Turkey’s currency, the lira, has plummeted over the past several years. This has severely impacted the nominal price of real estate in Istanbul and other cities.

By all means, the cost of buying real estate in Turkey rose in terms of its local currency. That’s natural in any country where the inflation rate is well above 50%.

Looking at prices in terms of USD and other major currencies, however, the difference is far less substantial.

You can still buy an apartment in Istanbul for well under US$1,500 per square meter outside the city center. Prime, centrally properties aren’t much more expensive than that.

A search on Turkish a real estate directory, like Zingat, will show luxury homes in Istanbul priced at barely above US$1,000 per sqm. These apartments and houses sometimes even enjoy unblocked views of the Bosphorus and other amenities.

Property values that low are practically unheard of in any large, reasonably-developed global city. But will cheap home prices in Istanbul last forever?

Wealthy foreigners, especially from the Middle East and Russia, have begun buying up luxury mansions on the Bosporus. They might consider it as a safe haven, although there’s a substantial amount of risk in Turkey.

Buying Property in Turkey? Consider Currency Risk

The lira began its multiyear plummet back in 2018 following tariffs imposed by the United States. It was the climax of a huge diplomatic feud between Washington and Ankara over an American pastor’s arrest.

Initially, such a drastic move in the lira was probably more psychological than anything. Yet this event caused Turkey’s currency to fall from approximately 4.50 to the dollar to about 7.00 by August of that year.

Since then, the lira’s depreciation has only intensified. The lira reached all-time lows of approximately 32.00 to the dollar as of the middle of 2024.

Basically: tariffs broke open old wounds in Turkey’s economy. The lira then proceeded to lose around 80% of its global purchasing power, as the nation’s structural issues became apparent.

The question is: what’ll happen with inflation and currency risk in Turkey this decade and beyond?

If current trends continue, which they often do, the lira will continue depreciating bar any significant policy changes.

Remember, if you’re buying a real estate in a foreign country, you aren’t simply buying an asset. You’re also making a bet on the future of that nation’s currency.

Property in Turkey is ultimately denominated in liras – even though some less scrupulous agents try to rip off foreign buyers by listing property for sale in terms of dollars!

As such, currency risk directly impacts the long-term investment potential of Istanbul’s real estate market.

Debt and Inflation in Turkey

Together, the numerous risks of investing in Turkey are significant and fairly complicated to explain.

Yet the demand for housing in Istanbul, the nation’s largest city by far, isn’t in a vaccum. It’s thus worth mentioning the risks that Turkey’s broader economy.

First, the country suffers from a staggering amount of corporate debt. Turkish businesses now owe debt above 70% of the entire country’s GDP

This figure has steadily risen, and the debt owed by companies in Turkey keeps increasing with each passing year.

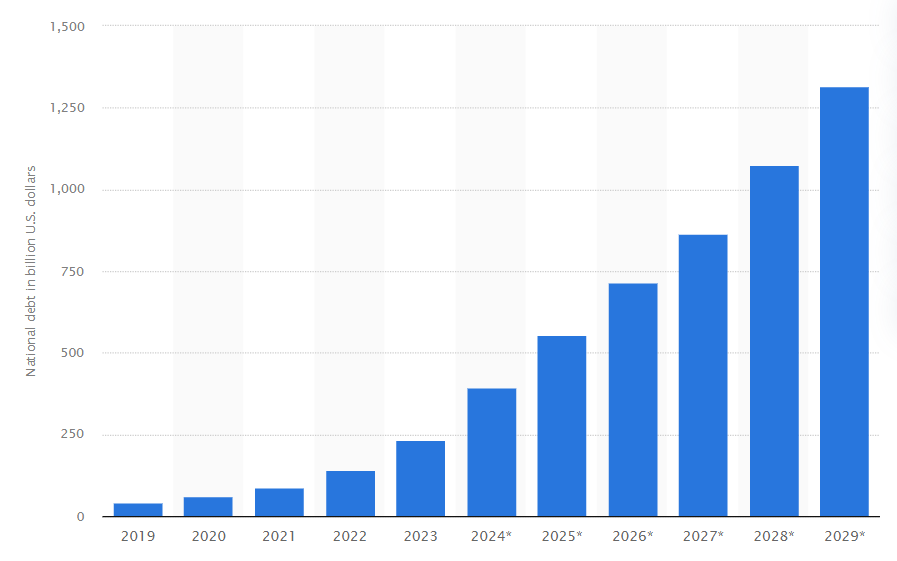

A chart showing Turkey’s historical, and predicted, debt to GDP ratio between 2019 and 2029 according to the IMF.

