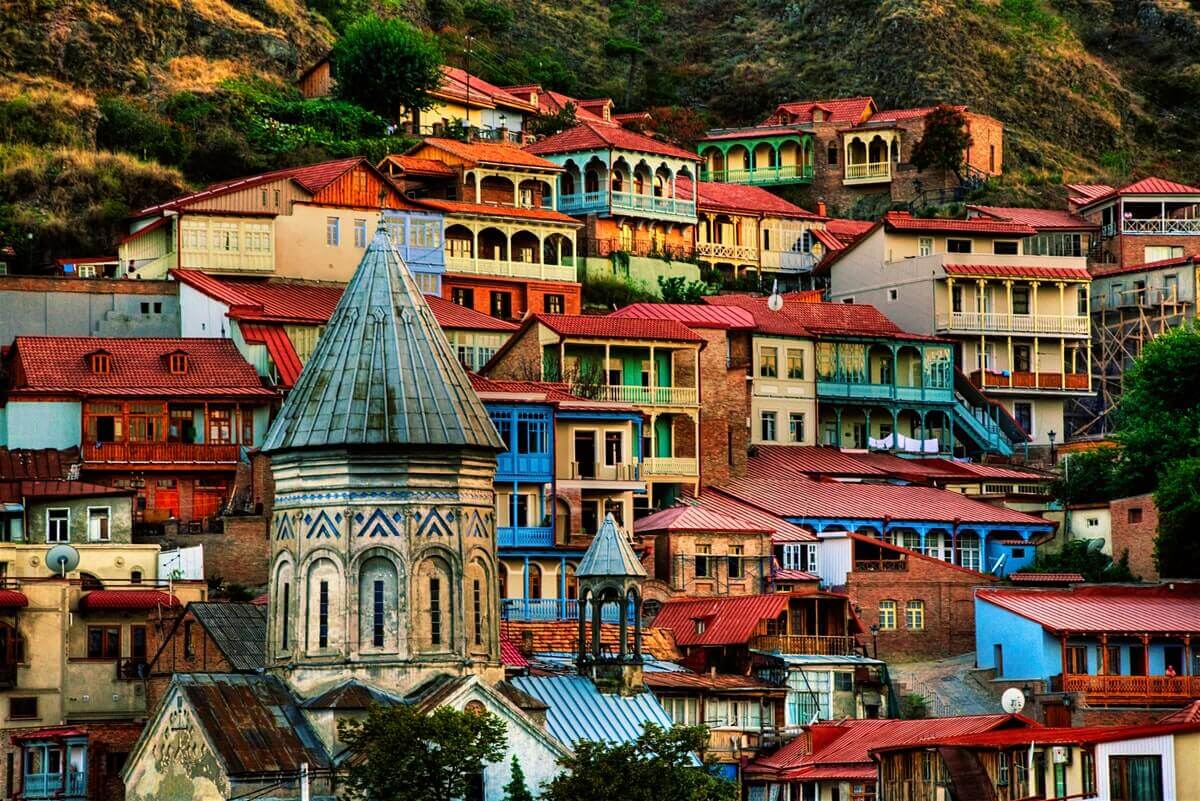

We enjoy covering overlooked places to invest like the Tbilisi real estate market.

Oftentimes, foreign property buyers have better opportunities in countries such as Georgia that aren’t yet swarmed by multinational firms and hordes of tourists yet.

Plus, there’s already lots of online info on “standard” investment destinations. People can learn about China or Japan on thousands of different websites. Real estate in Tbilisi is a niche topic though.

Today’s article is a bit outside our normal scope. We usually focus on Southeast Asian property markets, but Georgia is located in the Caucasus region bordering Europe and Asia.

Georgia (the country, not the U.S. state, just to be 100% clear) is more western than any other emerging economy we’ve covered thus far.

Depending on who you ask, Georgia isn’t even on the Asian continent!

Several geographic definitions, including the United Nations geoscheme, put Georgia in Western Asia. Georgia and its capital of Tbilisi are distinctly European in both a cultural and political sense though.

Either way, putting semantics aside, our main goal is informing readers about countries that are worthy of investment.

Keep reading to learn why real estate in Georgia’s capital of Tbilisi’s capital is among the world’s most undervalued.

Georgia’s Weak Reputation, But a Different Reality

Georgia doesn’t really have a bad global reputation. They merely don’t have much of one at all.

Foreign investors often choose a property market based on their perception of them. Here are some examples: you’re more likely to buy real estate in Thailand if you already visited there as a tourist.

Similarly, a person who rarely travels will typically stay at home and purchase assets they’re familiar with. Unadventurous people rarely make adventurous investors.

We all have a strong confirmation bias. Meanwhile, very few of us can visit every country, judge the situation “on-the-ground” with our own eyes, or make true comparative global investment decisions.

Basically, you’ll only consider investing in markets if you’ve heard of them in the first place. Georgia is very quickly gaining a reputation among tourists and companies though.

A quaint 547,000 passengers flew into Tbilisi’s airport back in 2005. Nowadays, Georgia gets about 8 million international arrivals during a normal year.

