Emerging markets are a crucial asset class for investors who seek total diversification and potentially higher long-term gains.

In itself, the term “emerging markets” involves dozens of different countries from around the world, each with their own individual economic prospects.

Because of this, painting all emerging markets with a wide brush isn’t practical. High net worth investors seek a more targeted approach that depends on their own specific goals.

For example, Malaysia is on the verge becoming a fully developed economy. They enjoy a GDP per capita above $12,000 which is four times higher compared to the Philippines.

Yet both of these places fall under the same vague “emerging market” umbrella despite a vastly different economic situation.

Likewise, an Indonesian oil company has far different long-term potential and risk than a retail business in China.

You can easily understand why emerging market stocks and real estate will, by nature, vary significantly based on the nature of the investment.

Still, because of their rapid growth and strong demographic trends, you’ll generally find great opportunity in emerging markets. Knowing where exactly to invest is crucial though.

Here are some pointers about the best ways to invest in emerging markets, based on our many decades of combined on-the-ground experience.

Don’t Buy Emerging Markets ETFs

Quite frankly, there are countless stock traders giving poor advice on the internet. Many of them have never done any type of business in the developing world.

Let’s help dispel some myths before getting into the ideal methods of emerging market investment

One widespread piece of advice is that you should buy an emerging market ETF or mutual fund as a solution.

These type of funds are easily-tradable and, admittedly, are the two easiest methods of owning assets in developing nations. But they’re also probably the worst ways to do so.

Perhaps most important reason to not invest in emerging markets ETFs is that they don’t actually buy assets in emerging economies.

Yes, you read that correctly. Lots of emerging market mutual funds and ETFs don’t even live up to their namesake and are blatantly misclassified. They consist largely of equities in developed markets.

One of the biggest emerging market ETFs in the world, iShares MSCI Emerging Markets (NYSEARCA:EEM), puts over 30% of its holdings in developed economies.

Two out of the three top countries they invest in are South Korea and Taiwan!

Places like Qatar and the UAE are somehow on their list as well. By using any reasonable standards, those are among the wealthiest nations on Earth and certainly aren’t emerging markets.

China also takes up more than 30% of the ETF’s holdings. There are now over $50 billion dollars in this fund even though half of EEM’s assets are held in either developed nations or China.

Besides the lack of actual investment in emerging market stocks, these ETFs also place unusually high allocation on tech. In fact, seven out of the EEM’s ten largest holdings are in the tech industry.

This simply isn’t consistent with a diversified portfolio or the real opportunities that exist in emerging markets.

Indeed, emerging market funds and ETFs remain convenient, especially if you’re a foreign trader. They remain the most common method of buying stocks in developing Asia.

However, you should consider a different path if you truly want to invest in emerging markets the right way.

Invest in Emerging Markets Directly

If you shouldn’t buy mutual funds and ETFs, that leaves you with direct investment in emerging markets.

Moving somewhere like Cambodia and starting a company is often the best (and hardest) way to invest in high-growth economies. Let’s be real though: that’s not practical for most people.

Buying up real estate in strategic locations may also lead to impressive gains over the long term, giving you both rental income and appreciation.

We’ll start off with the easiest way you can invest in emerging markets directly: owning individual stocks.

To be perfectly clear, that’s in contrast to purchasing a basket of stocks through a mass-market fund or ETF. There’s a very distinguishable difference.

You can purchase individual stocks in Asia, South America, and elsewhere without leaving your home because most brokers offer international trades.

Charles Schwab and Fidelity, two of the largest American brokerage firms, allow trading in over a dozen countries.

Furthermore, a few emerging market stocks list themselves in countries other than where they are based. Baidu, to give one example, is traded on both the NASDAQ and in Hong Kong.

With that said, we think making international trades using a local account is much better. Your existing broker might let you trade in other countries. But you should still put forth some effort and open local brokerage accounts in the places you’re investing in.

