THE WORLD’S FIRST & ONLY

FRONTIER MARKET PROPERTY FUND

Khmer Ventures owns prime real estate in Cambodia, Southeast Asia’s fastest growing economy.

Our assets include apartment buildings, land, and other properties in Cambodia’s capital city of Phnom Penh.

Meet the Manager

Reid Kirchenbauer has lived in Asia for fifteen years, and has managed real estate investment projects in Cambodia since 2016.

In this video, Reid shows why Cambodia and its capital city of Phnom Penh are positioned for immense growth in the coming decades.

Why Invest in Cambodia?

Asia's Best Economy

Cambodia has averaged GDP growth of more than 7% over the past ten years, ranking it one of Asia’s fastest growing countries.

There aren’t signs of Cambodia slowing down. The World Bank and IMF predict it’ll remain Southeast Asia’s fastest-growing economy until at least 2025.

High Rental Yields

Property in Cambodia has some of the world’s highest yields. Returns exceeding 8% annually are common in both commercial and residential sectors alike.

A rising middle class, large supply of well-paid expats, and lots of foreign retirees equals high demand for rental units in Phnom Penh.

Robust Demographics

With an average age of 25, Cambodia is undergoing a population boom that will last for decades. Millions of people are moving from rural

areas into cities.

Demographic trends rarely change once set in motion. Combined, these factors necessitate rising demand for real estate.

Business Friendliness

Foreigners can own 100% of almost any type of business in Cambodia. It’s easy to start a company, buy real estate, and get a long-term visa here.

Tax rates in Cambodia also are among Asia’s lowest. Rental income is taxed at a flat 12% and capital gains tax doesn’t exist.

Recession Avoidance

Cambodia has a long, history of recession avoidance spanning several decades.

Of course, a truly “recession-proof” country doesn’t exist. With that said, Cambodia’s long record of avoiding crises in the past makes its economy suitable as a diversification hedge.

Rising Property Values

Cambodia will see greater demand for housing over time. Prime real estate costs about US$1,000 per sqm in some cases.

Phnom Penh has some of the world’s least expensive property values for any capital city. Prices have few places to go except upward.

Skip the Next Western Recession

Cambodia’s economy is less correlated with the rest of the world. They’ve avoided almost every recession in the past three decades.

Skipping the Asian Financial Crisis of the 1990s, the tech bubble in the early 2000s along with the 2008 Global Recession, Cambodia has proven its resilience over a long period of time.

Southeast Asia’s Final Frontier

Located in the heart of Southeast Asia, Cambodia has over 4 billion people on its doorstep.

Frontier markets have the potential for strong growth, but often need a catalyst to start it off. Cambodia benefits from its robust tourism sector – something very few other frontier markets have.

Home to Angkor Wat, the world’s largest temple, Cambodia receives millions of international tourists annually.

