Last updated April 8th, 2024.

Among the most popular countries to buy real estate in Asia as a foreigner, Thailand ranks at the very top.

That’s partially because of its strong tourism sector with Bangkok being the most visited city on the planet – at least during a normal year. People often come to Thailand, enjoy their time here, and make the choice to buy property.

Europeans made up the clear majority of foreign real estate buyers in Thailand up until several years ago. Chinese investors have since replaced them.

Juwai.com, China’s biggest international real estate portal, lists Thailand as the most popular market in the world, topping the United States and Australia in recent years.

To clarify: our founder, Reid, spent nearly a decade living in Thailand full-time and has many good things to say about the country; he owns property here, is active in Thailand’s property market, and speaks from experience.

Some of our team members are living in, or are native to Thailand as well. With all that said, we’re not positive about the Thai real estate market’s future.

We understand people have said this for a long time. You can find forum posts from people shouting doom and gloom.

Thai property values have approximately tripled since then with many investors, including myself, achieving great returns if they bought in central Bangkok.

But several factors have recently made us reconsider our position. There are better places than Thailand to own real estate as a foreigner – at least if your primary goal is making a return on investment.

Compared to Bangkok’s real estate values, prices in neighboring capital city Kuala Lumpur are about half the price.

Mid-Term: Thai Real Estate Values Are Too High

Wealthy buyers from China, Singapore, India, and elsewhere are still flocking to the Thailand stock market.

To be fair, from their perspective, they consider Thai real estate prices as much lower compared to buying property in their home countries. They use this as a justification for making an investment here.

That’s a big mistake though. Sure, a condo in Bangkok costs roughly 25% of a comparable one in Singapore. Yet Singapore’s per capita income is also around six times higher than Thailand’s, while its scarcity of land helps drive up prices as well.

You could maybe justify expensive Thai real estate values if it had better economic growth prospects. After all, even if locals can’t afford a property at current prices, their purchasing power would soon catch up in a country growing by 6% or more per year like Vietnam.

Unfortunately, rapid growth hasn’t been the norm in Thailand for quite some time. It now ranks among Southeast Asia’s weakest economies.

Out of all ten countries in the region, only Brunei saw slower growth than Thailand since way back in 2015.

Do you really want to buy property in Thailand, which is Southeast Asia’s second-weakest economy?

Thailand’s average annual GDP growth appears stuck in the sub-3% range. Meanwhile, more developed markets such as Malaysia are outpacing them.

We had a different opinion in 2012 back when Thailand’s economic future was better and property values were 50% cheaper. A weak economy, combined with high condo prices relative to neighboring countries, doesn’t indicate a bright future though.

The situation looks even worse after you add rising consumer debt levels to the large pile of economic issues in Thailand.

Long-Term: Thai Population Decline Imminent

You might already know about Japan’s demographic problems. Following its long boom period last century, Japan’s economy has been stagnant since the 1990s. That’s partly because of their declining and rapidly aging population.

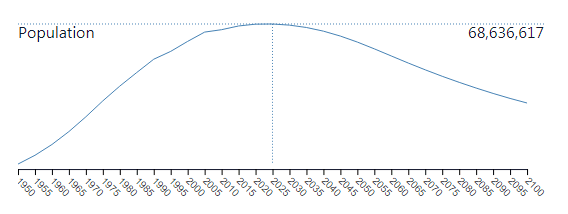

The same thing will happen in Thailand but with a very important difference. It won’t become a developed country before its population starts falling.

In other words, Thailand will be one of the first places to grow old before it’s ever wealthy. We therefore don’t think the Thai stock market enjoys solid long-term prospects.

Thailand will suffer from population decline starting around the year 2030. A shrinking population is bad news for the Thai stock market.

Obviously, this will have severe economic impacts in the not-so-distant future. Thailand’s aging population will directly translate to a less efficient workforce,

Far greater amounts of public funding will also be spent on social security, pensions, healthcare, and similar things that an aging society demands.

Population decline will probably keep Thailand stuck in the middle income trap. Aging populations are a demographic death knell for just about any economy – and affect real estate prices from Bangkok, to Tokyo, to Moscow.

A slow economy is never good for property values. Yet more importantly, a declining population is a precursor for weaker housing demand.

Fewer buyers, combined with an ever-increasing supply of inventory, is always a terrible mixture.

Thai Stock Market? You Have Better Investment Options

The opportunity cost of buying real estate in Thailand is simply too great. As an investor, why deal with all the negative aspects listed above when they don’t exist elsewhere in the region?

Cambodia and the Philippines are both growing at a pace of over 7% per year. They each have strong demographics and let foreigners own property on a freehold basis.

Likewise, Malaysia is one of few places in Asia where foreigners can easily own freehold land, under their own name, rather than just an apartment or condo unit.

Malaysia enjoys strong demographic trends and is growing in the high 4% range during a normal year, while real estate values are lower despite being a slightly more developed nation than Thailand.

If you like the Thai stock market and want to live in the country, don’t let any of that stop you from making a lifestyle decision and getting a condo anyway. Feel free to buy a condo wherever you enjoy spending time.

However, if your main objective is investment, you may want to consider looking at other real estate markets in Southeast Asia besides Thailand.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.