Last updated March 17th, 2024.

Diversifying your portfolio into different currencies is a great way to limit its reliance on a single country’s financial system.

World currencies, of which there are over a hundred, can be ranked on a scale from “very stable” to “absolute trash” though.

Investors repeat several nuggets of wisdom. One of them, a quote from Warren Buffett, is “Be fearful when others are greedy and greedy when others are fearful.”

This is generally solid advice. Regardless, it’s sometimes taken too far. Even savvy investors might take this quote too much to heart and think that just because others are fearful it is a good time to get an underappreciated asset at an excellent price.

In reality, people might become fearful because there are actual, legitimate reasons to be afraid of an investment.

Here at InvestAsian, we specialize in finding unique investment opportunities in Asia. We often venture into places where most traditional investors wouldn’t even dream of going.

Still, there are plenty of investments that we don’t recommend. The fundamentals simply aren’t there.

Below, we’ll look at three of the least valuable currencies in the world. You should avoid every single one of them.

Quite simply, they all carry far too much risk vs. the potential reward to be worth holding in the short term.

Keep in mind that this list isn’t written in stone. It’s subject to change as the country’s economy changes. With all that said, here are the three weakest currencies in the world as of 2024.

Myanmar Kyat

| Myanmar Kyat (Ks) | |

| Year on Year | -0.1% |

| 5 Years | -34% |

| 15 Years | -34,000% |

| Present Price in USD | 2,100.00 |

Myanmar is among the poorest countries in Southeast Asia with over a quarter of the population living in poverty and more than a third currently unemployed. To further add to this economic cocktail, the country has turned quite insular and paranoid as of late.

Back in early 2021, Myanmar had a coup, which resulted in a general strike that led to thousands of detentions and several hundred people killed.

To further complicate the situation, Myanmar’s international currency reserves were decimated when the New York Federal Reserve froze $1 billion mere days after the coup. The World Bank and the IMF also responded in kind by suspending projects in the nation.

This attack from all possible economic vectors quickly reduced the value of Myanmar’s currency, the kyat, by over 50%.

And when viewed over the course of a decade, the kyat has fared even worse. Don’t let the -34,000% value vs the dollar fool you. Things aren’t quite so bad.

One might even argue that the currency’s failure on such a large scale has been for the best. There used to be two exchange rates in Myanmar: one set by the government and one extraofficial.

Once the government found it untenable to maintain these arbitrary exchange rates, the official rate reflected the real rates. So, in a way, it was an attempt at liberalizing and reflecting economic realities, which aids trade.

The past decade has not been kind to the country though. And when you add recent events to the mix, things aren’t looking up for Myanmar or the kyat in the future.

As one might imagine, international companies prefer not to do business with military juntas, or at least unproven and unstable ones. Hence, international investment has dried up or was even withdrawn over the last few months.

It’s unclear where Myanmar is heading. Military juntas haven’t necessarily spelt the death of economies.

There were even moments where juntas could be considered beneficial, at least where finance is concerned. Pinochet’s Chile is one prime example. It’s studied as a model to emulate by macroeconomists to this day.

As things stand, we find it best to avoid fire. The kyat is one of the worst currency in the world, and you have dozens of superior options elsewhere.

On a price per square meter basis, Istanbul’s property market now ranks among Asia’s cheapest following a lira crash.

Turkish Lira

| Turkish Lira (₺) | |

| Year on Year | -55.00% |

| 5 Years | -450% |

| 15 Years | -1,800% |

| Present Price in USD | 32.00 |

Ever since the era of the Ottoman Empire, Turkey has had a certain appeal to the West. It’s in that “in-between area” of being familiar yet different. And when people think of investing somewhere foreign but known, they often gravitate towards Turkey.

We have often discussed the country for its investment benefits and risks. Just a month ago, we covered the intricacies of investing in Turkish real estate.

On paper, investing here seems to make sense. After all, it’s a wealthy nation and ranks highly on the human development index.

Turkey seems to have a lot going for it, at least in theory. Yet paper isn’t much good when having to contend with hyperinflation.

The Turkish lira has had a rough decade, transforming from a decent storage of value into a truly awful currency. Most of that decade was under the stewardship of President Recep Tayyip Erdogan.

It’s a matter of debate whether or not he is a dictator as he uses the mantle of legal legitimacy. One thing Erdogan certainly isn’t though? An economist.

To say that he has a unique take on finance is a mild understatement. Among Erdogan’s economic policies is the unconventional view that high-interest rates lead to inflation.

As such, he has remained insistent on lowering interest rates, despite the fact that the wider pool of money causes an oversupply of currency and, naturally, leads to inflation.

In other words, not only would you have to contend with an increasingly authoritarian state, but also inflation rates of upwards of 15% as the lira’s real value gets eaten up via dilution.

