Southeast Asia is one of the world’s fastest growing regions – and Malaysia is located at its heart.

Malaysia’s strong demographics, strategic location, and rising middle class led to a multi-decade boom period since the 1990s.

One economy stands out from most others in Southeast Asia: Malaysia. GDP growth is shrinking rapidly in Malaysia while the value of its ringgit currency is hovering near 15 year lows.

With Malaysia’s rising debt levels, the lowest consumer confidence in Southeast Asia, and the value of its ringgit currency hovering near 15 year lows, the economy has seen better times.

Even though Malaysia’s economy is historically one of Southeast Asia’s fastest growing, recent results show some disappointing numbers. The nation’s GDP growth dropped to 3.6% in 2023 – the second-slowest pace in over ten years.

According to the Central Bank of Malaysia, factors that contribute to lower GDP growth include a frail services sector. This is fueled further by weak expansion in several key industries.

The central bank believes domestic demand will be a major contributor to steady growth of the Malaysian economy in the future. However, it’s not guaranteed to offset continued weak performance in other sectors.

Plus, with infrastructure projects like the Singapore high-speed rail link cancelled along with frequent changes in programs such as MM2H, foreign investors have lost a certain amount of confidence in the Malaysian economy.

The Ringgit’s Depreciation

One of the most visible signs of Malaysia’s economic troubles is the sharp depreciation of its currency, the ringgit.

Ever since 2020, the ringgit steadily fell to its lowest level against the US dollar in over 20 years.

This currency weakness has put pressure on Malaysian consumers and businesses alike, in turn contributing to record consumer debt levels which are now among the highest in Southeast Asia.

Meanwhile, Beijing began devaluing the Yuan as the Chinese economy slowed down. This led other exporting countries to follow suit in an attempt to stay competitive overseas… and Malaysia was one of them.

That’s not all bad news though. Currency fluctuations are par for the course in emerging markets, and savvy investors know how to hedge their bets and even capitalize on these swings.

In fact, the weak ringgit could actually work in favor of foreign buyers of Malaysian assets like real estate, as their purchasing power is amplified in terms of their own currency.

Malaysia’s central bank has expressed confidence that domestic demand will help steady the ship and drive growth going forward, even if export sectors remain sluggish. We’ll see how the ringgit holds up from here.

Consumers Lose Hope in Malaysia Economy

Generally, citizens haven’t reacted well to Malaysia’s economic predicament – and average households are hurting the most.

Reports by Maybank say that Malaysia now has one of Asia’s lowest consumer confidence levels, suffering from a large drop even as other countries in ASEAN are now seeing their figures increase.

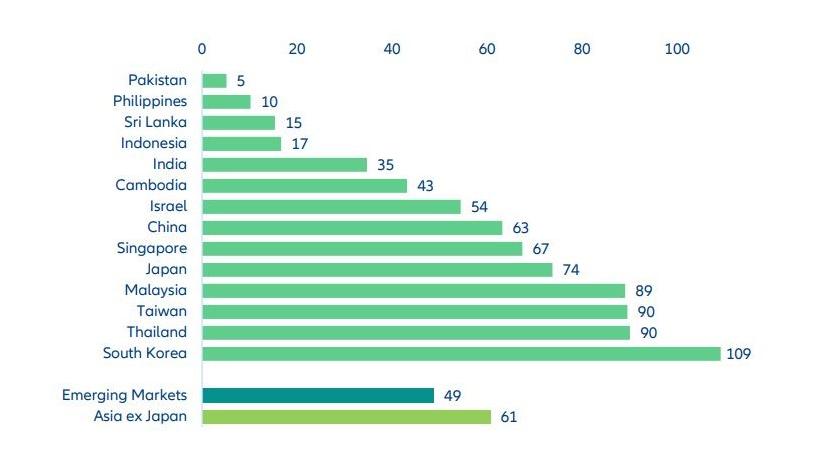

Malaysia’s consumer debt to GDP level is the highest in developing Asia – save for neighboring Thailand.

Much of this is based on reality, not just perception. Household debt to GDP in Malaysia is now above 85% – way above the average for Asia as a whole, let alone emerging markets.

To put it bluntly, rapid accumulation of household debt in Malaysia isn’t merely a number on a spreadsheet; it’s a flashing red warning sign.

Home mortgages make up the biggest slice of the debt pie, although the problem is far more pervasive.

Car loans, student loans, and easily obtainable credit from banks have all played a role in pushing Malaysia’s debt levels to these precarious heights.

Business Opportunities in Malaysia

Okay, we’ve pointed out everything wrong with Malaysia’s economy and made the case that Malaysian assets are at a cyclical low.

The question remains: how can you profit once Malaysia rises again?

One promising realm is the digital economy, which recently got a much-needed boost by the pandemic and shifting consumer behaviors.

Malaysia enjoys one of the highest rates of digital penetration in Southeast Asia, with over 80% of the population being active internet users.

The government has made the digital economy a key priority, setting a target for the sector to contribute 22.6% of GDP by 2025. Investors can find attractive plays in areas like e-commerce, fintech, and digital media.

Another sector that is ripe for growth is renewable energy. Malaysia has committed to achieving 20% renewable energy in its power mix by 2025, which presents a $8 billion investment opportunity.

Malaysia is set to be a regional leader in clean energy. With abundant potential in solar, hydro, and biomass energy, they’ve introduced a range of incentives to attract green investment.

We’re bullish on real estate in Malaysia as well – it’s one of few countries in the region where you can own freehold land as a foreigner. Investors can find attractive yields and capital appreciation, certainly with the ringgit trading at historically weak levels.

Of course, investing in Malaysia isn’t without its risks and challenges. The political scene has been volatile in recent years, with unexpected leadership changes and policy U-turns that have spooked some investors.

Foreign ownership limits in sectors like real estate are also cumbersome to navigate. And Malaysia’s economy remains vulnerable to global headwinds like commodity price swings, geopolitical tensions,

Fortune favors the bold, and in a region full of economic tigers, Malaysia may just be the hidden dragon waiting to be awakened by prescient global capital.

Indeed, Malaysia has a track record of defying the naysayers. They’ve bounced back from the Asian Financial Crisis and several other recessions in the past few decades to emerge stronger and more resilient than ever.

With shrewd positioning and a healthy dose of patience, foreign investors in Malaysia could gain as this Asian tiger roars back to life. Yet the country will eventually need to solve its ongoing debt issues.

FAQs: Malaysia’s Economy

What are Malaysia's Biggest Exports?

Malaysia's top exports are petroleum, electrical and electronic products (E&E Products), LNG, palm oil, machinery and equipment, iron and steel products, rubber and automobiles.

How Much Does Property in Malaysia Cost?

In general, property prices in Malaysia are quite low. You can find luxury condos in central Kuala Lumpur for under US$4,000 per square meter. Prices in Malaysia's large cities like KL and Penang are cheaper than many less developed cities in the region like Bangkok or Hanoi.

What's the Biggest Company in Malaysia?

With over 40,000 employees and market cap above $35 billion, Maybank is the largest company in Malaysia by far.

Can Foreigners Own Real Estate in Malaysia?

Yes, Malaysia is one of the few countries in Southeast Asia that allows foreigners to directly own land, houses and other types of property on a freehold basis. This makes it possibly the easiest place in the region for foreign buyers to acquire real estate.