Last updated February 22nd, 2025.

You could make a solid argument that, because of annual taxes, property owners don’t truly own their house or the land it sits on.

After all, what happens if you stop paying property tax to the government? They’ll come seize your home and put you in jail.

Real estate taxes are essentially a form of mandatory rent, forced on homeowners. While taxes might cost less than paying 12 months of rent, both are nonetheless a bill that you must pay to continue accessing your home.

Paying mandatory fees every year is very similar to having a lease. The only significant difference is the government taking on the role of “collector” instead of the landlord.

Thankfully, there are still several places with no property tax left in the world.

You might have to pay a transfer fee when you initially buy real estate in these countries. But there aren’t any annual, ongoing tax obligations.

Most countries with no property tax are located in Southeast Asia and the Middle East. Here’s a list of three of them, plus a few others with a very low “near 0%” rate.

Thailand

Not long ago, Thailand was the only place in Southeast Asia with truly no property tax at all.

Back in 2019, the government introduced annual property tax. Yet tax rates on condos (foreigners may only own condo units in Thailand) remain extremely minimal – low enough that we’re still keeping the country on this list.

For example, you’ll pay about 2,000 baht ($60) per year on a condo worth 20 million baht ($600,000).

You also must pay a fee upon first purchasing a property. Transfer tax is 2% of appraised value. Typically, the seller usually pays that entire amount – or at the very least half of it, subject to negotiations.

Besides this one-time transfer payment, you can own a condo in Thailand with absolutely zero obligation to the local tax authorities. That is, unless you either begin renting out or sell the property, or simply own more than one condo under your name.

While foreigners can directly own freehold condo units in Thailand, they’re banned from purchasing land or houses. Thus, you will have to pay a yearly management fee due to the co-owned nature of a condominium building.

Of course, management fees aren’t really the same as property taxes since that money goes toward keeping your asset in good condition. Having access to facilities like a pool, garden, and gym certainly helps.

United Arab Emirates

Moving away from Southeast Asia and toward the Middle East, the United Arab Emirates (and particularly Dubai) ranks among the world’s best tax havens.

Dubai isn’t simply a low tax jurisdiction for real estate owners, but also with regards to practically everything else.

The UAE is famous in the global expat community as one of few countries that don’t tax personal income. Notably, the 0% tax rate extends to all rental income on properties in Dubai.

Dubai’s property prices are relatively cheap (about $7,000 per sqm) considering the UAE is a highly-developed nation. Real estate taxes are low here as well, which leads to its popularity as a second home destination.

Additionally, residents of the United Arab Emirates aren’t liable to pay capital gains, inheritance tax, stamp duty, or property taxes among several other types of levies.

The situation gets far more complicated if you are not living in the UAE full-time while earning income here though.

UAE property taxes can also change based on the specific emirate you’re in. Generally speaking, you’ll find less favorable tax treatment in Abu Dhabi and elsewhere compared to Dubai.

Bahrain

Situated in the Arabian Gulf, Bahrain has a long history as a trading hub and continues to be one of the most business-friendly countries in the Middle East.

A key reason Bahrain appeals to international investors is its pro-business policies and openness to foreign ownership. The government has worked hard to diversify the economy beyond oil and create an environment that welcomes global capital.

But perhaps the biggest draw for property investors is that Bahrain levies no taxes on real estate. That’s right – there are no property taxes, no transfer taxes, no stamp duties, nothing.

This zero-tax regime, combined with freehold ownership for foreigners, has helped spur a development boom in the capital city of Manama. Luxury projects like Amwaj Islands and Durrat Al Bahrain offer high-end villas and apartments with waterfront views.

Georgia

Thanks to its free economic policies and low taxes, Georgia is one of the most business-friendly countries in the world. Georgia ranked 7th out of 190 countries in the World Bank’s latest Ease of Doing Business Index, reflecting its efficient government and lack of red tape.

Most people haven’t considered investing in Georgia due to its obscurity, but that’s actually one of its strong points. The nation’s government is highly efficient, banks are easy to work with, and businesses can be incorporated in less than a day.

One of the biggest perks for property owners is that Georgia does not charge any annual property taxes in most cases.

