You’ll find plenty of ways to invest in Asian markets. The sheer number of international investment options might leave some people confused; from buying real estate or stocks, to starting your own business.

With that said, buying stocks is still the first method most people consider when it comes to investing in Asia. Nearly anyone can trade stocks in Asia online, from home or wherever they are, and with little effort.

Practically every online brokerage will let you buy stocks listed on major global exchanges, including those in Asia.

If your brokerage firm doesn’t allow trading on the world’s most populous continent, you might want to consider changing your brokerage. At the very least, stock markets such as Shanghai’s and Singapore’s should be the mainstays of any brokerage that’s worth using.

A good broker should let you trade stocks across multiple countries in Asia – regardless of where their headquarters is based.

Secondary Listings and ADRs? Not Always an Option

Companies in Asia often have secondary listings outside their home market. Secondary listings are most common in New York and London.

Giving just two examples, Baidu is listed on the NASDAQ whereas Toyota is listed on the NYSE through American Depository Receipts (ADRs).

Many ADRs are low-volume compared to the main listing in their home market though, and are sometimes difficult to sell quickly or at a fair price.

It’s worth mentioning the United States has the highest concentration of listed stocks in Asia outside of the continent itself. Because of this, trading stocks in Asia via a US broker account is a popular option for investors based in North America.

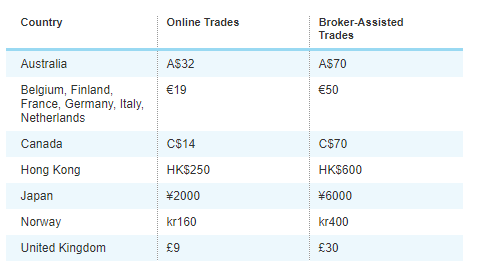

A table showing Schwab’s international trading fees. Is your transaction size big enough where $50 commissions don’t affect overall returns? Because that’s the reality of buying stocks in Asia through a broker outside of the region.

Trading Stocks in Asia with an Offshore Broker

However, when it comes to buy and sell stocks in Asia, using your American or European account to do so isn’t an ideal method of investment at all.

Why shouldn’t you trade with your normal broker? For starters, you’re giving up key competitive advantages. It takes away many of the perks that come from investing offshore in the first place.

By the very nature of trading stocks that are listed in New York or London, you’re now competing with multi-billion dollar hedge funds and other large institutional investors.

Banks, hedge funds, and other institutional buyers have complex algorithms and thousands of highly paid researchers. Can you really extract value out of a market when your competitors are performing in-depth analysis and executing trades in under a second?

Very rarely, some retail investors consistently outperform the market. But a hedge fund will usually get to any true, mathematically-proven “value stocks” while an individual investor waits for Google Finance to load.

This reason is also why I prefer smaller exchanges including Malaysia’s and Vietnam’s. Countries such as these have hundreds of hidden gems with almost no analyst coverage.

If you’re solely trading in markets where everyone else is buying up assets, it might be worth allocating your portfolio differently.

Of course, the online brokerage you’re already using may let you trade in Japan or China. Yet they almost certainly won’t let you buy stocks in Vietnam or Malaysia. You’ll probably need to open a brokerage account in Asia to access the more exotic, emerging and frontier markets.

In short, you’re severely limiting your investment options by not opening a local brokerage account in Asia. Most stocks on the continent don’t have secondary listings, and even when they do, it typically means higher fees alongside less liquidity.

Higher Returns and Lower Fees

Maintaining your ability to find hidden gems in frontier markets such as Indonesia and the Philippines isn’t the only reason to open a brokerage account in Asia though.

You’ll also save yourself a lot of money in fees through setting up a local account in the region. Brokerage firms often charge extremely high commissions on international stock trades.

For example, Fidelity (a major broker in the U.S.) charges HK$250 to buy or sell a stock in Hong Kong – a whopping US$32 per trade. A local account such as Boom Securities charges HK$88, or just US$12 per trade by comparison.

Trading stocks in Asia is similar to anywhere else in the world once you’ve opened your brokerage account. We won’t get into details or specific stock recommendations – they depend entirely on where you’re trading.

Some markets, including the Tokyo Stock Exchange, have lunch breaks while others have minimum orders and other quirks.

But as with most things in life, your end result depends on how much effort you’re willing to put in.

The best way to buy stocks across Asia is to open a local brokerage account in a regional finance hub like Singapore or Hong Kong and invest directly.

While trading Sony or other companies listed on western exchanges technically does count as investing in Asian stocks, you aren’t truly diversifying your assets either.

Emerging and Frontier Market Stocks

For the most part, you can trade stocks in developed Asian markets such as Japan, Singapore, and Hong Kong through any large brokerage firm in the world.

However, the process gets far more difficult if you’re looking to invest in emerging and frontier markets as a foreigner.

Emerging markets like Indonesia, Vietnam and the Philippines have seen rapid growth in recent years, making them attractive to investors seeking higher returns. Yet their capital markets are less mature and efficient compared to developed economies.

Places like Cambodia, Laos, and Mongolia are at an earlier stage of economic development. Their stock exchanges are small with only a handful of listed companies – the Cambodia Securities Exchange has just 10 stocks for example.

The main obstacle for foreign investors is that these frontier markets often restrict access to their exchanges. You usually can’t just hop online and start trading.

Instead, you may need to physically travel to the country and open a local brokerage account in person. Some countries like Laos and Bangladesh even require you to obtain a long-term visa or citizenship before allowing you to invest.

Such entry barriers can be a major hassle, but they also serve to keep asset prices fair by limiting foreign capital inflows.

Whereas an emerging market like Vietnam has already attracted attention from large institutional investors, frontier markets remain largely untapped and disconnected from global market movements.

This means there is potential to find hidden gems and undervalued companies before they get discovered by the broader investment community. The lack of analyst coverage and market efficiency can work in favor of diligent investors who put in the legwork.

Of course, with greater opportunity comes greater risk. Frontier markets tend to have weaker corporate governance, less transparency and more volatility. Thorough due diligence is essential.

There’s also the liquidity risk to consider – with such a small number of stocks trading on low volume, it may be difficult to enter or exit positions at a fair price. Not to mention the risk of markets being abruptly closed off to foreign investors due to policy changes.

For most people, investing directly in frontier markets is probably biting off more than they can chew. A practical first step would be to open a brokerage account in a regional hub like Singapore or Hong Kong, which provides access to larger, more liquid emerging markets.

From there, investors can gradually venture into the more exotic frontier markets as they gain experience. It’s the ultimate way to tap into the long-term growth of rising Asia – if you know where to look and how to manage the risks.

FAQs: Trading Stocks in Asia

What's the Best Performing Stock Market in Asia?

Japan's stock market was the top performer in Asia for 2023, with the benchmark Nikkei 225 index soaring an impressive 28% over the course of the year.

However, past performance is no guarantee of future results. Emerging and frontier markets, while more volatile in the short-term, have often outpaced developed markets like Japan over longer time horizons.

How Can I Trade Stocks in Asia?

The optimal method for trading stocks across Asia is to open a brokerage account in a regional financial hub such as Singapore or Hong Kong. This will grant you access to the larger, more liquid emerging markets.

In contrast, most Western brokerages like Fidelity or Interactive Brokers have limited access to Asian exchanges. They typically only offer the major developed markets like Japan and maybe a few of the larger emerging markets.