Last updated April 12th, 2023.

China’s goals are becoming even more globally ambitious as its size and influence grows.

Having already taken the title of world’s largest economy in terms of purchasing power parity, this trend will almost surely continue into the 2020s.

Right now, China is focusing on three main areas: its currency, role in the global economy, and outbound foreign investment.

Beijing’s actions will impact just about everywhere on the entire planet: whether we’re talking about developed countries like the US and Japan, or emerging economies such as Mexico and Thailand.

However, China will almost certainly affect frontier markets more than anywhere else. That’s because a huge amount of Chinese capital and knowledge now goes toward developing these rapidly growing nations.

In fact, you should probably invest in Asia’s frontier markets instead of China itself. Countries including Kazakhstan, Laos, and Vietnam have all of China’s upside, while limiting themselves from nearly of their larger neighbor’s downside potential.

Quite simply: China has more capital to invest in nearby countries than ever, giving a boost to their economies.

Yet compared to places Cambodia or even Vietnam, China’s own demographic trends are extremely weak and there are few remaining internal growth factors.

The Yuan Goes International

China’s yuan is increasingly used as a global currency. They’re setting up trade deals and swap agreements with dozens of countries each year.

Beijing is doing everything they can to internationalize the yuan. They boast size and influence, but a major worldwide currency is one of few things the Chinese economy lacks.

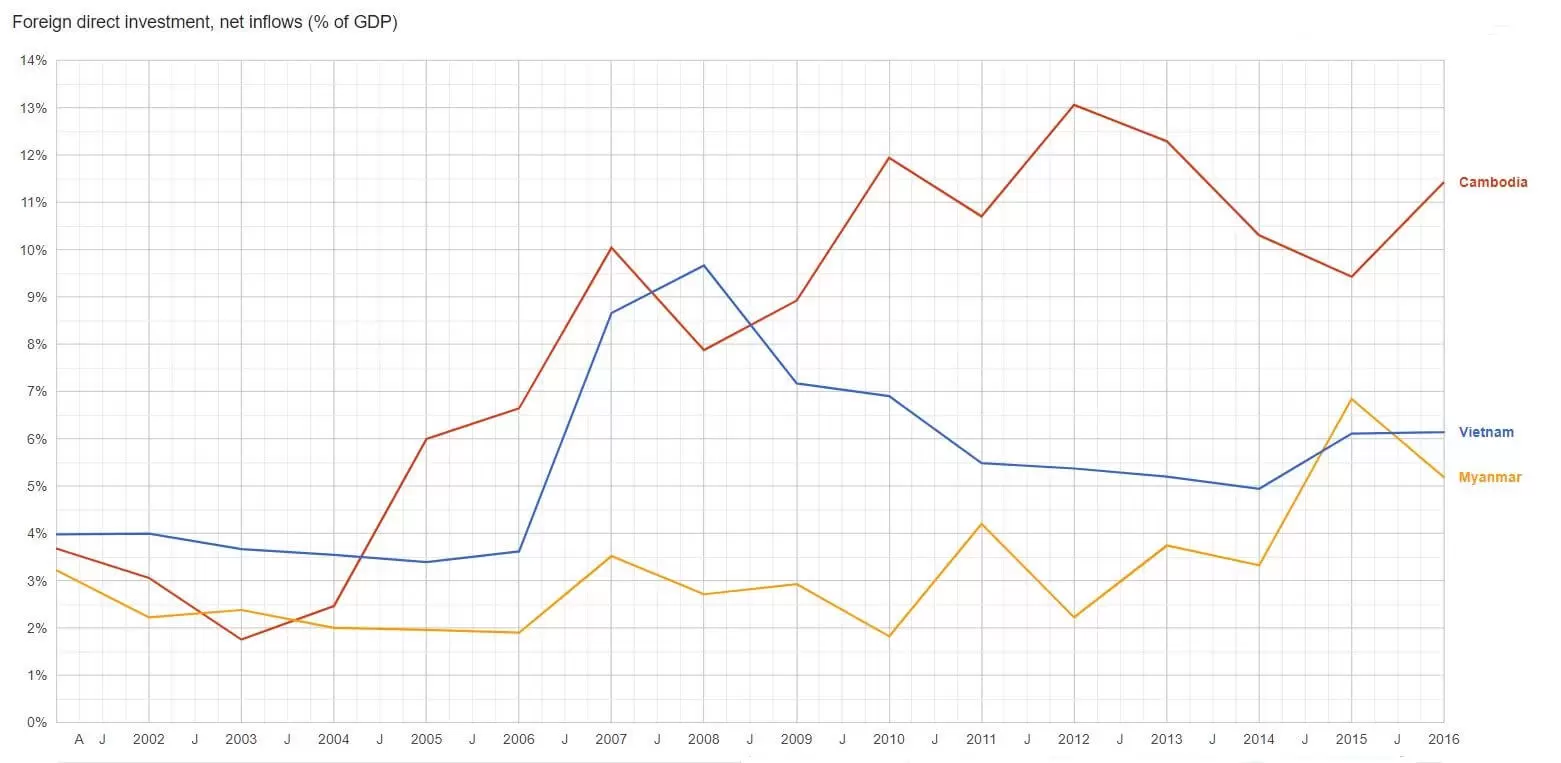

Foreign direct investment (FDI) has soared across Asian frontier markets since the early 2000s. A major reason why? The fact that they now have a new, easy financing option nearby in the form of an internationalized Yuan.

