Last updated April 28th, 2025.

Retiring in Singapore is becoming more popular among wealthy expats looking to live out their golden years in Asia.

This small island nation offers a high quality of life, advanced healthcare, low crime rates, tropical weather, and a favorable exchange rate for any foreigner who wants to retire in Singapore.

Whether you plan to relocate full-time or split between multiple countries, retirement in Singapore offers comfort to the maximum degree possible. In this guide, we’ll cover all you need to know about retiring in Singapore – from visa options to healthcare and more.

Whether you’re planning to relocate on a full-time basis or split your golden years between multiple countries, retiring in Singapore offers comfort to the maximum degree possible.

Housing Prices in Singapore

One of the biggest considerations when moving abroad for retirement is housing costs. As one of the most expensive cities in ASEAN, housing in Singapore can be pricey compared to other parts of Southeast Asia.

In the city center, you should expect to pay around S$2,500 monthly to rent a one-bedroom apartment and S$5,000 for a three-bedroom unit.

Outside of Central and Orchard, prices drop to around S$1,400 for a one bed and S$2,300 for three beds.

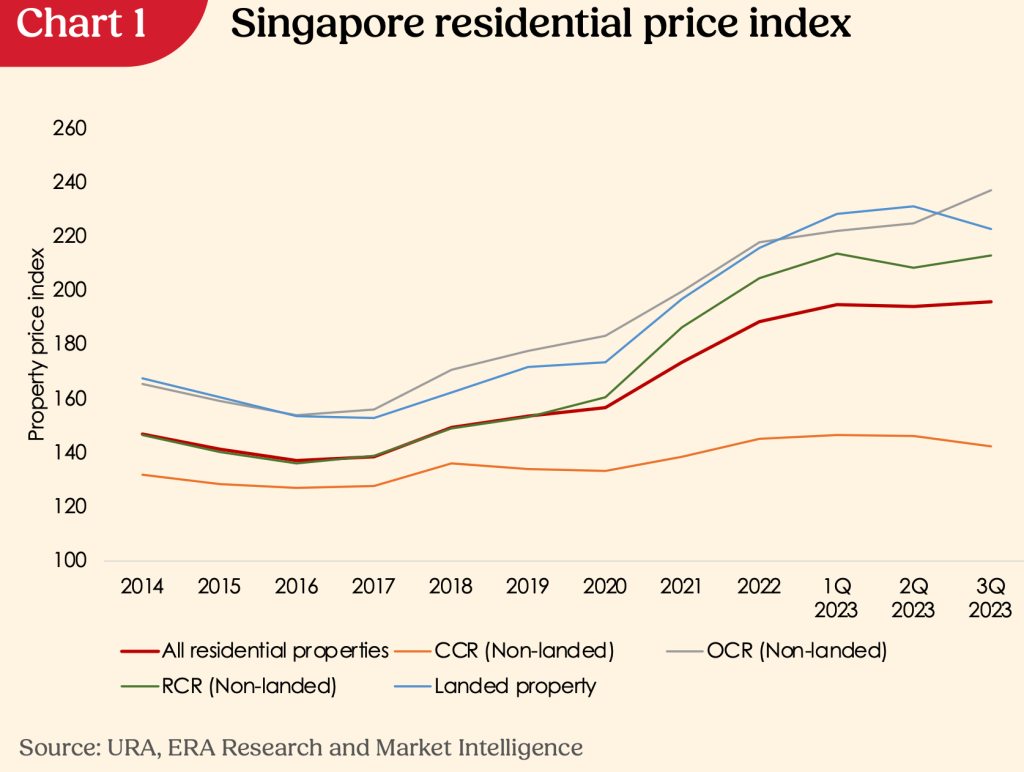

Property values in Singapore have increased significantly over the past decade. Besides getting your visa, the main cost of retiring in Singapore will certainly be housing.

To purchase property, prices range from S$30,000 per square meter in prime central areas to under S$15,000 per square meter in the suburbs.

