Last updated December 20th, 2019.

Singapore’s GDP growth is far weaker than economists hoped for, with some analysts blaming the nation’s sluggish manufacturing sector along with an intensifying US-China trade war.

Businesses are still trying to counteract this somewhat unexpected decline. More than 70% of Singaporean manufacturing firms plan on investing in new machinery and other technologies.

In an ideal situation, this would let companies stabilize the manufacturing industry by boosting their production capacity and exports.

Yet considering such a drastic decline in these clusters, Singapore’s economy demands further measures to revive its trade and manufacturing activity.

Corporate spending simply isn’t enough. Outdated policies and laws must also be reviewed to maintain Singapore’s competitiveness.

Will Investment Help GDP Growth in Singapore?

Singapore’s economy has certainly seen better times – it’s not all bad news though. Significant deals were struck lately.

For example, Temasek recently bought an additional 30.6% Keppel Corporation in a deal worth US$3 billion.

Most service-based industries are growing at a healthy pace, well within (or maybe even above) a proposed “ideal rate” of between 2% to 4%. Banking and insurance sectors are now growing by more than double that amount, in fact.

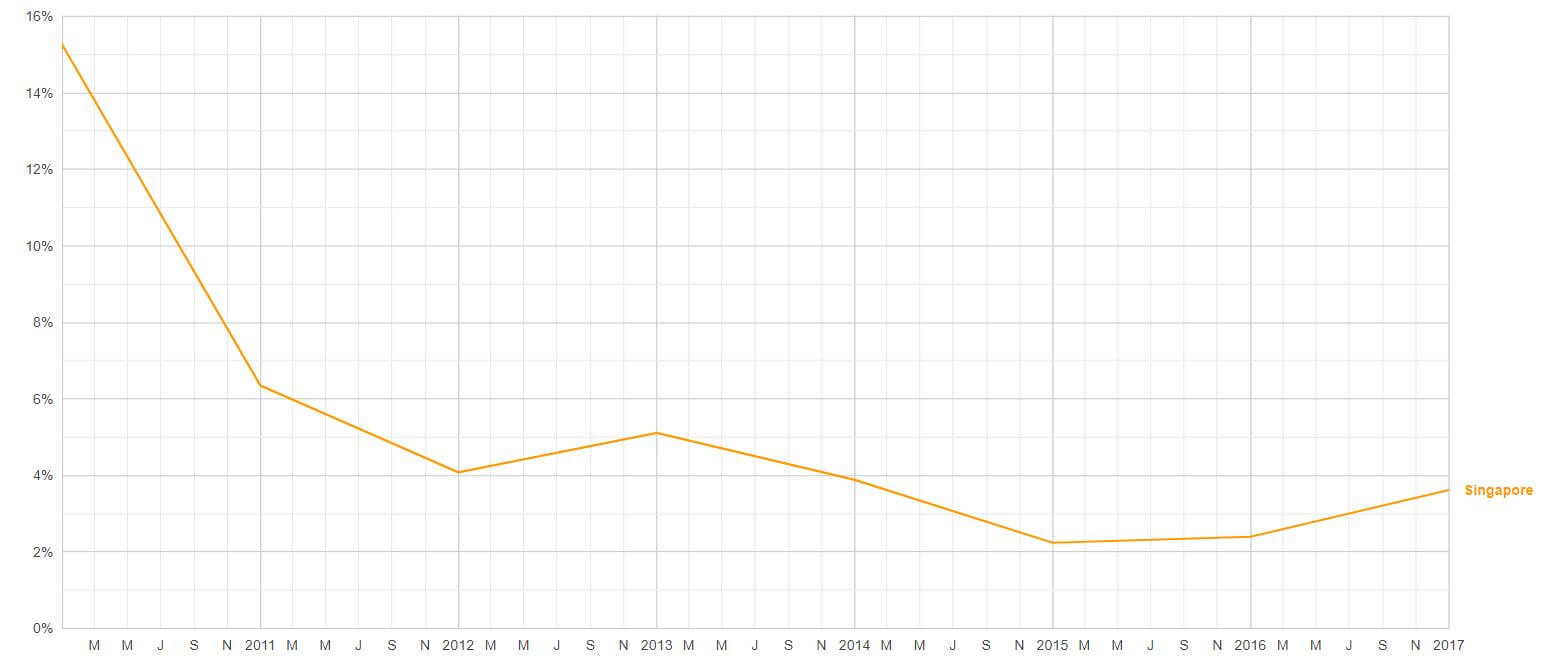

But taking everything else into account, GDP growth in the city-state has remained sluggish for practically a decade. This will prove a major challenge for Singapore’s government in 2020 and beyond.

A chart of Singapore’s GDP growth since 2010, showing a weakening trend throughout the decade.

We’re already noticing significant movements in the right direction. Eventually, Singapore and its GDP growth should return to their former selves.

It just won’t happen anytime soon. Prepare yourself for a prolonged Singaporean slowdown.

A Shift in Singapore’s Main Industries

Countless experts acknowledge Singapore’s economic advantages. Indeed, the nation is adept at changing to global conditions, specifically regarding its tech and financial sectors.

Singapore’s track record of innovation is staggering given their economic history in the past 50 years. The city-state transitioned through many stages of economic development in just barely a few decades’ time.

But does this mean Singapore will respond effectively to the current global slowdown?

The answer is most likely yes, although a slow Chinese economy could also affect their outlook. Singapore has proven, on several occasions, its rare ability to respond to changing conditions.

With trade tensions between the US and China at their peak, Singapore’s Ministry of Trade and Industry said the city-state’s economy is “unlikely to weaken further”. Certain sectors are failing yet others could still blossom in the near future.

In the meantime, it may be a better choice to stay away from stocks in Singapore and invest in emerging markets nearby instead.

Diversification is important no matter where you live. Remember: just like investing in a single stock is risky, investing in a single country is also dangerous.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.