Update for October, 2019: This article was originally written in 2015. Our predictions were accurate and China stocks saw a significant decline over the past few years.

However, we’re still bearish on Chinese stocks and think they can fall even further. Information and numbers in this article were updated to reflect more recent figures.

Few people would have argued that China stocks were on fire.

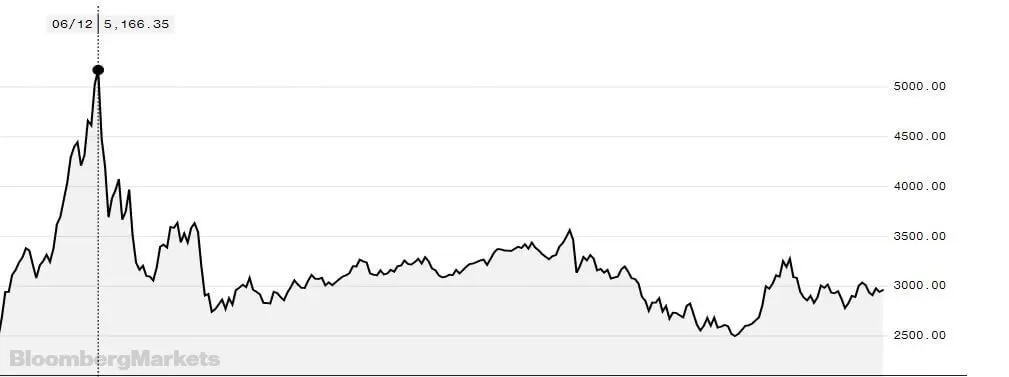

The Shanghai Composite Index rose by 149% back in 2015. Meanwhile, Shenzhen’s composite index increased 190% during the same time period.

China’s stock market achieved mainstream status among its local populace just as the nation’s economy and property market went through a cooling off period. This probably wasn’t driven by sound economics either.

Back in the 1990s and 2000s, it was common for Beijing release annual GDP growth numbers above 10%. But economic growth in the world’s most populous country is now at its weakest since the Great Recession in 2009.

Expansion is expected to fall into the high 5% range before 2020. And we haven’t even started talking about a looming US-China trade war yet. Placing sanctions and tariffs on China certainly won’t help their already dire situation.

As such, the Chinese economy is arguably carried higher by government stimulus and investor frenzy rather than fundamentals.

The Shanghai Composite Index suffered declines of up to 50% since its 2015 highs.

Stock Market Bubble in China: Will it Burst?

This raises the question: are Chinese stocks in the midst of a bubble? If so, is it still safe to buy stocks and invest in China?

Sadly, there are growing indicators of speculative fervor in China stocks. People in the country sunk much of their excess savings into the local real estate market throughout recent years.

Yet the bubble in China’s property market is finally deflating. Capital must go somewhere – and it’s piling into the skyrocketing Chinese stock market.

Likewise, Beijing started cracking down on capital flight in recent years, making it very difficult for people to transfer money out of China.

Real estate is bust. International investment options aren’t available either with Chinese capital controls now in place. Therefore, stocks are practically the only option available if you’re a local investor.

“There’s no question there’s a lot of domestic euphoria about equities within China,” according to Albert Brenner at People’s United Wealth Management.

China Stocks Are Traded “Just for Fun”

A poll by CNN Money revealed that retail investors trade China stocks frequently to “have fun”, treating the act of investing less like a plan of long-term growth and more of a casino game.

Regardless, non-Chinese investors are along for the ride too. Exchange-traded funds that track China – the most popular way for foreign investors to play China – have also soared lately.

The iShares MSCI China ETF (MCHI) and SPDR S&P China ETF (GXC) both rose over 20% in early 2018 despite a broader sell-off. However, even these top-performing funds weren’t immune to a summer rout which forced them to hit multi-year lows.

Liquidity that was pumped into markets by rate cuts from China’s central bank is yet another ill omen.

Part of this is was because of the Hong-Kong Shanghai Stock Connect, which lets investors buy stocks in Shanghai through Hong Kong and vice versa, even though the cross-border program is less popular than expected.

Does a Bubble Exist? Analysts Offer Mixed Opinions

Despite all this, many are still bullish. Goldman Sachs does not seem to be too worried about the current situation.

Timothy Moe, co-head of macro research in Asia at Goldman Sachs, told CNBC that the market “certainly is getting frothy” amid “very frenetic retail activity.” However, he doesn’t yet see it as the “bubble that will crash the system”.

Others are less optimistic. Multiple investment officers such as Ankur Patel, chief investment officer at R-Squared Macro, thinks that a bubble certainly exists.

Analysts like them say that instead of enjoying the ride, people should stay away from China stocks altogether.

“The problem with any bubble is if you bet against them, bubbles can become more irrational. The herd mentality can essentially run investors over,”

For those wanting to invest in Asia, it may be worth looking at nearby frontier markers rather than the Chinese stock market.

Just to the north, the Mongolian economy is booming. Myanmar and Cambodia are also great options.

Each of them, unlike China, now enjoy strong demographic trends and numerous high-growth industries.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.