Buying a condo in Singapore is popular among expats, offering amenities like pools, gyms, security, and maintenance services.

Mansions and large houses with gardens are rare in Singapore given limited space and restrictions on foreign investors buying land.

The government also offers affordable public housing called HDB flats, though these units have restrictions on purchase and resale for foreigners.

Overall, expect housing costs in Singapore to take up a significant portion of your budget as a retiree.

Getting a Visa in Singapore

Since Singapore doesn’t have a retirement visa program, obtaining long-term residence requires more planning (and money!) compared to countries with dedicated retirement visas.

The main alternative paths to a retirement visa are:

Employment Pass – This work visa leads to eligibility for permanent residence after living in Singapore for over a year. To qualify, you must have a job offer paying at least S$3,900 per month.

EntrePass – Entrepreneurs and investors can get this visa by starting a Singapore-based business with at least S$50,000 in paid-up capital. It also provides a route to permanent residence.

Foreign Artistic Talent – Renowned artists and cultural figures may qualify for permanent residence by demonstrating contributions to Singapore’s arts scene.

Marriage Visa – Marrying a Singaporean citizen or permanent resident provides a direct path to gain permanent residence.

Investor Visas – Options like the Global Investor Programme (GIP) provide immediate permanent residence in exchange for investing at least S$10 million into a Singapore business.

Alternatively, you can qualify for the GIP by investing at least S$25 million into a fund approved by the Singapore Economic Development Board, or S$50 million into a family office.

Once permanent residence is obtained, you can live in Singapore long-term without needing to maintain a work visa. Do note that PR status requires renewing every 5 years.

Retiree Lifestyle in Singapore

Known for its multiculturalism and ultra-modern amenities, Singapore offers a very comfortable lifestyle for expat retirees. English is widely spoken given Singapore’s British colonial history and status as a global business hub.

The tropical climate stays hot and humid year-round, though indoor spaces feature air conditioning.

Singapore’s low crime rate and general safety makes it easy to settle in quickly as an expat. Activities like walking or taking public transportation at night are worry-free.

The city also has abundant amenities like international shops and restaurants that make the transition smooth.

Due to limited space, most retirees live in high-rise condos rather than houses. Car ownership is extremely expensive, so most rely on the efficient public transit system. Taxi rides are affordable and ubiquitous for older adults who prefer not to drive themselves.

While not as low-cost as neighboring countries, fresh food, utilities, amenities, and dining out in Singapore are priced reasonably compared to Western cities of its stature.

Overall, Singapore offers a modern, safe, and convenient lifestyle for expat retirees.

Healthcare in Singapore

Singapore’s healthcare system is renowned as one of the most efficient and high-quality in Asia. The country provides quality medical care and facilities on par with developed Western nations.

The government provides integrated medical savings and insurance accounts for citizens, while expat retirees must enroll in private insurance plans.

Premiums vary based on the level of coverage, deductibles, and co-pays, but expect to budget S$200 to S$400 per month for a robust retirement health plan.

Even without insurance, out-of-pocket costs for general doctor visits, dental care, and prescription medications are quite reasonable as a foreigner choosing to retire in Singapore.

Specialist visits, procedures, and hospital stays are more affordable with insurance coverage.

Singapore’s base of internationally accredited hospitals, cutting-edge technology, and skilled English-speaking doctors and nurses make it a reassuring choice for healthcare in your retirement years.

Best Places to Retire in Singapore

When choosing where to settle down in Singapore, three areas stand out as particularly appealing for retirees – Orchard, Jurong, and Woodlands.

Orchard is Singapore’s prime upscale shopping and entertainment district. Located right in the city center, Orchard offers unparalleled convenience with high-end malls, restaurants, hotels and attractions within walking distance.

The area has a lively cosmopolitan vibe and is well-connected by public transit. Housing options include luxury condominiums and brand new developments.

Of course, the convenience and amenities of Orchard come at a price – expect real estate here to be the most expensive in Singapore.

