Last updated February 10th, 2024.

We at InvestAsian have long held a fascination with Japan, from its culture, people, and food. Naturally, that fascination extends to the Japanese real estate market.

We’re not the only ones! Millions of foreign tourists visit the country yearly to enjoy its remarkable efficiency, beautiful landmarks, and famous hospitality. Not as many, but still some, fly to Japan in order to buy property.

Japan and its capital city, Tokyo, is one of the most popular places in the world for tourists. The country was the third most visited country in Asia before the pandemic.

With its developed infrastructure and the cultural influence it has on the world, it’s not a surprise that people would favor the country over several others. Especially if you’re living in Southeast Asia, visiting Japan would feel like an escape from your everyday life in the developing homeland. But even if you’re not from Asia, chances are you’d still be drawn to the country’s charms once you’ve experienced it.

In fact, some tourists may even be so charmed to the point they consider buying a property there, which begs the question: “Is buying property in Japan possible for foreigners?”

And the answer is yes, foreigners can buy real estate in Japan. As a matter of fact, Japan is one of a few countries in Asia that have very few restrictions for foreigners buying property.

That said, we would never buy property or invest too much money in Japan, despite our love for the country.

Specifically, three huge problems would make us avoid investing here – perhaps minus a few Japanese stocks that have their own individual merits.

Property taxes in Japan are high – usually about 2% of appraised value. Meanwhile, rental yields remain perpetually low. Those are just the obvious reasons why buying Japan property isn’t ideal for investment purposes, though.

The major factors contributing to why you shouldn’t invest in Japan are rooted in three facts of life in the country. Namely, the Japanese mentality toward real estate investment, the nation’s poor demographic trends, and regional tensions in East Asia.

Investing in Japan Real Estate? It’s Not an Asset

Property is considered an investment in most places. Assuming that you take good care of a house or apartment building, it should last indefinitely and appreciate in value along the way.

Yet, that isn’t usually the case when purchasing property in Japan.

Whereas some of the most desirable pieces of real estate are over a century old in the Western world, it’s the opposite here; Japan real estate is typically assumed to have a useful life of between only 20 and 30 years.

That’s the harsh reality of a nation prone to earthquakes, tsunamis, and destructive wars for as long as anyone alive now can remember.

It’s beaten into the psyche of a people where families historically owned a generational plot of land, and when older family members passed away, all structures on it were razed and rebuilt.

To be fair, it’s mostly true that Japanese real estate won’t last long. Your dream home will have a lifespan of several decades, in all probability.

Repairs can usually be made, and the Japanese do enjoy some of the world’s best earthquake-resistant buildings. However, repairing aged structures is costly. Even the best homes will be damaged after a few 8.0 earthquakes.

And if the tsunamis, quakes, and nuclear meltdowns don’t eventually get your assets, a “crazy neighbor” next door might. Owning property in Japan is riskier than it appears on the surface.

Demographic Crisis Haunts Japan Property Market

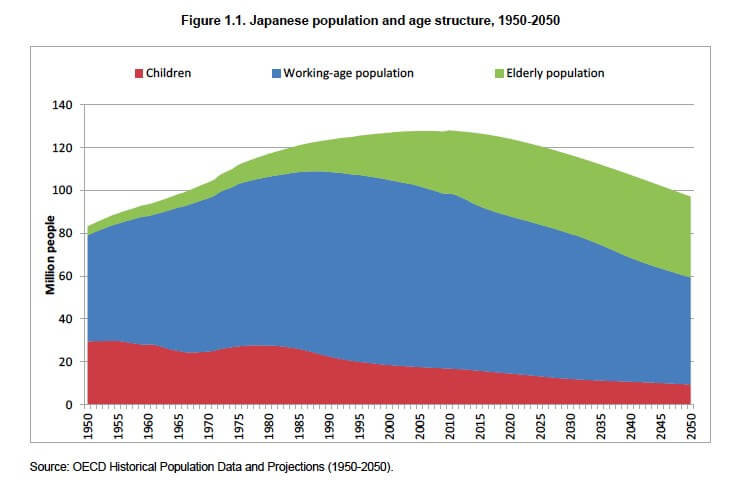

You may already know that Japan faces an ongoing demographic crisis. Sadly, their citizens’ average age is older than anywhere else on the planet.

Combine that with a falling population, along with the implications for Japan’s workforce productivity, and it’s easy to see why the nation’s economy will almost certainly have a rough few decades.

A greater amount of public spending will undoubtedly need to be allocated toward healthcare, pensions, and other social services in Japan.

Japan’s property values will face downward pressure in the future, even in bigger cities like Yokohama and Osaka. Central Tokyo will nonetheless see continued demand, though.

Japan’s population will fall by over 20% in the next three decades alone. It’ll look even worse by the end of this century.

By 2050, Japan’s population will decline to under 100 million. On top of that, the percentage of retirees will rise dramatically at the same time. Tackling both these factors at once will prove challenging.

Of course, all these things will negatively affect the Japan property market. Less people means downward pressure on real estate demand.

You can already see rural Japanese towns practically vanishing off the map. 8.2 million homes across Japan are now unoccupied. Meanwhile, Japan’s population decline will only make these problems worse until housing oversupply even plagues major cities like Tokyo and Osaka.

Geopolitics Will Affect the Japanese Real Estate Market

Japan (and really East Asia in general) has enjoyed relative peace and stability since the end of World War 2. Nations in the region were far more concerned with economic growth, rebuilding themselves, and/or consolidating control over their citizens.

The situation is more tense today. Back in 2011, the Chinese economy finally surpassed Japan’s to become the world’s second-largest. Many decades of rapid growth currently allow China to compete economically and militarily with Japan.

China’s buildup of armed forces and greater assertiveness is forcing its historic rival towards a once unthinkable decision. Specifically, Japan is taking the first steps of reactivating its military for the first time in generations.

Furthermore, a nuclear armed North Korea remains a wildcard in the Asia-Pacific region. Peace talks between North and South are making slow progress – but Kim Jong Un’s true motives are still unknown.

I’m not screaming doom or saying war is coming. However, ancient rivalries and geography are two things which don’t usually change. You should consider all factors surrounding such a big decision like making a real estate purchase in Japan.

Investors should be aware that history often repeats itself. A continued rise in tensions may, at the very least, cause greater economic uncertainty. At worst, they could possibly wreak havoc on Japan’s real estate and financial markets.

Do you agree with this article or not so much? Either way, there are plenty of other countries in Asia with better fundamentals than Japan. Consider investing in one of them instead.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.