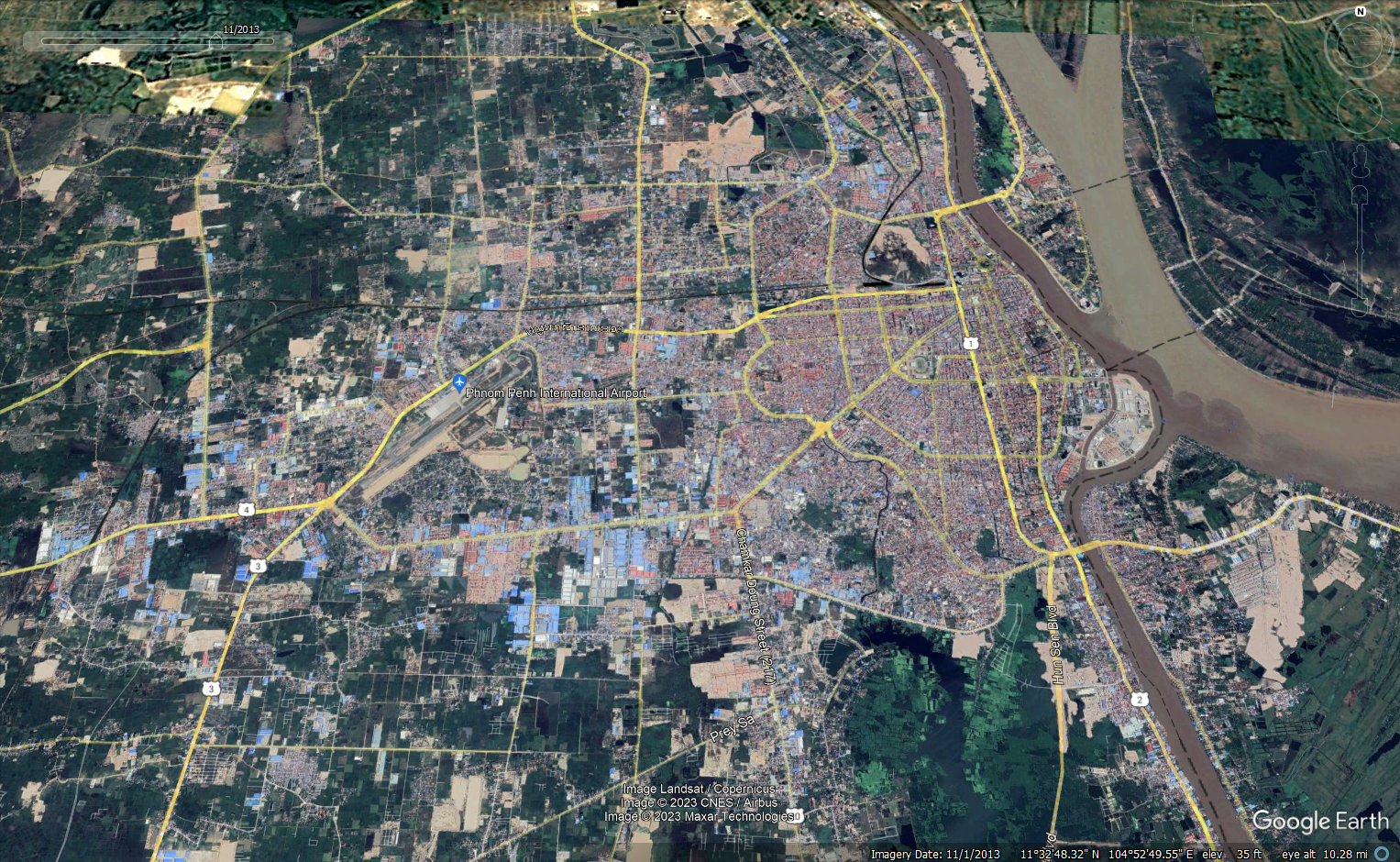

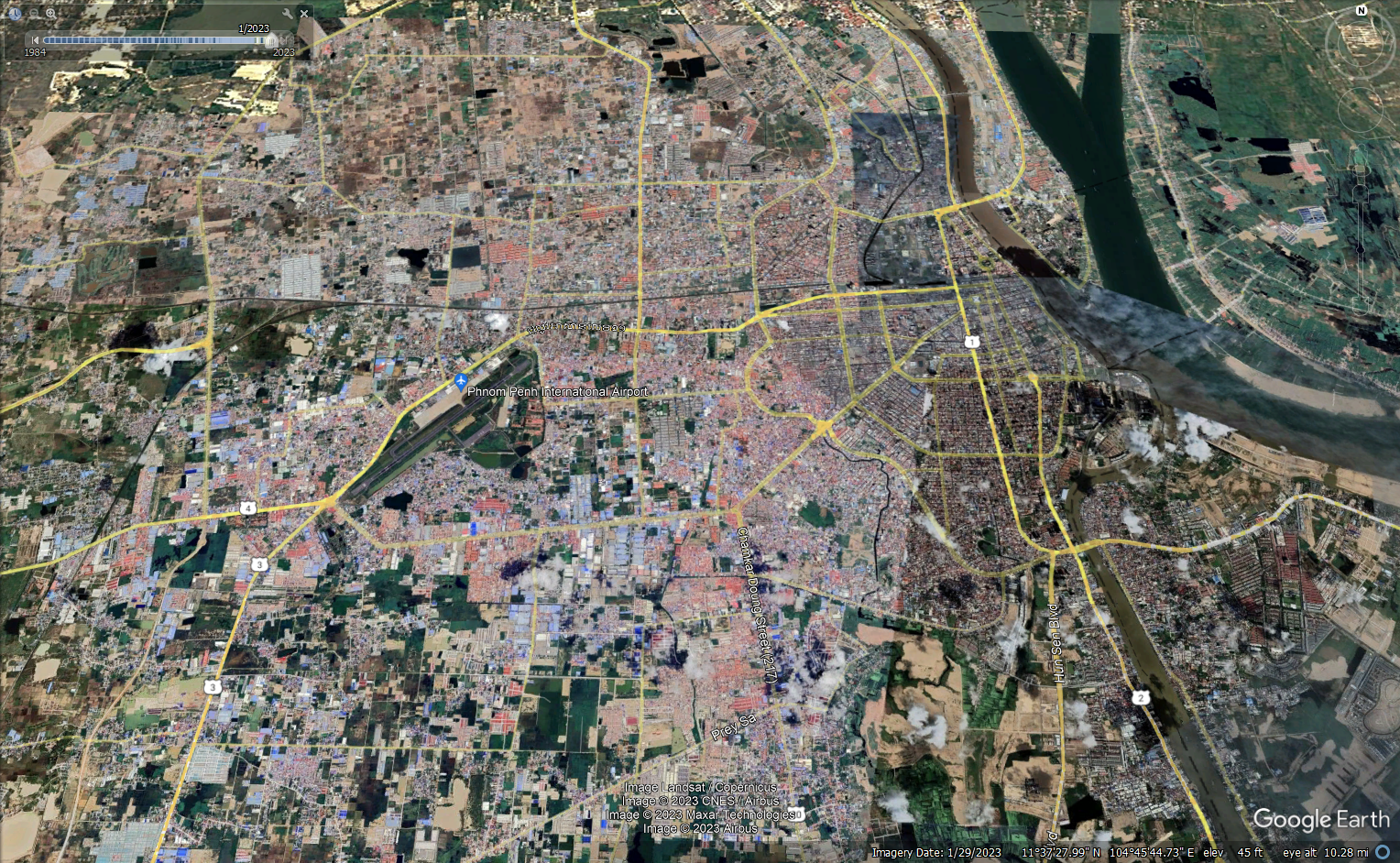

Rapid urbanization is a main driver of Cambodia’s real estate market. The nation’s capital of Phnom Penh now has a population of about 2.5 million.

By the year 2035, this number will more than double to above 5 million. Ongoing migration of people from rural areas into cities naturally leads to rising demand for real estate.

Cambodia’s is also the youngest country in Southeast Asia. Its average age of just 25 years old helps ensure a productive workforce and rising population for at least the next several decades.

This forms the basis for an uncorrelated investment. Unlike the overall global economy’s whims, demographic growth is rather predictable and rarely changes its path once set in motion.

Proven History

Our record spans eight years. Satisfied clients and repeat investors attest to our strong performance since 2016.

Fully Managed

Our management team works with tenants, analyzes the market, and maintains the assets.

Global Clientele

Our group consists of individual and institutional investors from over a dozen countries.

First & Only

We’re the pioneers in our class. Khmer Ventures is the world’s first frontier market REIT.

OUR HOLDINGS

We operate one of Cambodia’s largest and most exclusive real estate portfolios – from apartment buildings in unique areas, to high-performance hospitality assets.

Khmer Ventures’ assets include more than 4,000 sqm of property located in the center of the nation’s capital of Phnom Penh.

Our properties are selected based on their rentability and potential for long-term capital appreciation.

We specifically target unique locations that are hard to replicate – no matter how Cambodia’s real estate market evolves.

Several of our most valuable assets include land next to future mass-transit stations, hospitality assets in the city center, and apartment buildings near the Royal Palace – the type of locations that simply don’t have any equal.

