Last updated July 3rd, 2023.

Normally, property investors will buy a physical structure under their own name to either resell or rent out themselves. Yet buying shares of a real estate investment trust (REIT) or property fund is a superior option for many people.

In the most basic explanation possible, REITs are companies that own a full portfolio of properties. You’ll own a several different pieces of income-producing real estate through holding shares in a REIT.

Investors pay a small annual fee to a REIT’s management, typically about 2% every year, toward the fund’s management expenses and upkeep.

Of course, the whole point is that you should gain back way more than a 2% management fee.

It’s often worth paying the extra cost to obtain greater economies of scale, access to local expertise, along with the preservation of your own personal time.

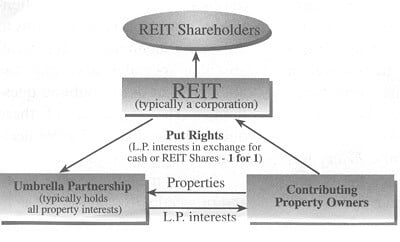

A diagram of a standard REIT structure. Shareholders own the company, which in turn directly purchases real estate and distributes income.

Diversified and Return-Optimized

Buying into a REIT or property fund is an ideal setup because of a few reasons. First off, they provide a fully-diversified portfolio.

You aren’t merely buying one property, nor must you rely on a single dwelling in order to generate returns. Instead, REITs give access to hundreds, or sometimes even thousands of different buildings.

Diversifying your holdings across multiple geographic locations and sectors is a good idea. It makes you less exposed to natural disasters, local economic woes, and other regional issues.

Likewise, pooled investments give you allocation to assets that require a large amount of upfront capital such as office buildings and malls.

Commercial properties are out of reach for small, individual investors. They offer higher rental yields in practically every major city in the world though.

A property fund breaks down the barriers to entry if you don’t have millions to spend on commercial real estate.

REITs and Property Funds: Hands-Off Investments

Secondly, buying into a REIT removes the hassle of managing assets yourself. A landlord must spend their energy searching for tenants, making repairs, and collecting the income.

If you’re a foreigner looking to invest offshore, getting a built-in management team along with your property absolutely makes things easier from a logistical perspective.

While a fund that specializes in foreign real estate is a hands-off type of investment, owning a physical asset and managing it from abroad is often impractical. Especially if you don’t speak the language, or aren’t familiar with the market you’re investing in.

Here’s an example of one interesting niche REIT: the Mapletree Industrial Trust. Based in Singapore, they own logistics parks and warehouses across developing Asia.

There are tons of different REITs and funds available all throughout the Asia-Pacific region and internationally.

Property funds are common in countries that already have developed financial sectors including Korea, Australia and Japan. Although you can increasingly find real estate funds in frontier and emerging markets like Thailand, Malaysia, and the Philippines too.

Most funds are rather general in nature, although some invest in a specific sector such as industrial, commercial, or residential property.

Others are completely diversified across all different sectors: hotels, warehouses, malls malls, you name it!

In summary, while the idea of simply buying a house and renting it out yourself sounds appealing to some people, you’ll usually have more room to profit by owning shares in a REIT or property fund.

Such assets are especially worth considering if you’re making an international investment, or are looking at emerging and frontier markets. It’s hard to accomplish much in places like Cambodia or Vietnam unless you speak the language and have local connections.

A good property fund adds value by providing a full package of financial expertise, local knowledge, and economies of scale.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.