Last updated December 5th, 2018.

Previously a high-growth market in Southeast Asia, the Thai economy is no longer what it used to be. That’s especially true with declining tourism numbers and a GDP growth rate well below the regional average.

A brief look at economic indicators shows the Thai economy has indeed been going downhill since a coup back in May of 2014. Likewise, it appears the authorities in “The Land of Smiles” understand this fact.

Thailand’s ruling party is doing their best to bring the economy back to its feet through driving FDI and tourism arrivals. Elections are planned in mid-2019 and time is now running out for an economic revival before then.

One way Thailand is trying to lure more foreign investment is by offering business incentives in the form of tax benefits and better infrastructure.

Similarly, the government is now hyping up Thailand’s Eastern Economic Corridor (EEC). It’s a free trade zone that will offer foreign investors a right to own freehold land, low flat tax rates, and other perks.

Will all these things be enough to revive Thailand’s FDI numbers though?

Slow Growth, High Debt in Thailand Economy

There are many factors working together, transforming Thailand from one of Southeast Asia’s top performing economies into arguably the worst.

A major reason is the change in the country’s leadership. The coup in May 2014 resulted in the military junta taking control of Thailand.

The nation failed to boost investors’ confidence following the coup, therefore inbound foreign investment dropped significantly.

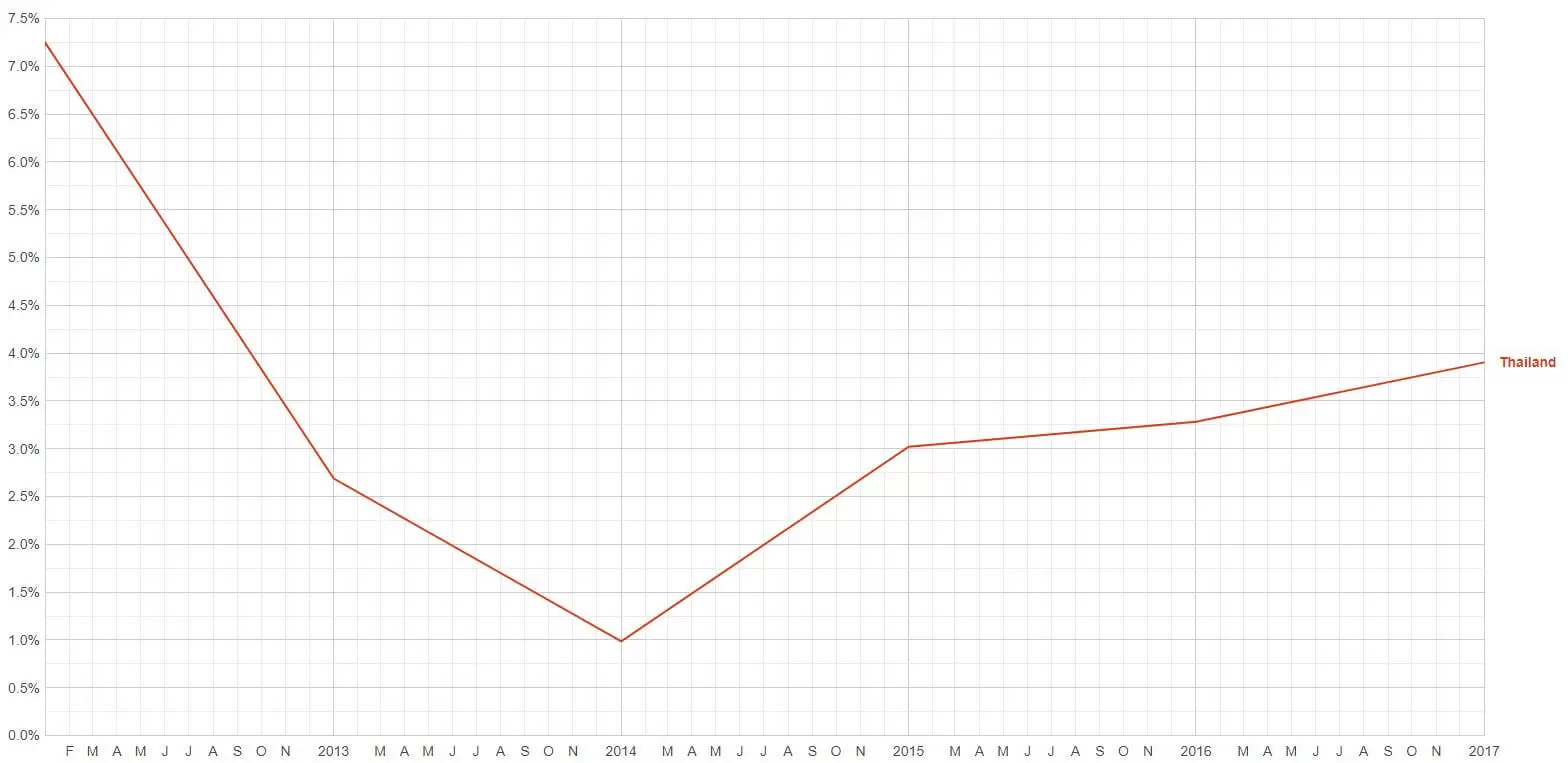

Thailand’s 7.2% GDP growth rate back in 2012 seems like a long time ago. You may as well call them the “good old times” because 2019’s GDP growth forecast is 4.3%.

During the first half of 2018, Thailand only managed to attract under 10% of ASEAN’s inbound foreign investment in total. That’s despite boasting the Southeast Asia region’s second largest economy.

Not only does Thailand have a different time luring foreign investors, it has trouble attracting its own local investors too. Thais are investing in their own country less while investing abroad more, especially throughout the rest of Southeast Asia.

Furthermore, household debt is at the highest point in a decade. More than 80% of Thailand’s population is incurring debt – an increase of over 10% from last year’s figures. The number of homeless people is also on a discouraging upward trend.

A five-year graph showing Thailand’s GDP growth rate between 2012 and 2017. Now rising at below 5% annually, the Thai economy is among Southeast Asia’s weakest.

More Foreign Direct Investment is Key

According to a panel of experts, the only way out is for Thailand to focus on bringing in more foreign investment. But progress is hindered by high labor costs, a low supply of labor, and a tough regulatory environment.

Thailand must create an environment that properly welcomes foreign investors. The Kingdom has to become a stable, efficient, and transparent place for capital.

Whose responsibility is it to make all that happen? The Finance Ministry and Thailand Board of Investment are two institutions leading the change.

Taking small steps towards a bright future, Thai Finance Minister Apisak Tantivorawong wants to set up tax incentives and increase investment throughout his country.

Meanwhile, the Thailand Board of Investment (BOI) appears several steps ahead of the Finance Ministry.

The BOI already offers numerous tax benefits for private investors and they recently approved seventeen projects worth 78 billion baht in total. Subsidiaries of multinational firms like AirAsia Ford Motor, and Toto are included.

It’s very possible that a rough Thailand economy could turn still itself around. Yet it will require a conscious effort from government, businesses, and citizens alike.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.