As Khmer Ventures continues growing with each passing year, we’re looking forward to several major acquisitions in the near future.

Our full portfolio is generally kept private for investors, but here’s just a small sample of our assets.

“Reid is the real deal. He lives and breathes Asian investments and has built an impressive company. He has earned my trust and is one of my go-to resources on all things Asia.” – Andrew Henderson, Nomad Capitalist

FREQUENTLY ASKED QUESTIONS

What Do You Invest In?

We focus on apartment buildings, strategic land, and commercial assets in the capital city of Phnom Penh. In total, Khmer Ventues operates more than 4,000 square meters of prime floor space.

What is the Minimum Purchase Requirement?

The minimum investment amount is currently US$150,000.

How Large is Khmer Ventures?

We now have approximately US$8,000,000 worth of assets under management.

What Properties Does Khmer Ventures Operate?

Please fill out our quick application. For the benefit of our investors, the full details of our portfolio aren't made public. Potential clients are given details upon qualifying though.

How is a Fund Different from Buying Property Myself?

We earn higher returns and manage all the hard work. Furthermore, we can invest on the same terms as a local. We have unique market insight, local connections, the ability to speak Khmer, and most of our contractors provide us with bulk discounts.

Essentially, Khmer Ventures operates on scale. We renovate and purchase real estate in Cambodia at a lower cost than smaller investors, and in turn, pass the profit to our investors.

Can I Have More Information?

Please fill out our quick application by clicking the button below. Upon qualifying, potential clients are sent a full information package.

STILL HAVE QUESTIONS? WE ARE HERE TO HELP

Please complete the form below. Our team will reply to you within two business days.