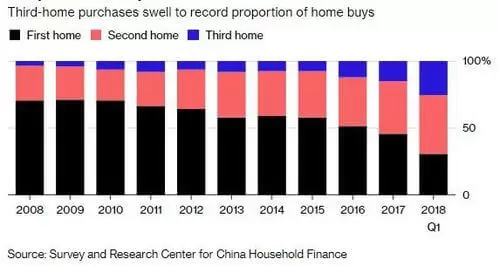

The government also curbed mortgage lending to reduce the number of speculative purchases and second/third home sales.

Fewer Chinese citizens are buying homes in order to actually occupy them anymore. This isn’t a good sign, especially when combined with population decline.

Second and third homes now make up a greater proportion of total residential houses for sale in China than ever before.

China will soon face a demographic crisis on top of everything else. Its population will peak at about 1.4 billion inhabitants by the year 2030.

After that, China will rapidly age while shrinking in population size. Lower demand for housing will be just one of many negative repercussions.

They’ll soon become the first country ever to grow old before reaching developed nation status – a dire situation for China’s real estate market and its economy as a whole.

We believe all those factors combined together will inevitably lead to a construction slowdown in China or even a property crash.

Stocks Sink First, Then Real Estate in China

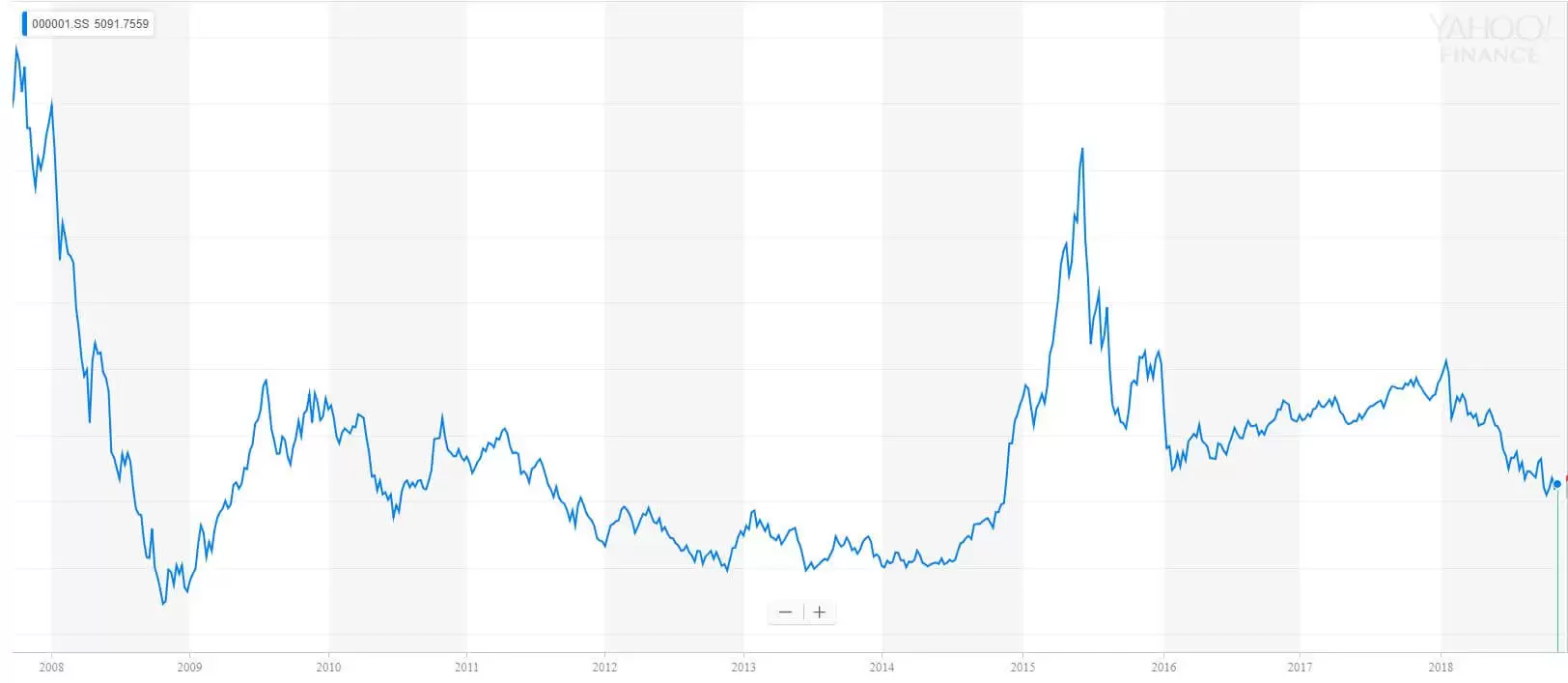

Equities in China have gone through a tough few years. Way back in 2015, the Shanghai Composite Index was above 5,000 points. The index has since plummeted by half into the ~2,500 range.

The China stock market decline hasn’t been reported as such by the media. Yet a drop of 50%+ is certainly more than just a simple correction.

Most unbiased equity analysts would call that a full-blown collapse without any hesitation at all.

10-year chart of the Shanghai Composite Index since 2008. China stock prices are selling below half their recent highs.

Why does the Shanghai Composite have anything to do with China’s property market? Because real estate values were only kept inflated by stock market outflows in the first place.