To even begin making a profit, you’d already have to considerably outperform investment benchmarks like the S&P 500 in order to beat inflation and earn a profit in real terms.

Hence, for the foreseeable future, you’ll likely lose money in real terms if owning Turkish lira. It’s certainly among the poorest currencies in the world.

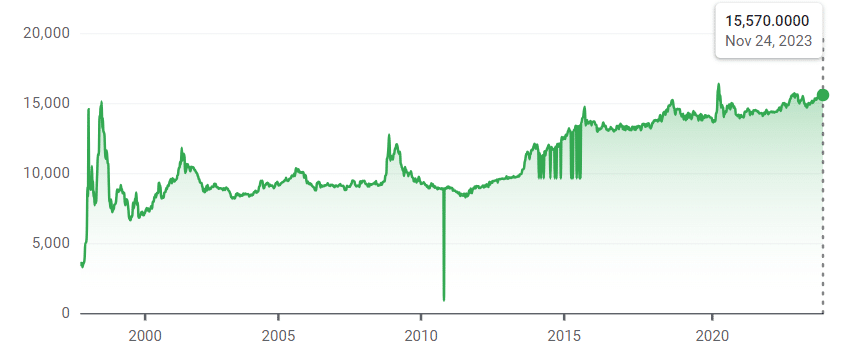

While Indonesia’s rupiah has remained stable over the past few years, a multi-decade chart shows a different story of consistent long term depreciation.

Indonesian Rupiah

| Indonesian Rupiah (Rp) | |

| Year on Year | 0.35% |

| 5 Years | -10% |

| 15 Years | -34.00% |

| Present Price in USD | 15,600.00 |

Indonesia is another one of those countries that looks promising on paper. It’s the seventh-largest economy in the world in terms of GDP and even has ambitions to become the fourth-largest economy by 2045.

The nation ranks among Asia’s largest exporters of automobiles and oil. Unfortunately, during the last decade, the Indonesian rupiah also declined against the USD by over 30% which makes it one of world’s worst currencies.

Indonesia’s government prices basic goods (such as some food items and electricity) and meddles in the development of the free market as a whole through heavy-handed policies, or direct ownership.

Worse still, this heavy hand is wielded by a government broadly perceived as corrupt and arbitrary. A survey from the World Economic Forum reports 70% of entrepreneurs believe that corruption has kept increasing in the country over the years.

Hence, the system evolves to satisfy a growing kleptocracy, which naturally weakens the overall competitiveness of Indonesia.

If Indonesia’s economy and rupiah are to see positive growth, the nation must undergo deep structural reforms that eliminate, or at least reduce the most callous abuses by the system.

This is also coupled by growing labor unrest, which is partially fueled by the staggering inequality present in the country. Indonesia’s decline isn’t directly attributable to a single cause but a litany of small problems that compound each other.

So, despite its recent and surprising stability – especially given recent economic volatility – the currency as a whole has shown a steady decline over the years.

We believe that there is a ray of hope though, as Indonesia’s massive population of 250 million inhabitants, strong demographic trends, and rising middle-class all bode well for the country’s future.

Indonesia’s rupiah doesn’t have immediately strong prospects. Certainly not compared to other currencies in Asia.

Still, the rupiah could appreciate over the next few decades as Indonesia’s economy grows. They have the fourth largest population on the planet which, by its nature, adds long-term potential.

World’s Worst Currencies Aren’t Worth the Risk

Don’t take the presence of any currency on this list as a permanent indictment of the country as a whole. There are often opportunities to be found when a country’s currency is weak.

For instance, if you invest in a company that sells materials denominated in a strong foreign currency, then a poor performing local currency works in your favor.

The reason is that revenues are kept stable, or even increasing, while local expenditures like labor, capital or land might be decreasing as they’re set far in advance and might not be able to adapt quickly enough in real terms.

Consequently, a sinking local economy – reflected in a weak currency – might be a good thing. At least under the right conditions.

As it stands, we’d actively discourage you from holding any of the worst currencies in the world are highlighted in this article.

Not only should you avoid them for speculative purposes, but also any business venture that involves these currencies should be approached with extreme caution. Preferably without leverage and below 1% of overall portfolio allocation.

You have countless opportunity while investing offshore. Let’s not forget the risks as well!

FAQs

What is the Least Valuable Currency in the World?

The Myanmar kyat is now the worst currency in the world. This is based on its long-term depreciation over the past 15 years combined with its lack of usability.

Are Any of These Currencies a Good Investment?

No. We don't recommend either the Myanmar kyat, Indonesian rupiah, or Turkish lira. Once a currency reaches a certain threshold of depreciation, it's unable to recover.

Why Are These Currencies So Weak?

The reason is different for each country. For the Turkish lira, it's because of hyperinflation. Civil war and conflict is the reason for the Myanmar kyat's weakness. Indonesia is meanwhile hit by inflation and a general economic imbalance.