Last updated January 30th, 2024.

The Hong Kong Stock Exchange is only Asia’s third largest in terms of market cap. Yet it’s the most internationally-focused trading platform in the whole region.

When it comes to secondary listings, foreign companies list themselves in Hong Kong more frequently than anywhere else in Asia. You can trade shares of Microsoft, Prada, Prudential, and countless other multinational firms on Hong Kong’s stock exchange.

Considering the opportunities available, it is understandable why investors from all over the world are keen to invest in Hong Kong’s stock market.

The important question is: what’s the best way to buy stocks in Hong Kong as a foreigner?

You have several different ways for foreigners to buy and trade in the Hong Kong Stock Exchange. The easiest method is, unsurprisingly, through a brokerage based in your home country.

But the easiest way doesn’t always mean it’s the best or lowest-cost method, though. The better way in our opinion? Opening a brokerage account in Hong Kong directly.

You can remotely set one up without getting on a plane or leaving home; all it requires are a bit of time and patience.

People usually buy foreign shares through a brokerage based in their home country. The problem is, brokers outside of Asia charge substantial fees for international trades in the region.

For example, top US brokerage Fidelity Investments charges HK$250 (US$32) per trade on the Hong Kong Stock Exchange. A brokerage based in Hong Kong will charge you as little as HK$8 (US$1) as a comparison.

We suggest setting up a local account in Hong Kong partially because of this. You may not care about a US$64 round trip transaction cost if you’re making larger trades. Lots of investors might wince at paying such a commission at least a bit though.

Plus, there are many other reasons you should open a stock account in Hong Kong as a foreigner.

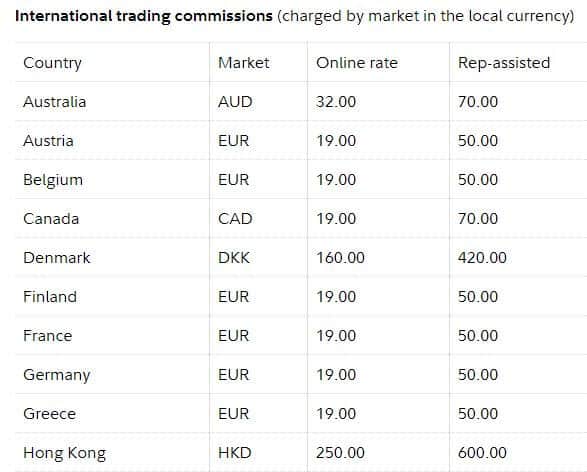

A table showing international trading fees from Fidelity, a major broker in the US. You’ll pay anywhere from 3 to 10 times the commission buying Hong Kong stocks as you would with a local account.

Why Trade Stocks in Hong Kong?

Hong Kong is Asia’s de-facto financial center. Because of its status, foreign traders enjoy ample opportunities to profit from the whole region’s growth by owning stocks in Hong Kong.

Public companies which are based in Hong Kong are obviously listed on the city’s stock exchange. Yet you aren’t just limited to local shares either.

You can trade equities from Malaysia, Japan, the United Kingdom, and other nations too. These are often dual/multi listed stocks of large multinational firms.

For example, Starbucks and Intel are both listed in the US. But they’re listed in Hong Kong as well. Having a secondary listing on the Hong Kong Stock Exchange lets them easily raise funds from investors who are based in Asia.

In addition, to open a brokerage account in Hong Kong is one of very few ways you can purchase stocks in mainland China.

Foreign investors couldn’t buy stocks in China up until several years ago. However, the Shanghai-Hong Kong Stock Connect launched in 2014. It allows anyone with a brokerage account in Hong Kong to trade shares listed in Shanghai.

The Shenzhen Stock Exchange was added to the link soon after, further expanding the Stock Connect initiative.

Best Ways to Open a Hong Kong Brokerage Account

If you have not known how to open a broker account in Hong Kong, allow us to clarify.

Unless you’re able to make a trip to the city (which is something we highly recommend doing at some point in your life), there are limited ways to open a Hong Kong brokerage account.

You still have options though. Three of them, in particular.

Boom Securities is a brokerage in Hong Kong which lets foreigners, including US citizens, open an account with relative ease. You can start the process online, and then mail them some documents.

Everything can be done remotely. The process may take up to two or three weeks to complete, though.

You can also trade stocks in Thailand, South Korea, Indonesia and other difficult-to-access markets with a Boom account. Having a brokerage account in Hong Kong is indeed a great way to start investing all across Asia.

Trade commissions are much higher than if you were to open a local account in each of these countries individually. Nonetheless, it can be difficult to access Asia’s smaller, niche markets. Keeping all your Asian stocks in one place is convenient too.

A good second option is through the trading app “moomoo“, which is a stock investment platform backed by Futu Holdings and Chinese tech giant Tencent.

It’s worth mentioning that moomoo is registered in the United States and Singapore as well. Thus, in addition to a Hong Kong brokerage account, you can easily open a Singaporean or US trading account if you’re based in any of those jurisdictions.

The only negative aspect of moomoo compared to the other brokers mentioned in this article is that you’re locked out from more exotic markets like Thailand and Vietnam. But if you’re only interested in trading stocks in Hong Kong, then that shouldn’t matter.

Your third option is using Saxo Bank, which is a Danish brokerage with an office in Hong Kong. They offer services similar to Boom Securities and are frequently recommended by foreign expats.

In summary: opening a Hong Kong brokerage account isn’t just a superb way to invest in greater China. Hong Kong also serves as a hub, and setting up roots in the territory can help you trade stocks across the entire Asia-Pacific region.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.