Last updated September 10th, 2025.

Cambodia, a relatively small nation of roughly 18 million people, isn’t the first place that most foreign investors consider.

While this country in the heart of Southeast Asia had its problems in the past, over four decades have passed since the Khmer Rouge era.

Modern-day Cambodia is now open to foreign business, is developing at a fast pace and now home to one of Asia’s top performing real estate markets.

Below, we’ll detail why Cambodia is one of Southeast Asia’s most promising countries for international property investors.

This includes a comparative analysis with other real estate markets in Asia, rental yields in major cities like Phnom Penh and Siem Reap, along with a general overview of Cambodia’s economy.

Hopefully, you’ll understand why we’re bullish on property in Cambodia by the end!

Southeast Asia’s Strongest Economy

Naturally, a country’s property market depends on its overall economic performance. For its part, Cambodia’s economy is among the best in Asia.

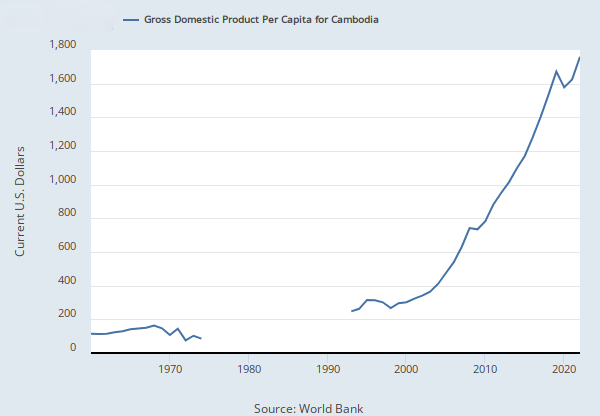

Cambodia’s GDP rose by 6.9% on average each year during the 2010s, which ranks as the second fastest growing in Southeast Asia behind an otherwise noncompetitive Laos.

Not only that, but Cambodia has a long history of sustained growth which hasn’t slowed down in decades.

In fact, Cambodia skipped the Asian Financial Crisis of the 1990s, missed the tech bubble during the early 2000s, and outgrew the 2008 Global Recession.

Keep in mind: Cambodia managed all this while achieving GDP growth above 6% per year on average as well.

A chart showing Cambodia’s GDP per capita over a multidecade timespan. The nation has largely avoided global economic turmoil while sustaining annual growth above 6%.

Obviously, there isn’t such thing as a “recession-proof economy”. Each country has its own problems and each investment has its risks.

That said, Cambodia is about as close as one gets. The Kingdom remains less correlated with global markets than a majority of countries.

Lack of reliance on global markets, in addition to its strong demographic dividend, work in Cambodia’s favor.

The nation’s capital city of Phnom Penh is at the core of its ongoing boom phase. Large numbers of workers are moving from the countryside into Phnom Penh, as Cambodia’s population rapidly urbanizes.

And since Cambodia’s average age is only 25 years old, this trend is primed to continue for several more decades.

This will naturally support demand for real estate in Phnom Penh over the long-term, where an established middle class is just beginning to form.

Cambodia Property Prices: The Best Value in Asia?

There aren’t many capital cities left in the world where you can purchase prime property at a low price.

Centrally-located property in Bangkok is worth over $5,000 per square meter on average. Meanwhile, a leasehold apartment in less-developed Hanoi, Vietnam will even cost you more than $3,000 per square meter.

However, Phnom Penh stands out as one of few the only Asian capital cities where you can buy real estate in the middle of the CBD for below $1,000 per square meter.

Do note though: we aren’t talking about Cambodia’s newly-built condos in Phnom Penh which have started popping up over the past few years.

Condo buildings in Cambodia are often large, impressive, and a testament to the nation’s development in the real estate industry.

Yet they’re usually way too expensive, selling at prices approaching the range found in Bangkok.

Instead, look toward Phnom Penh’s older shophouse flats. Such colonial apartments don’t have a pool or a gym, but they’re about 25% the value of a new condo in Cambodia and in good structural condition overall.

Either that, or if you have a few million dollars to invest, you can set up a land holding company or buy commercial property in Cambodia though a trust.

Cambodia’s older shophouse apartments have attractive prices – even if a bit of renovation work is often needed.

Rental Yields in Phnom Penh

A few property markets in Southeast Asia have great capital appreciation prospects, yet suffer from horrible rental yields.

For example, real estate in Singapore is fairly valued compared to its peers. Prices are around half of those Hong Kong. Net rental yields in these places are about 2% though, which is abysmal compared Phnom Penh.

Similarly, Kuala Lumpur’s property market is among Asia’s least expensive. Rental yields are still barely above 3% though.

Cambodia’s major real estate markets, including Phnom Penh, Sihanoukville, and Siem Reap, are all fortunate enough to have both high rental yields and capital appreciation potential.

The types of shophouse apartments in Cambodia we mentioned before have high rental yields above 5%, on top of their low prices compared to elsewhere in Asia.

However, the current situation won’t last forever – and neither will $1,000 per sqm house house prices in Phnom Penh.

The overall trend is clear: Cambodia’s real estate prices will surely gain over time from all these factors working together in tandem.

FAQs: Real Estate in Cambodia

How Much Does Property in Cambodia Cost?

If you're buying a standard house or shophouse apartment in Cambodia, you'll pay about $1,000 per square meter in Phnom Penh.

Housing prices are even less in Cambodia's second-tier cities such as Siem Reap and Sihanoukville.

But if you're looking at newly built condos in Cambodia, these usually cost above $2,000 per square meter. That's because the property developer includes their expenses and profit in the sale.

Can Foreigners Buy Real Estate in Cambodia?

Yes, foreigners can own condo units and other strata titled property in Cambodia on a freehold basis.

What Are Phnom Penh's Rental Yields?

Rental yields will depend on a propery's specific details including size and location. Generally though, average rental yields in Phnom Penh is about 5%. This is far superior to cities like Singapore or Kuala Lumpur, where yields hover around 2% to 3%.

Cambodia's rental yields are normally higher for small apartments, and less for larger properties - which is true for most cities in the world.

Is Investing in Cambodia a Good Idea?

We think so, and have several good reasons why property values will increase further.

First, Cambodia has an average age of 25 years old with large numbers of people migrating from rural areas into the city. This ongoing, multi-decade process will inevitably create demand for real estate in Phnom Penh.

Likewise, the historic performance of nearby Southeast Asian property markets like Vietnam and Thailand is strong. Housing prices in both countries rose significantly when they were at Cambodia's current stage of economic development.

How Do Cambodia’s Demographic Trends Impact its Property Market?

Cambodia has a young and rapidly urbanizing population, with an average age of 25. This demographic shift is driving demand for housing in urban centers like Phnom Penh, creating long-term growth potential for the real estate market.