Yet China’s efforts to internationalize its Yuan didn’t just start recently. Back in 2014 alone, the Singapore exchange listed its first stock denominated in yuan and London hosted its first bond yuan-denominated bond.

During the same year, China’s Yuan became Asia’s most actively traded currency too. That’s on top of countless other developments all throughout the 2010s.

Although perhaps the most crucial evidence of Beijing’s ambitions was their campaign to have the yuan included in the International Monetary Fund’s SDR (Special Drawing Rights) basket.

The SDR is re-weighted every five years, and is held by most central banks around the world as an asset on their balance sheets. Essentially, it’s a basket that’s meant to represent the world’s most widely-traded currencies.

Why is the SDR important? For starters, being part of the SDR is a general sign of confidence in a nation’s currency. The U.S. Dollar, Euro, Japanese Yen, British Pound – and now China’s Yuan – are the five notes included in the SDR.

China’s yuan was non-deliverable barely a few years ago, and certainly wasn’t included in the SDR’s weighting.

Today, in 2023, it’s not only included but at a weighting even higher than the British Pound’s.

How Does This All Impact Frontier Markets?

Frontier markets could benefit most from greater investment and stability in China’s currency.

Thirty different nations, and counting, have currency swap deals with China. Many of these are frontier markets including Mongolia, Nepal, Cambodia, Ukraine, Laos, and others.

Such pacts are similar to lines of credit, giving these countries’ central banks some emergency liquidity during a period of slow growth.

Furthermore, China has a history of valuing a currency’s stability. China’s yuan was one of the world’s best performing currencies following the 2008 Financial Crisis.

As such, frontier markets can access easy liquidity in the form of a stable yuan if another crisis strikes.

China’s Infrastructure and Development Goals

Seemingly everywhere from Canada to Columbia are joining the China-led Asian Infrastructure Investment Bank (AIIB). Considered a counterweight to a western-dominated World Bank, AIIB positions China as an infrastructure powerhouse.

Infrastructure has been one of China’s strengths for a long time. Much of their effort in frontier markets focuses on Africa, yet they boast a massive amount of ongoing and complete projects across the world.

You only must look at the China Road and Bridge Corporation’s website to understand. They have plenty of examples.

Once the AIIB gets into full-swing, greater competition should lead to lower interest rates and more funding for frontier markets looking to borrow capital.

In turn, this will create jobs and infrastructure in Asia’s developing countries… along with tons of investment opportunities for people like you and I.

Phnom Penh, Cambodia’s growing skyline in 2023. State spending gets a lot of media attention, yet China’s private companies offer a far greater amount of financing in Asia’s frontier markets.

The Growth of Chinese Foreign Investment

A worldwide yuan provides China with numerous benefits. First off, a global currency leads to a more open capital account.

Numbers from China’s Ministry of Commerce state that outbound foreign investment exceeded US$150 billion.

This was the largest amount ever. Most notable though, is that Chinese investors were heading to emerging and frontier markets rather than developed countries.

Chinese investment in the EU declined 15% while investment in Latin America, Oceania, Africa and Asia grew by 133%, 52%, 34% and 17% respectively.

Practically all this capital is flooding into emerging and frontier markets. Latin America enjoys a decent share of this growth – albeit not quite as much compared to Southeast Asia.

Why would China invest in Latin America? The motives could be political and involve “playing in the United States’ backyard” so to speak.

In addition, most countries that still recognize Taiwan are in Latin America. China has a history of trying to lure them to its side through investment.

One region worth keeping an eye on is Central Asia. China’s Belt and Road Initiative means this area will play an important role because of its strategic location and historical involvement.

How Can You Invest in Frontier Markets?

There are many different ways to profit from frontier markets and China’s crucial role in their rise.

One method is to open a brokerage account in Hong Kong and trade stocks that will benefit via the Shanghai-Hong Kong Stock Connect.

Some ETFs also invest in either a single frontier market or a diversified group of them. You can only trade the majority of these on U.S. financial markets though. Or at least through a broker based in another top financial hub like Hong Kong or Singapore.

However, the best way to profit in frontier markets might be going there and directly investing in them yourself.

The world’s best opportunities aren’t found on the New York Stock Exchange – and they often require a bit of effort.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.