Last updated April 9th, 2024.

Thailand’s stock market is not the first one investors would usually think of when they consider investing in Asia.

Granted, Thailand is one of the world’s most visited countries. During any typical years, its capital, Bangkok, sees more tourists than any other city on the planet.

Because of this very reason, the country is often people’s first experience with emerging Asia. Visitors notice more construction, workers on the move, and economic activity than they might have seen in their entire lives.

This naturally makes them want to participate in the growth by investing in Thailand. While we still think there are better places to invest in Asia, the country’s appeal and accessibility are hard to deny.

One way to invest in Thailand is through purchasing real estate. We already covered that route extensively in our ultimate guide. The other way is, obviously, through the Thai stock market.

If you’re here to learn how to buy and trade on the Thai stocks market, you’ve come to the right place. So, read onward!

Step 1: Open a Thai Stock Brokerage Account

The very basics of investing the Thai stock market are similar to anywhere else in the world. As such, a brokerage account is the first thing you’ll need.

We strongly recommend setting up a local brokerage account in Thailand instead of using one based in another country. There are two good reasons for this.

First, international brokers rarely grant you access to the Thai stock market or let you buy stocks in Thailand. Firms based in the United States or Europe will usually let you trade on only the world’s top dozen or so stock exchanges, which, unfortunately, Thailand’s isn’t one of those.

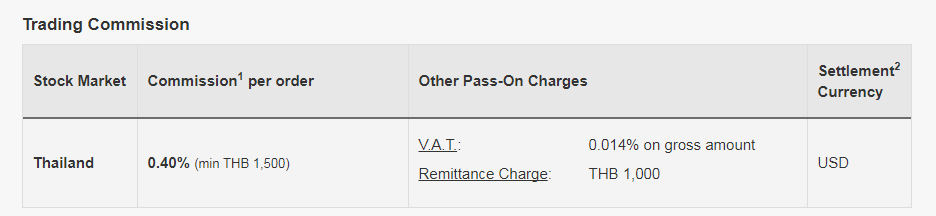

But you aren’t entirely out of luck if you cannot get a local account. A select few brokers, like Boom Securities in Hong Kong, will let you trade on the Thai stocks.

This brings us to our second reason: you’ll save a lot of money in brokerage fees by opening a local account. It’s something that’s true when purchasing foreign equities anywhere in the world, not just on the Thailand stock market.

International trades often equal high fees. You can save money by using a brokerage based in the country you’re buying stocks in.

For example, Boom Securities will charge you a minimum of 1,500THB (~US$50) per trade. The same commission costs closer to 60THB (~$2) through a Thai brokerage account.

Large commissions might be fine if you’re making sizable trades. Otherwise, round-trip transaction costs of US$100 are a deal-breaker for many people.

With all that said, to access to the Thai stock market, you’ll also need a long-term visa. You cannot open a stock brokerage account in Thailand without such visa.

Having a 30-day tourist stamp won’t cut it. There are several exceptions, and it depends on the specific bank. Yet, I won’t ruin things by telling everyone where to go on a public article.

Buying stocks in Thailand is far easier if you’re already a resident with a long-term visa. Just go to Bangkok Bank’s head office on Silom Road and open a Bualuang Securities account. They’ll walk you through the process.

Non-residents have two main options. First, you can deal with higher brokerage fees and open an account outside of Thailand. Second, you can buy mutual funds in Thailand using a regular bank account rather than a separate brokerage account.

A few Thai banks will let foreigners open a bank account with a tourist visa. But you must open an actual trading account, which requires long-term residency, in order to buy individual stocks and ETFs.

If you prefer managed funds or simply aren’t a resident, Bangkok Bank also boasts the largest selection of mutual funds and ETFs in Thailand. Whether they will let you open a bank account as a tourist seems to depend on the branch and the employees.

Aberdeen Asset Management enjoys some of Thailand’s best-performing funds. Unfortunately, their current policy doesn’t allow non-resident foreigners to open accounts.

Besides that, Kasikornbank and SCB are solid banking options. The former is generally easier to open an account with as a foreigner compared to the latter.

Step 2: Trade Stocks in Thailand

With the hard part out of the way, you’re now ready to buy Thai stocks with your new, shiny brokerage account.

We won’t cover trading strategies or recommendations here. This article is about setting yourself up with a brokerage in Thailand, more than specific investment advice or the best stocks to buy in Thailand.

Here’s a quick overview of what you can expect, though: the Stock Exchange of Thailand has about 600 listed companies. In fact, it’s Southeast Asia’s second biggest in terms of market capitalization after Singapore’s.

The Thai stocks exchange’s current market cap is about US$600 billion – not a small equity exchange by any means.

A few of Thai stocks worth looking into are those of the biggest public companies in Thailand include PTT, Airports of Thailand, and Siam Cement, each of which is worth between US$15 billion and US$30 billion.

Concerning the exact mechanics of the stock exchange, you should feel comfortable trading on the Thai stock market if you’ve traded anywhere else in the world.

Market orders, limit orders, stop loss orders, and other types of transactions that you’re likely familiar with in your home country are all supported in Thailand.

The Thai stock exchange’s operation hours are between 10 AM and 4:30 PM. They have a generous lunch break between 12:30 PM until 2:30 PM.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.