You see, Chinese investors firmly believe that property is a safe-haven asset. They’ve seen the stock market boom and bust cycles. However, real estate prices haven’t fallen ever since China began allowing private homeownership.

That’s a major reason why money began shifting toward commercial property in China soon after stocks collapsed. It’s also why Chinese real estate prices remained stagnant until recently despite a stock market collapse and poor economic data.

In other words, the China housing bubble was supposed to pop years ago. Outflow from the stock market simply delayed the inevitable.

Ever-stricter capital controls are geared toward ensuring that local wealth stays within Chinese borders.

Unfortunately, declining property and stock prices alike mean investors have fewer Chinese assets left to buy.

Trade War: If Things Weren’t Bad Enough

The US-China Trade War officially began and will probably stay for a while. Many analysts think the situation will worsen before improving in the long term.

Shots have already been fired. China and the United States have each imposed tariffs on $250 billion worth of each other’s goods. But China imports almost exactly $250 billion in products from America.

It’s not possible for Americans to buy property in China, nor can any other foreigner own land on a freehold basis.

While foreigners can’t buy a house in China, it’s very possible to own land in the US as a Chinese citizen. There are cases of states attempting to change this without much legal success.

Tariffs on China’s side are maximized. China, therefore, has only two ways left to respond to the United States. Each of those retaliation measures would harm their real estate market, though.

For starters, China could potentially devalue the Yuan further. The currency has already sunk beyond its psychological ceiling of 7.00 to the U.S. Dollar.

A weaker yuan would inevitably have the side effect of devaluing any assets denominated in Yuan, including all stocks and property in China.

Additionally, China might sell its U.S. treasuries. Yet this would make global interest rates skyrocket, in turn sinking the Chinese mortgage market, consumer spending, and real estate demand even further.

A trade war with the world’s biggest economy compounds China’s existing problems like falling asset prices and housing oversupply.

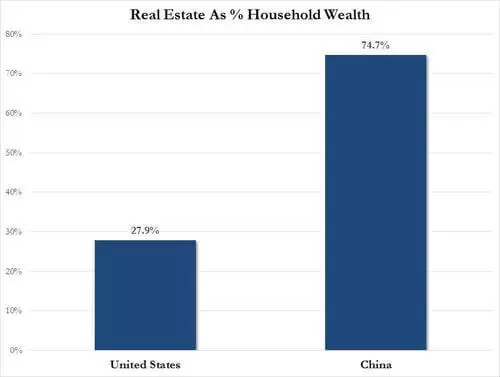

Compared to the United States, China’s percentage of household savings in the real estate market is nearly triple.

Foreigners Can’t Buy Property in China

Putting all the above aside, fundamental problems with China’s real estate market still exist.

One, you can never truly own property in China, whether you’re a foreigner or local. Every plot of land is technically owned by the state and can only be bought on a leasehold basis for up to 70 years.

This makes real estate in China a depreciating asset. If you (or any heirs) decide to sell a house in China 50 years after buying it, the fact that 20 years are remaining on your land use right would be reflected in the sales value.

Not only that, but foreign property buyers in China are severely restricted by law. Perhaps the worst limitation is that you must have already worked or studied abroad in China for one year and possess a long-term visa before buying real estate.

You may “own” a maximum of one apartment in China as a foreign buyer. Furthermore, you’re forever banned from renting it out and making any money off the home.

Many cities place additional limits on foreign real estate owners. In Shanghai, for example, you must marry a local Chinese citizen before owning property. Beijing demands that foreign purchasers show five years’ worth of tax returns.

Finally, owning property in China by itself doesn’t give you any right to live there as a foreigner. Compare that to countries like Thailand or Malaysia that give investors permanent residence.

Most foreign investors want the right to actually live in countries where they’re buying residential property.

It’s regrettable that you can’t ever truly buy a house in China as a foreigner. Nor will it ever entitle you to permanent residence, or any long-term visa.

Alternatives to Investing in China

People often ask us a seemingly easy question: “Is this a good investment?”.

Whether they’re talking about property in China or something entirely different, we must, and always, answer these types of questions relative to other investment options.

After all, opportunity cost is very real. Why would you buy a high-risk, low-return asset when there are thousands of superior options for growing your wealth?

We strongly believe that’s the case with property in China.

Asia boasts developed countries with less financial risk, where you can own freehold property while paying less money per square meter… and a permanent resident visa included on top of all that.

There are several better places to buy real estate in Asia as a foreigner for you to choose from. Depending on specific needs, you might consider investing in Malaysia, Cambodia, or the Philippines instead of China.

Should I Invest in China's Real Estate Market?

If you're a foreigner, property in China can't be rented out for profit. You can only use it for residential purposes.

Because of this, along with major restrictions on foreigners, we don't suggest real estate in China as an investment.

Can Foreigners Buy Property in China?

Foreigners can buy property in China on a leasehold basis of up to 70 years. Mind you, this isn't a restriction solely on foreigners. All land is owned by the state in China, and locals are subject to the same rules.

There are other restrictions as well, sometimes depending on the city. You also can't rent your home in China to tenants as a foreigner and it must be used for residential purposes only.

Can Americans Buy Land in China?

As a foreigner in China, whether American or otherwise, you can lease residential land for a period of up to 70 years. Commerical land is possible for a leasehold period of 40 years.