Last updated July 20th, 2023.

The stock market’s day-to-day movements are surprisingly random and rarely based on logic.

Why? It’s because stocks move at the whim of human beings who are often illogical themselves and driven by emotions.

It’s natural: every investor wants greater insight into how a stock might perform in the future. At the higher end, this type of research is financed by billions of dollars from hedge funds and multinational banks.

Yet stock market psychology still remains one of the top influences on your portfolio. Realizing this fact can help you learn how to invest better.

Investment psychology is a vital, but underappreciated element of stock trading. Analysts normally focus on mathematics and trends. However, anyone who ignores human and social aspects of the stock market is making a serious error.

Four different emotions cause the vast majority of investment mistakes – especially if you’re an individual stock trader.

Those four emotions are greed, fear, hope, and regret. Here’s why they could lead to greater losses in your portfolio even compared to an economic recession.

1. Greed

Greed is the desire for money and wealth. When a trader experiences greed, they are only able to think about how much money they have made from a stock… and how much more they can make by keeping their position.

The problem? Profit is not realized until after a position is closed. Until you sell a stock, a trader only has the potential for profit.

Greed can make an investor hold stocks far longer than they should, hoping to achieve greater returns – until their asset price eventually plummets.

Learning how to invest better involves intuition and knowing when to quit while you’re ahead. Make sure to take some capital gains once in awhile.

2. Fear

Fear, arguably the most powerful of all emotions, causes a trader to sell a position regardless of its price. Unlike most other emotions, fear is a survival response.

The Dow Jones Industrial Average took from 1983 until 2007 (24 years) to grow from 1,000 to 14,200.

In contrast, the index took less than two years to lose about 50% of its value (2007-2009) between. That’s the immense power of fear.

Don’t get us wrong: fear is beneficial if it gets you out of a poor trade earlier than normal. Yet it can be dangerous when causing investors to not buy a stock that would otherwise be profitable.

3. Hope

Hope is a feeling of expectation and want. It’s perhaps the second second worst human emotion if you’re a stock investor. That’s because hope will keep a trader in an unprofitable position.

When a losing stock decides to go up, investors often keep holding in the “hope” of recouping past losses. That’s dangerous because, regardless of your wishes, the market will do what it does anyway.

A good investor should know when to cut their losses. Recognizing that you made a bad trade can bruise anyone’s ego. Nonetheless, it’s better to accept the learning experience and move on.

4. Regret

Regret is a feeling of disappointment over missed opportunities or a poor investment. This emotion can cause an overwhelming loss of focus.

Every experienced stock trader makes a bad investment once in awhile. Moving on is important though. Continuously dwelling on the fact that you lost a bit of money never helps.

Not every choice is a positive one, and feeling regret over them is natural. But an investor must simply learn from what went wrong and find another opportunity.

We all have emotions. Greater self awareness and understanding how your own stock market psychology impacts your trades will help make you a better investor.

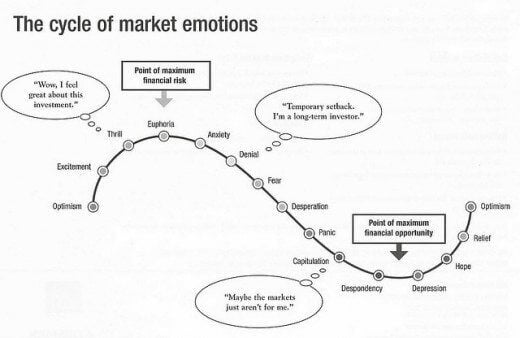

The cycle of investor psychology. Stock prices move like a rollercoaster… and so can emotions when your portfolio suddenly rises or drops in value.

Market psychology can be a very powerful tool. Traders usually just wonder if they should buy or sell a stock. Instead, consider asking yourself “what is everyone else doing?”.

Sometimes, not following what other investors do will help your own stock portfolio perform better.

Remember: your trading success will probably depend on intuition and stock market psychology more than crunching numbers.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.