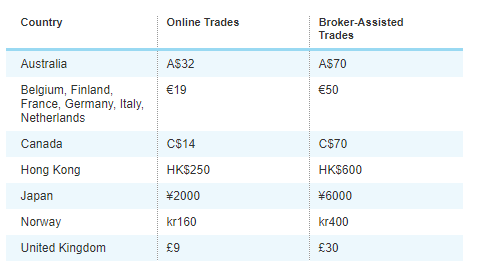

The fee structure of a major American brokerage. International trade commissions are often as high as 10x the amount a local stock broker in Asia would charge for the same transaction.

That’s because brokers usually charge outsized fees for international trades. By nature, you’ll pay much more commission than if you’re trading with a local account.

For example, US-based Charles Schwab charges HK$250 per trade if their clients want to buy or sell stocks in Hong Kong. Local firm Boom Securities charges HK$88 for the same trade.

Plus, buying shares of multi-billion dollar firms listed in New York negates most of the reasons why you should invest in emerging markets in the first place.

Stocks like Baidu have unattractive valuations and are over-analyzed by every single bank on Wall Street!

These aren’t exactly the types of hidden gems in that make outsized returns, nor are they the best way to invest in emerging markets if you want a return optimized asset.

Real Estate vs. Stocks in Emerging Markets

Trading stocks is solid way to invest in emerging markets… if done correctly.

Places like Vietnam and the Philippines have tons of undervalued small-cap stocks that see practically zero analyst coverage.

However, setting up your own business or purchasing real estate in those countries is often an even better choice.

The reasons are similar to why small-cap stocks in Vietnam have greater potential than ones listed in New York. Easily-accessible markets are already flooded with major players.

Hedge funds and banks spend billions of dollars on highly-paid analysts and complex software. These firms will buy stocks with any true, mathematically-proven value before you even realize the opportunity exists.

Morgan Stanley isn’t buying apartments in Manila though. The “normal” investors can still find value in emerging market real estate before everyone else does.

In a similar way, places like Cambodia lack basic business concepts that you might take for granted in your home country.

There aren’t any drive-thru car washes or major e-commerce players in markets such as the Philippines or Cambodia yet.

Because of this, it’s natural that entrepreneurs have plenty of opportunities in emerging markets, and especially in frontier markets if you’re willing to go a step further.

We understand that not everyone can fly to Indonesia and spend time buying property or starting a business on a whim.

Yet that’s part of the reason why direct investment is the best way to invest in emerging markets.

Entry barriers can keep out institutional buyers and help maintain attractive valuations… globally-minded investors just need to break through them.

Finally, remember that not all emerging markets are growing quickly and it’s important to pick the right country. Here are three of them that you should completely avoid.

FAQs

What is an Emerging Market?

An emerging market is one with a newly-industrialized economy that meets some criteria of a developed nation, but hasn't yet reached a sufficient level of overall wealth.

While emerging markets have a great deal of investment opportunity, they're often difficult to access and have a higher degree of risk than developed markets.

A few examples of emerging markets include China, Thailand, and Malaysia.

What is a Frontier Market?

Frontier markets are either too small or not developed enough to be classified as emerging markets yet.

Generally, frontier market economies are growing quickly, and propelled by internal factors such as population growth and urbanization.

Several examples of frontier market economies include Cambodia, Nepal, and Vietnam.

How Can I Buy an Emerging Market ETF?

Practically any large brokerage firm, including IBKR, Fidelity, and Schwab, will allow you to trade emerging market ETFs.

However, for reasons stated further above though, we don't suggest these ETFs.

What's the Best Way to Invest in Emerging Markets?

While an ETF is the easiest method, the most effective way is to invest in emerging markets directly by either owning individual stocks or real estate.

What's the Largest Emerging Markets ETF?

Vanguard FTSE Emerging Markets (VWO) is the largest emerging market ETF in the world with over $50 billion of assets.

The second biggest such ETF is iShares MSCI Emerging Markets with about $15 billion under management.