Let’s be perfectly clear from the start: an investment which is 100% safe against recessions doesn’t truly exist. Nothing is guaranteed in life, and making money always involves a degree of risk.

Recessions vary in their cause – some are deflationary in nature, while others are inflationary. No single economic crisis is the same. Thus, it’s practically impossible to find a single asset class that “does it all” when it comes to avoiding recession.

With that said, here’s the next best thing: you can hold assets with a proven record of outperforming other investments in a recession.

During any crisis in the past, there have always been assets that appreciate in value regardless of overall economic conditions. Countries with a long history of skipping previous recessions also exist.

Several countries in the world have avoided recession for decades. In some cases, they’ve missed every single economic downturn over the past thirty years. Not many investors realize that such places exist.

It’s possible to guard your portfolio against recessions country by holding uncorrelated assets and diversifying internationally.

Vietnam is just one example of a frontier market that tends to skip recessions. In fact, it skipped every single economic crisis for the past 30 years. It missed the tech bubble of the early 2000s, outgrew, the 2008 Recession, and has maintained positive GDP growth ever since 2020.

Specific countries that have a history of skipping recessions include Cambodia, the Philippines, and Bangladesh. Each of these Asian frontier markets have been able to maintain growth while the rest of the world fell into a global crisis.

And each of those countries share a few things in common too. Read more below about how to invest in places that avoid recessions.

Skip the Next Western Recession

Learn the best places to invest – and where to avoid – by downloading our free Investment Cheat Sheet.

How Do Some Investments Avoid Recession?

Developed markets, including the US and Japan, are among the first to suffer when a recession strikes the global economy.

All developed nations are highly integrated into the global financial system, and therefore, will follow the rest of world’s path when it goes into recession. Right off the end of a cliff.

Many people try to invest in emerging markets in an attempt to avoid recession, thinking these types of economies are immune from a recession. But emerging markets aren’t a safe haven, and in fact, often perform even worse than developed nations during a global crisis.

That’s because, instead of being uncorrelated with the world economy, emerging markets depend on it.

Once an economy has reached a certain stage of development, it then becomes reliant on the overall global financial system. Emerging markets, like China, Thailand, and Mexico, already have plenty of foreign investment… and they depend on even more of it to continue growing.

With developed and emerging markets proven to be unsafe during a global recession, that leaves us with frontier markets.

Right now, 24 million people live in Manila, the Philippines’ capital city. That number is expected to be 35 million by the year 2030.

Frontier market economies are unique, and usually sustained by their own internal factors rather than external forces. Demographics are an important driver of growth in Asia’s frontier market economies.

That’s a very important reason why frontier markets avoid recession, since demographic trends rarely change once set in motion.

The Philippines and Cambodia, for example, each have an average age of 26 years old. As such, both of these frontier markets benefit from a productive workforce.

A low average age also means the population in these countries will continue growing throughout the 21st century.

Naturally, a greater number of people in any given area leads to higher demand for real estate, goods, and services in general.

Frontier markets benefit from this long-term cycle of sustainable growth. And it doesn’t rely on how the NASDAQ or S&P500 performs.

That’s our first solution to safeguarding your portfolio against recession. You’re making a good start by investing in countries with a proven record of dodging them in the past.

What Are The Best Investments in a Recession?

You can only avoid a financial crisis by holding assets that aren’t related to its underlying cause.

Unfortunately, it’s not easy to find investments which meet this criteria. That’s especially true considering how different industries rely on each other’s performance and that our world is (mostly) interconnected.

As we covered above, picking a specific country with a history of avoiding recession is one method. But let’s get outside the realm of geography for a bit and look at specific assets.

While relatively uncommon, there are some individual stocks that have a negative correlation with the overall market. In other words: their value increases in a bad economy.