As long as your income sourced from within Georgia is under 40,000 GEL per year (about $15,000), you won’t owe a dime in property tax. Even if you exceed that threshold, the property tax rate is a very reasonable 1%.

On top of that, Georgia doesn’t levy any transfer taxes or stamp duties when purchasing property. This keeps closing costs low and makes the buying process a breeze compared to other countries.

The mix of an efficient business environment and minimal property ownership costs have fueled a real estate boom in Georgia, especially in the capital city of Tbilisi.

Cambodia

Cambodia technically does have annual property tax. It’s a rather miniscule 0.01% of the total appraised value.

To give an example, the owner of a house in Cambodia worth $100,000 owes just $10 per year worth of real estate tax.

But things aren’t always as they appear in frontier markets. The government seems to hardly ever bother collecting this tax in practice. Perhaps because it’s such an insignificant amount.

You could get a call from somebody if you own an expensive apartment in Phnom Penh or a piece of prime land. However, a clear majority of Cambodian property owners don’t pay any tax.

Enforcement in many frontier markets, including Cambodia, is often lax. If you asked every single property owner in the nation, it’s doubtful that over 10% could honestly tell you they pay annual property taxes.

We think that’s good enough to include it on our list of countries with no property tax.

That said, Cambodia does have a substantial tax on unused land. Whether for agricultural or residential purposes, the goal is putting land to use. You shouldn’t “just sit on it” if you’re buying property here.

Countries With Low Property Tax

We might have missed a few smaller jurisdictions. Just about every other country in Asia, besides those mentioned above, does have property tax beyond a hundred dollars or so. And they strictly enforce the law.

Yet some jurisdictions do enjoy incredibly low tax rates. They might cost a bit more than $60 annually (or better yet: nothing) like the aforementioned countries.

A few places are nonetheless still worth mentioning although they don’t quite fit into a “zero tax” category.

Malaysia is one example. You must pay two different annual fees (property assessment and quit rent tax), although rates on both of them are miniscule.

The precise amount of taxes you’ll pay in Malaysia depends on location, type, and size of your property. But even large homes aren’t usually subject to more than a few hundred dollars per year.

Essentially, it could just as easily be included on our list of countries without property tax. Paying a few hundred dollars annually on a multimillion dollar home isn’t a big deal.

South Korea is another dynamic market where you hardly pay real estate taxes. Homeowners fall into one of four tax brackets depending on their property’s appraised value. A majority pay well under $1,000 per year.

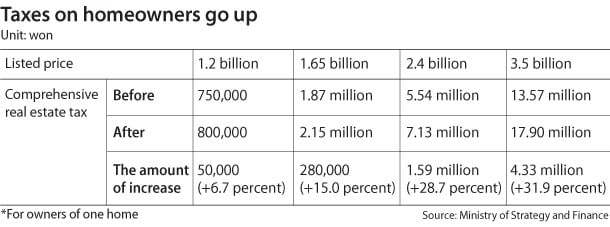

Here is a chart showing previous real estate taxes in South Korea compared to a recent rate hike.

Korea did increase its property taxes recently, however, the rate hike only truly impacts the luxury home market though.

For example, owners of homes worth under KRW1.2 billion (~$1 million) pay a flat tax of just KRW800,000 (~$700) annually!

That concludes our list of countries to buy property if you don’t want to pay tax on it. We all know the famous quote by Benjamin Franklin about “death and taxes”.

He clearly never went to the UAE, Thailand, or any of the other places without property tax.

FAQs: Countries Without Property Tax

Which Country Has the Lowest Property Taxes?

The lowest tax rate would be zero percent, and several countries in the world meet this criteria including Bahrain, Georgia, and the UAE.

Other countries like Malaysia and South Korea have property taxes, but at very low rates that are almost negligible.

How is 0% Property Tax Made Possible?

Having no property taxes might seem too good to be true, but it is a reality in some countries. This is often made possible by the government generating revenue from other sources, such as natural resources or tourism, rather than relying on taxing property owners.

In places like the UAE, the government can afford to offer tax-free property ownership because of the immense wealth generated from oil and gas reserves.