In western Singapore, Jurong provides a more affordable alternative while retaining good connectivity to the rest of the city. Home to several universities and Singapore’s main port facilities,

Jurong has seen significant development and infrastructure investment in recent years. The area offers a wide range of housing options, from HDB flats to private condos, at prices below central Singapore.

Jurong’s lower property prices, good infrastructure, and relative quietness have made it one of the best areas to retire in Singapore.

The downside is that Jurong is farther from the city center and Changi Airport. Still, its relatively affordable real estate prices makes it attractive to retirees seeking value.

For those desiring a more laid-back suburban lifestyle, Woodlands in northern Singapore is a top choice.

Woodlands borders Malaysia and is known for its abundance of parks, open spaces and greenery compared to the rest of built-up Singapore. It provides easy access to nature while remaining well-connected to the rest of the city by metro and bus networks.

Woodlands offers high quality housing, international schools, amenities, and healthcare facilities at lower prices than central Singapore neighborhoods. The trade-off is longer travel times to downtown.

Overall, living in Woodlands combines affordability and livability for an appealing retirement option.

Is Retirement Singapore a Good Idea?

With its tropical climate, modern conveniences, friendly visa options, and stellar healthcare, Singapore is understandably a coveted destination for retirement.

Keep in mind though: a retirement visa doesn’t exist in Singapore. Buying property here, by itself, doesn’t confer the right to live in Singapore as long as you’d like.

The easiest alternative to a retirement visa is expensive. Plan on investing millions of dollars into Singapore if you truly want the right to stay permanently.

By planning ahead for visas, budgeting properly for housing costs, and getting the right insurance coverage, you too can spend your golden years enjoying everything this island nation has to offer.

FAQs: Retiring in Singapore

Does a Singapore Retirement Visa Exist?

No, Singapore does not have a dedicated retirement visa program. Retirees looking to live in Singapore long-term must explore alternative visa options, such as the Employment Pass, EntrePass, or Investor Visas.

For instance, the Global Investor Programme (GIP) offers permanent residence to those willing to invest at least S$10 million in a business or S$25 million in an approved fund. Another route includes marrying a Singaporean citizen or permanent resident which provides eligibility for PR status.

How Much Does it Cost to Retire in Singapore?

Retiring in Singapore can be expensive, especially due to high housing costs. Renting a one-bedroom apartment in the city center costs around S$2,500 per month, while purchasing property in central areas can go up to S$30,000 per square meter.

Suburban housing is slightly more affordable, with one-bedroom apartments costing approximately S$1,400 monthly. Healthcare is another significant cost, with private insurance premiums ranging from S$200 to S$400 per month, depending on coverage. Overall, retirees should budget carefully to accommodate Singapore’s high living standards

What is the Retiree Lifestyle Like in Singapore?

Singapore offers a modern, safe, and highly convenient lifestyle for retirees. The city-state is known for its low crime rates, efficient public transportation, and world-class amenities. Retirees can enjoy a multicultural environment where English is widely spoken, making the transition smoother.

While car ownership is prohibitively expensive, the public transit system and affordable taxis provide excellent alternatives. Housing is typically in high-rise condos due to limited space, and the tropical climate ensures warm weather year-round. Dining out, utilities, and fresh food are reasonably priced compared to Western cities of a similar stature.

Where Are the Best Places to Retire in Singapore?

Three key areas stand out for retirees in Singapore: Orchard, Jurong, and Woodlands. Orchard is the most upscale option, offering luxury condominiums and easy access to high-end malls, restaurants, and entertainment, albeit at a premium cost.

Jurong, located in western Singapore, provides more affordable housing options and a quieter environment, while still offering good connectivity to the city.

For those seeking a suburban lifestyle, Woodlands in northern Singapore is ideal, with its abundance of parks, lower housing prices, and access to nature. However, Woodlands is farther from downtown and Changi Airport, which may require longer travel times.