Likewise, Georgia is climbing up the international business rankings. The World Bank rates them 7th place out of 190 countries in their annual Ease of Doing Business Index.

Georgia ranked 26th out of 180 countries in the Economic Freedom Index as well. Not bad at all, considering it’s the poorest country in Europe outside of Ukraine.

Of course, it’s simply a matter of time before the rest of the world starts noticing Georgia along with Tbilisi’s undervalued real estate market.

First movers always gain most when investing in frontier economies. Capital appreciation, when it does occur, is often dramatic and without notice.

Getting into these emerging markets early is better than too late. Recent gains in Tbilisi is a perfect example of that.

How Much Does Property in Tbilisi Cost?

Currently, it costs about $2,000 per square meter to buy real estate in Tbilisi’s city center. Vake is the most expensive neighborhood in the city, followed by Vera and Saburtalo.

Further out, in areas like Didi Dighomi, housing prices become less expensive – closer to $1,000 per square meter or even lower in Tbilisi’s distant suburbs.

Prime real estate in middle of a capital city usually costs US$1,000 per square meter ($90 per square foot) at the very minimum. That’s true almost anywhere on the planet.

It doesn’t matter if the local economy is underdeveloped. Heck, a even two bedroom condo in central Beijing costs around two million dollars. Property in less established cities like Prague are still valued at around US$4,000 per square meter.

You might consider these prices expensive. However, it’s worth remembering that a nation’s capital or primary business center possesses a certain type of sway that other cities simply don’t.

This is because residing in a nation’s capital is often the only way a business, whether local or international, can effectively operate in a country. Greater demand drives up real estate prices – especially in smaller countries like Georgia with just one major city.

You could count the number of capital cities where it’s possible to buy central property for under US$1,000 per square meter on one hand.

Tbilisi made this list up until recently. As of 2025, prices have roughly doubled compared to pre-2021 due to an influx of foreign buyers. Especially Russians!

It’s notable that rental yields in Tbilisi are also high, hovering around the 7% range. Buying an apartment or house in Tbilisi to rent out while awaiting long-term capital appreciation remains a solid option.

All these factors indicate that the Tbilisi real estate market is clearly undervalued within an international context.

There are reasons to believe that property prices in in Tbilisi could increase upwards from here.

A newly built, one-bedroom apartment in Tbilisi costs around US$100,000. That’s a price unrivaled by almost any other European or Asian capital city.

Is Buying Tbilisi Real Estate a Good Idea?

A single country’s asset prices, whether you’re buying real estate or stocks, depends heavily on its broader economic performance.

Tbilisi is one of the biggest success stories to come out of the former USSR. Following major institutional reform back in the early 1990s, a newly democratic Georgia began opening up to foreign investors.

The Georgian economy has proven itself resilient to the rest of the world’s problems since then. In fact, Georgia enjoys a long history of avoiding recessions and suffered just a single year of GDP contraction over the past two decades.

Large multinational firms such as McDonald’s and Carrefour started to set up shop in Tbilisi rather recently in the grand scheme of things.

Huge luxury malls are opening, the airport is under renovation, and entire sections of the city are getting refurbished.

Georgia’s upgraded infrastructure and new real estate developments are positive for not the Tbilisi property market, but the nation’s economy as a whole.

Consider buying property in Tbilisi if you want to invest in Georgia’s overall growth. But you’ll also need to think very hard about the country’s geopolitical issues, and proximity to hostile neighbors.

Since Georgia doesn’t have its own stock market, the Tbilisi real estate market is one of your best options to invest in the country as a foreigner.

FAQs: Real Estate in Tbilisi

How Much Does Property in Tbilisi Cost?

Location will determine the price you'll pay for real estate in Tbilisi. In central parts of the city like Vake or Saburtalo, housing costs are about $2,000 per square meter.

Further out in neighborboods like Didi Dighomi and Isani-Samgori, you can expect to pay half the price. It's still possible to buy an apartment in Tbilisi for $1,000 per square meter, even if you won't be living in the city center.

Can Foreigners Own Real Estate in Georgia?

Yes, foreigners can buy property in Georgia on the same terms as any local citizen for the most part.

However, foreigners can't own agricultural land in Georgia - you'll encounter limits if you're looking outside the residential sector. But practically any type of house or apartment in Tbilisi is fair game.

Is Buying Property in Tbilisi a Good Idea?

The cost of Tbilisi real estate has nearly doubled since back in 2021, when large numbers of Russian migrants poured across the border.

Lately though, the Georgian property market is more subdued. Those who wanted to migrate from Russia to Tbilisi have already done so, and in fact, many people have already moved back. There isn't any other clear catalysts that will continue to drive demand for real estate in Tbilisi.

How Much are Rental Yields in Tbilisi?

Yields will largely depend on location, size of the property, and several other factors.

Generally though, you can expect rental yields of about 8% for an average apartment in Tbilisi's central neighborhoods like Vake, Vera, and Saburtalo.