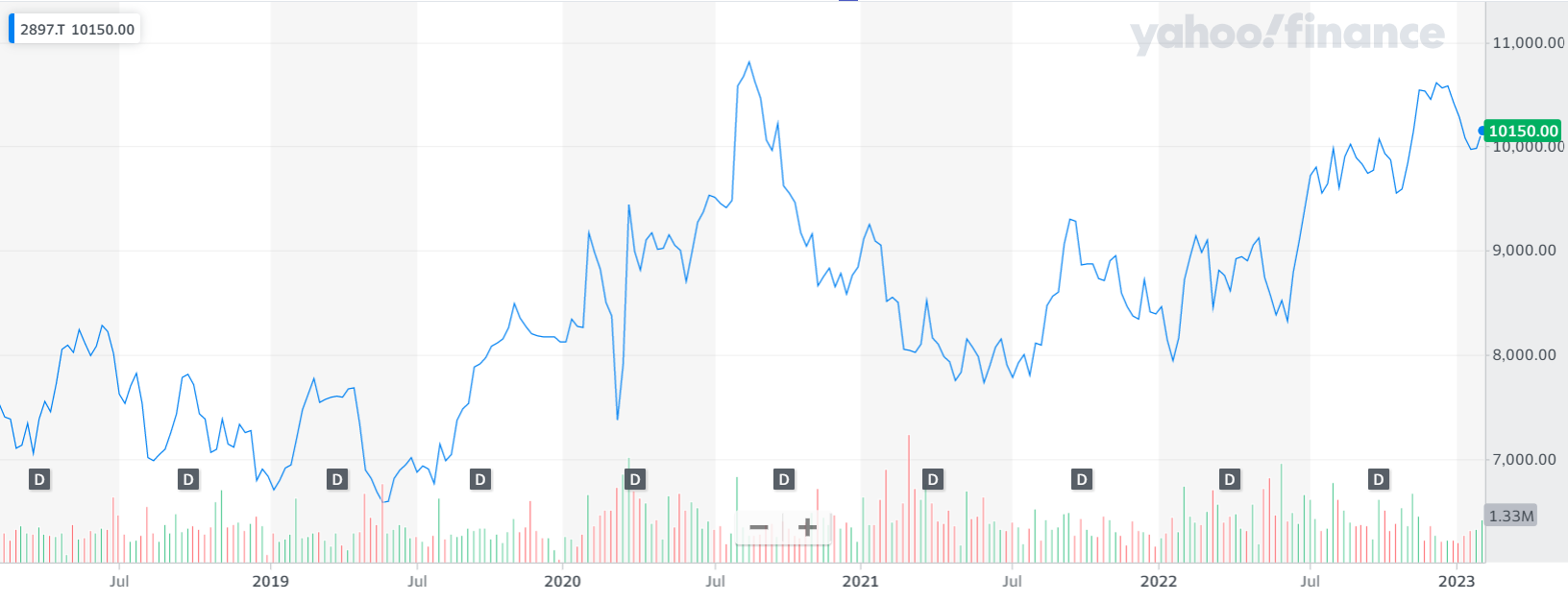

Shares in Nissin Ramen, for example, have a multi-decade history of outperformance during recession. That’s because people start buying cheaper products as a substitute for their preferred goods when they have less money.

You can also find a similar effect in sectors like entertainment and some parts of the tech industry. After all, how do consumers act when funds are short, and the news is constantly talking about how terrible the economy is? They often escape into movies, video games, social media, and other forms of cheaper entertainment.

A five-year chart of Nissin Foods Holdings. Note its significant price gains during the 2020 lockdowns, and also towards the beginning of 2023 as inflation began rising.

Debunking Myths on Recession Proof Assets

We mentioned further above that, contrary to popular belief, emerging markets probably won’t help you in a declining global economy.

There are also other investments that many people claim are safe to hold during a financial crisis, when in fact, they’re just as susceptible to recession (or perhaps even moreso) when compared to any other asset.

Gold’s History of Weak Performance in a Recession

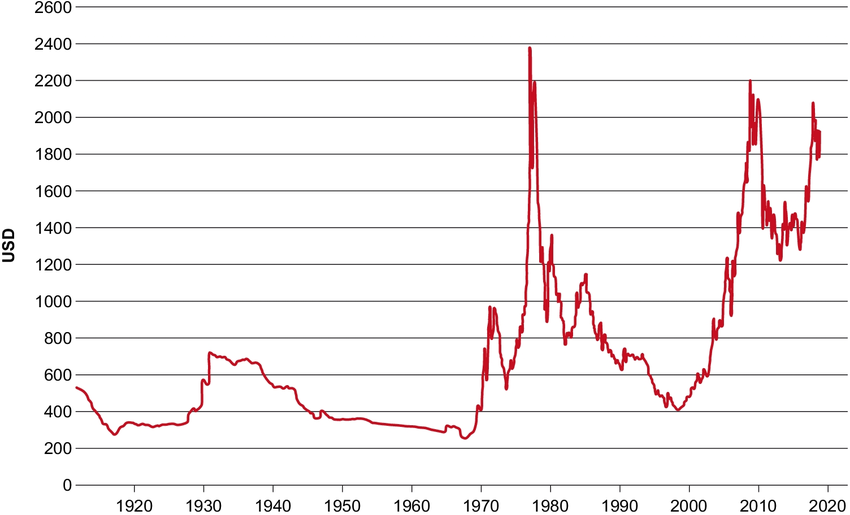

Gold, silver, and other precious metals certainly aren’t immune to recession. History has proven this – and gold prices have plummeted during every single recession since the 1990s.

