Last updated January 13th, 2024.

The term “emerging market” brings to mind a country with an outstanding economy growing quicker than most.

Emerging markets are typically going through a phase of rapid urbanization, rising foreign investment, and improved infrastructure quality.

All these things help emerging markets, quite frankly, emerge like their namesake says.

Not all emerging markets enjoy a robust economy, though. Wealthy nations like Taiwan and Singapore are even seeing higher growth than the developing countries below.

Here are three emerging markets you should probably avoid. They’re all going through a period of tepid GDP growth and don’t exactly have a bright future ahead.

For now, most investors should pass on these places – whether we’re talking about buying stocks, real estate, or private equity.

Although the world is constantly changing, the three emerging markets on our list aren’t truly emerging at all.

Turkey

Turkey has gone through a rough several years, to say the least.

Once the darling of European investors, foreign capital began fleeing Turkey following political uncertainty and the lira’s dramatic fall.

The general elections in 2023 helped cement Erdogan’s grip on power, marking a continuation of Turkey’s problems. The lira depreciated by more than 20% against the US dollar in the month following his reelection.

While the nation’s GDP rose in lira over the past few years, the Turkish economy fell nominally from last decade’s highs of US$957 billion to under $800 billion in 2023.

Likewise, foreign business interests were kept away from Turkey even before 2020. Regional security risks, along with a renewed war with Syria and the Kurds and the Ukraine-Russia war, were putting investors on edge at the time.

The lira’s recent crash absolutely didn’t help; the country was in poor shape to begin with, quite frankly.

Like many other emerging markets, Turkey relies a fair amount on tourism. Yet this sector is unstable. They can’t depend on a large amount of wealthy Russian migrants forever.

It’s now up to Erdogan to improve the Turkish economy. The problem? There’s not much more he can do.

Disappointing growth figures are set to continue well into 2024 and beyond amid Turkey’s high inflation.

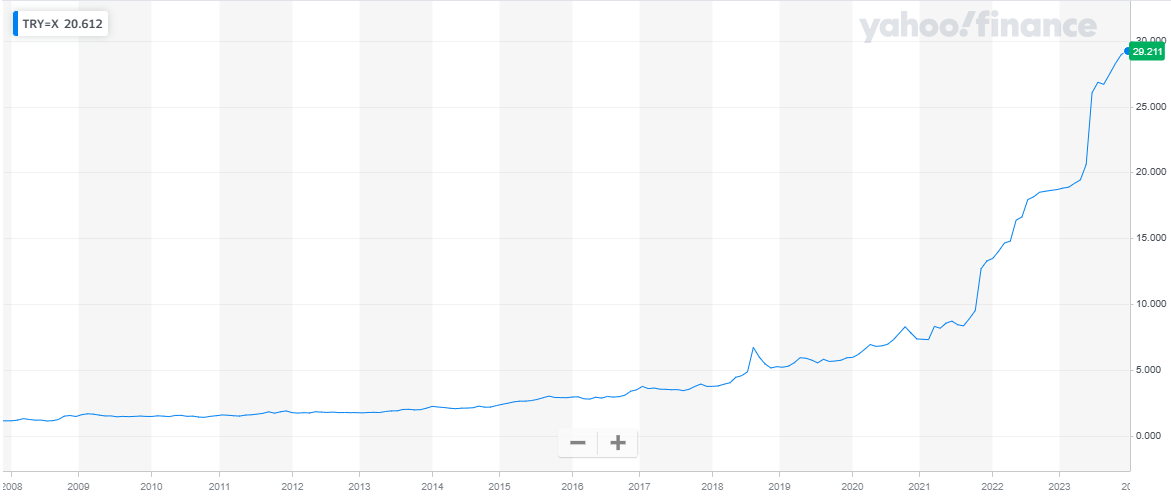

A fifteen-year chart of the Turkish lira compared to the US dollar. The lira has lost around ten times its value over the last decade. Remember: when you invest in a country, you’re also taking a position on the future of its currency.

Thailand

A military coup took control of Thailand back in 2013, which was largely responsible for a decade worth of slow development.

Thailand’s economy, which once boomed in the 1990s and early-2000s, commonly saw GDP growth below 3% during the entire decade of the 2010s.

Not very impressive for an “emerging market,” to put it lightly.

In 2023, elections saw am outpouring of votes for “pro-democratic” parties such as Move Forward and Phue Thai. Many considered this a sign that the “Land of Smiles” was finally turning a new leaf.

Yet the new leadership, led by the Shinawatra-backed Phue Thai party and backed by the previous military government, hasn’t shown any significant change to the Thai economy.

One could easily say there’s a new government but it doesn’t really matter.

After all, political uncertainty and risk of natural disaster aren’t even the start of all the economic problems in Thailand, where consumer debt levels are now barreling toward 100% of GDP.

While not precisely scared off, foreign companies are reluctant to pledge more capital. The Thai government’s relatively strict control over the internet, combined with legal feuds targeting Facebook and Google, don’t help sentiment in the tech industry.

Not to mention, it’s not possible to own over 50% of a company in Thailand as a foreigner. You must have a local partner to do business here.

Practically every other emerging market in Southeast Asia lets foreigners own 100% of a business without hassle. Naturally, this forces foreign firms to expand into other nearby countries instead of Thailand.

Why would a multinational pour billions of baht into a Thai subsidiary which they don’t even own half of?

In the most basic sense, the problem is that Thailand must be more competitive than it is now. Upkeep and labor costs in Cambodia and Vietnam are lower, while manufacturing quality remains comparable.

Meanwhile, nearby Singapore, Malaysia, and even the Philippines boast a higher-skilled workforce.

Thailand can’t offer foreign investors anything that their neighbors don’t have, while sometimes doing so cheaper and better.

Right now, manufacturers should be here only if they’re doing business in a specific sector like auto or semiconductor production.

Thailand still enjoys a competitive advantage in those two key industries, but who knows for how long?

Demographic trends haven’t been kind to the country, either. Thailand’s economy is now threatened by the aging population.

Predictions also show the number of working-age Thais will decrease by 11% by 2040 – the fastest rate in ASEAN.

Thailand must step up its game quickly if they don’t want to fall behind. They run a high risk of growing old before ever becoming a wealthy society.

Property values in Thailand have doubled, and its currency has remained stable during the previous decade. Nonetheless, the broader Thai economy is flatlining while valuations aren’t as attractive as they once were.

Brazil

We will step out of the Asian continent to look at perhaps the weakest emerging market in the world.

Rather than merely growing at a slow pace, Brazil is now struggling to avoid a deeper recession and declining currency.

Brazilian GDP has grown by under 2% every year since 2010. This tepid growth ranks Brazil as one of the worst emerging markets in the last decade.

Political issues have been the leading cause of Brazil’s economic malaise (do you see a trend?) over the past few years.

Each level of government in Brazil, from Congress all the way to the presidency, has been marred by corruption scandals.

South America, generally speaking, is going through hard times. Practically everywhere from Mexico to Chile is watching their economy grind to a halt, often alongside mass protests and public unrest.

Meanwhile, the value of the Brazilian real and other currencies across the region has suffered longstanding declines.

It’s sad, but despite losing about half its value during the previous decade, the Brazilian real is one of South America’s best currencies. The Argentine peso fell by over 2000% within the same period!

This is yet another reason why Asia is a great place to invest. Emerging markets like the Philippines and Vietnam are growing quickly and possess solid economic fundamentals.

Currencies of emerging markets in Asia are also generally safer, while governments are politically stable in comparison to Latin America.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.