It gets even worse once you realize most of this debt is denominated in US dollars rather than Turkish lira.

As such, the amount borrowers owe have effectively tripled over the past five years. Turkish corporate debtors must pay off their loans in terms of dollars. Meanwhile, the lira is depreciating rapidly.

Besides debt problems in Turkey, the second major risk is that public spending is wasted on expensive infrastructure projects.

Many of these developments are poorly conceived, and few of them would ever become a net gain for the Turkish economy.

Kanal Istanbul is merely one example of overspending. It’s a planned 50km canal that’ll run alongside the Bosphorus and is expected to cost more than US$10 billion.

Putting a second canal in Turkey has two big problems though. For starters, the Black Sea doesn’t get anywhere near enough trade volume to justify its huge cost.

There just aren’t many ships passing through – especially with all the nearby conflict in the past few years!

Plus, international law clearly says that all transit through the Bosporus is free-of-charge which makes a second canal redundant as well.

The final risk of buying real estate in Turkey is its severe financial management problem.

Nonetheless loved by his base, the Erdogan administration’s strong point arguably isn’t economics.

Up until recently, they held a controversial view that high interest rates lead to inflation and were adamant that rates must be low.

Any high-ranking economic official who dared to raise interest rates was quickly fired, even though it was the right decision years ago.

In fact, Turkey had three different finance ministers since in less than five years!

The result is that international investors are losing faith in Istanbul’s property market, along with Turkey’s economy as a whole, as long as the lira continues its steady decline.

Risks of Buying Real Estate in Istanbul

Tariffs might have triggered the lira’s crisis in the first place. Unfortunately, Turkey’s problems are immense and go far beyond political issues.

Quite frankly, Turkey is a total economic basket case. Major structural problems in Turkey aren’t being solved and will probably get worse before ever improving.

Istanbul’s property market suffered from oversupply even way before the lira crisis as well. Large scale urban housing developments were already creating a supply glut many years ago.

Demand from wealthy foreigners, many of them who fled war in nearby countries, kept demand for luxury homes in Turkey high for a limited period of time.

But at this point, anyone wanted to escape Russia or Ukraine have already done it. The surge of foreign real estate buyers in Istanbul was temporary and couldn’t last forever.

Plus, Turkey’s lira has always maintained its worrying trend of depreciation. Did you make the mistake of holding lira during the past 10 years? If so, you lost roughly 80% of your purchasing power.

The lira has never shown itself capable of appreciating over the long-term. We certainly don’t believe that will change within the near future.

In summary: you shouldn’t fall into a Turkish lira value trap. Istanbul’s property market may appear cheap at first glance, yet the nation’s economic crisis is arguably only getting started.

You shouldn’t bet on a lira comeback anytime soon. Instead, consider buying real estate further eastward than Turkey.

Turkish Property Market: FAQs

How Much Does Istanbul Real Estate Cost?

The cost of real estate in Turkey differs widely based on location based on location and many other factors.

On average, you should expect to pay about $2,500 per square meter for an apartment or house in Istanbul that's in a good location.

If you're looking at luxury condos or mansions near the Bosphorus, it's possible to pay above $5,000 per sqm though.

Likewise, it's still possible to find cheap apartments in Istanbul's distant suburbs for less than $1,000 per sqm.

Can Foreigners Own Property in Turkey?

Yes, foreigners are allowed to own practically any type of real estate in Turkey.

In fact, it's even possible to buy land in Turkey on a freehold basis as a non-citizen.

How Much Did the Turkish Lira Depreciate?

Over the past ten years, the Turkish lira has depreciated by about 1,000%.

What is Turkey's Inflation Rate?

As of the middle of this year, Turkey's inflation rate is about 59.52%.