Of course, there are countless people online who will try to sell you gold, store it, and act as the agent. They often show misleading charts and try to pass gold off as an asset which has appreciated in value over the long-term.

Did you know that gold is currently priced lower than it was back in the 1970s? Not much of a “hedge against inflation”!

That doesn’t even consider the fact that precious metals have a buy/sell spread if you actually want to turn it in. Plus, physical assets must be kept safe. If you’re paying money every year to store precious metals in a secure facility, those annual fees will eat into your performance even more.

Here’s a chart showing gold’s performance over the past 100 years. Companies that buy and sell gold will typically show you a misleading 20-year chart, starting from the 2000s.

How Does Crypto Perform in a Recession? It’s Hard to Tell

Cryptocurrency, despite some people’s claims, isn’t immune to global recessions or an overall poor economy either.

Don’t get us wrong: Bitcoin, Ethereum, and other cryptocurrencies are revolutionary and have their place in a portfolio. But it’s factually incorrect to say crypto outperforms during a recession there’s no precedent of it. In fact, you might be worse off owning crypto than other investments.

Crypto is a relatively new asset, and thus far, the only record we have of its performance in a time of overall declining asset prices is during 2022 and 2023’s crash. This was one of Bitcoin and Ethereum’s worst years ever with crypto values declining by more than 70% from their highs.

We can only make predictions based off past performance. If anything, cryptocurrency has proven to have greater volatility than most other investments.

What About Bonds?

Bonds and fixed income are also hit-and-miss when it comes avoiding recessions. Recently, as interest rates began rising and inflation soared, the value of corporate and government bonds plummeted across the board.

Anybody who owned bonds for retirement, or otherwise relied on them as a “safe haven” asset, ended up sorely disappointed.

Plus, bond issuers are more likely to default in a recession. We saw back in 2008 how mortgage-backed securities, once considered a safe investment, absolutely fell apart and took the rest of the world with them.

That leaves us with two ways to realistically guard yourself against a recession. Either hold assets with a history of inverse correlation to the global financial system. Or invest in countries that don’t rely on the system in the first place.

Skip the Next Western Recession

Learn the best places to invest – and where to avoid – by downloading our free Investment Cheat Sheet.

READ MORE ABOUT RECESSION AVOIDANCE

3 Most Stable Currencies in a Recession

The world economy is facing uncertain times. Family offices and other large wealth managers hoard cash, while governments from China to Switzerland buy up resources. We're not necessarily saying that a recession is imminent – nobody can predict the future. That said,...

3 Countries That Have Been Recession Proof

We should start off by clarifying: there's no such thing as a truly recession proof country! This should be rather obvious. Every investment has its risks. Anywhere can plunge into a recession with little notice. With that said, a few places have managed to avoid...

This Country Avoided Recession for 30 Years: Here’s Why

Recessions are a fact of life in most countries. They seem to arrive every 7 years or so on average, leaving unemployment and stock market collapses in their wake. Many people have tried to avoid recession, and attempts to bypass them aren't anything new. Indeed,...

How to Beat Inflation: Protect Your Portfolio

Last updated May 4th, 2025. A metaphorically infinite number of dollars are chasing a limited number of goods. The result? Inflation! There’s no ignoring the elephant in the room – it’s gotten so large that there’s barely any space left. Open any financial newspaper...

How to Avoid a Recession? Invest in These 3 Markets

Last updated December 18th, 2023. People are often surprised to learn that some countries completely skipped the 2008 Global Financial Crisis. It's even more shocking that several places have managed to avoid recession for over two decades. Even when the latest...

Best Investments During a Recession: Are You Prepared?

Last updated March 14th, 2024. If you're concerned about a future economic downturn, you aren't alone. People around the world are wondering: what are the best investments during a recession? A recession strikes the international economy once every few years on...

READY TO INVEST IN THE WORLD’S FASTEST GROWING COUNTRIES?

Join 50,000+ monthly readers. Discover property, stocks, and other investments that will drive global growth in the 21st century.