Singapore transformed from an undeveloped swampland into one of the world’s wealthiest countries. And it only took them under half a century.

Because of this, property in Singapore is highly sought-after, and it’s among the most expensive in the world. In fact, out of every real estate market in the world, only Hong Kong’s is more expensive than Singapore which ranks a close second.

Despite such sky-high prices, buying property in Singapore can be appealing to foreigners who reside or do business in the country.

And given the city-state’s high level of development and status as Southeast Asia’s finance hub, Singapore is different from its neighbors – all of them emerging markets.

On the positive side, the entire process of buying a condo in Singapore is far easier than other Southeast Asian countries.

Singapore’s higher standards for developers, strong rule of law, and efficient business practices make buying a condo easy for locals and foreigners alike.

Since English is Singapore’s official language, you won’t need to worry about hiring a translator either.

Yet while buying property in Singapore is a relatively painless process, a Singapore condo unit does not come cheap. And you likely won’t see major returns on your investment. Rental yields in Singapore often hover around the 2% to 3% range.

A condo in Singapore, along with every other investment, comes with its own unique benefits and drawbacks. We created this guide to give you an overview of Singapore’s property market including:

- Foreign property ownership laws in Singapore;

- The cost of buying property in Singapore;

- Singapore’s different neighborhoods;

- Property taxes and other fees; and

- Is buying a condo in Singapore a good investment?

Although foreigners can own a variety of residential and commercial real estate in Singapore, this guide will focus primarily on buying condos. You should read our guide about investing in Singapore property if you’re interested in buying a house or another type of real estate.

Billionaire James Dyson recently bought a three story penthouse in Singapore’s CBD, paying S$73.8 million.

Foreign Property Ownership in Singapore

Unlike most Asian countries, Singapore allows foreigners to buy condos rather easily. Foreign owners can purchase a condo in their name through a freehold title, and they enjoy the same property rights as Singaporean citizens.

The only big difference between a Singaporean condo owner and foreign condo owner, legally speaking, is what they must pay in property taxes. We’ll address this topic later in our guide.

However, while foreigners are legally allowed to own freehold condos in Singapore, developers may choose whether to sell their property on a freehold or leasehold basis.

For example, many developers in Central Singapore will only sell long-term leases since they’ll not want to relinquish ownership of such high-value properties.

Whether you’ll be able to own a freehold condo in Singapore depends on where you want to buy and the developer that you’ll buy from.

You may need to search harder for developers that sell freehold condos. Still though, buying real estate in Singapore is a straightforward process, and entry barriers remain few and far between.

If you’re considering a piece of landed property as a foreigner, however, you must get government approval for your purchase. It’s not easy, and quite frankly, it’s unlikely that anyone reading this would qualify.

Purchasing land in Singapore as a foreigner involves a bureaucratic process to prove that your purchase will benefit Singapore’s economy. There isn’t any specific figure to make that argument, but the ballpark figure is about S$50 million.

The vast majority of foreigners looking to buy property in Singapore will purchase non-landed condos to avoid such hassle.

How Much Does a Singapore Condo Cost?

Singapore has one of the most expensive housing markets in the world, so if you plan to buy a condo there, you should prepare to spend a considerable amount of money.

The average condo price is just shy of S$875,000. But if you wish to buy a bigger unit or one in a prime location, you can expect to pay upwards of S$1 million. A two-bed condo in Central, for instance, costs an average of S$1.6 million.

You also likely won’t make much of a return on your investment. While Singapore’s real estate market is quite stable, growth has slowed considerably, and rental yields can be low.

In light of these sky-high property prices, Singapore’s government has introduced new cooling measures to keep rising real estate costs at bay. These include raising stamp duties for foreign buyers along with Singaporeans buying second residences.

New laws have indeed helped stabilize housing costs. Lower supply and high demand among foreigner buyers let developers continue selling property at premium prices though.

Simply put: condos in Singapore aren’t cheap. You should expect to invest a considerable sum money on your new property here.

Not every flat in Singapore is outrageously expensive. Apartments in Singapore’s East Region, near Changi Airport, are commonly priced below S$1 million.

Neighborhoods in Singapore

Singapore is one of the world’s smallest nations. But you have plenty of choices when deciding where to buy a condo. The city state boasts a variety of unique neighborhoods, each with their own benefits and drawbacks.

Regardless of where you choose to live, you should always consider your condo’s proximity to public transit. Owning a car in Singapore can be costly and inefficient, thus most residents rely on Singapore’s extensive MRT network to commute.

So, if you wish to live and work in the city, living near an MRT station is a crucial part of getting around. It’ll also help maintain your property’s long-term value.

Central

Central is the heart of Singapore. Here, you’ll find the city’s central business district along with major tourist areas like Marina Bay and Chinatown. For the purposes of our guide, Central also includes Orchard and its surroundings.

Living in Central is ideal for anyone wanting to be as close to the action as possible. Of course, it comes at a price too. Central is among the costliest areas to buy apartments in the city with real estate values at roughly S$20,000 per square meter.

Another drawback to buying a condo in Central Singapore is that freehold property is difficult to come by.

While foreigners can technically own freehold property in Singapore, many developers do not wish to give up prime real estate in Central. So they choose to sell their condos on a leasehold basis.

You may be able to find some freehold condos closer to Orchard Road, but you should expect to pay a premium for freehold ownership.

East Singapore

East Singapore includes a variety of neighborhoods between Central and Changi Airport, such as Bedok and Tampines, and like Jurong to the west, it is a more industrial area of the city.

Thanks to its lower housing costs and proximity to the airport, East Singapore has attracted a good number of expats. Additionally, since East Singapore is nearby Central, commuting to the central business district is quite easy if you’re near an MRT station.

While housing prices here are much less expensive than in Central, the cost of your condo will depend on where you wish to live. Coastal property prices can rival those of Orchard Road, yet you’ll find relatively affordable condos in “local” areas of East Singapore.

Woodlands/Sembawang

Woodlands and Sembawang are are on the northern tip of Singapore, bordering the Singapore Strait that divides the city from Malaysia.

These neighborhoods are certainly on the outskirts of the city. Nonetheless, they’ve attracted expats and middle class Singaporeans alike due to their relative affordability and abundance of parks and greenery.

Living in Woodlands or Sembawang is best for those looking to escape the hustle and bustle of Central for a suburban environment. As a bonus, real estate costs considerably less than in the center.

You won’t find anything cheap (at least regional standards) in Singapore. However, you will find greater growth potential here as Singapore’s urbanization continues.

Living in these neighborhoods are appealing both aesthetically and financially. Just remember that you’ll probably deal with a lengthy commute to Central. Living near an MRT station should remain a priority if you move to Woodlands or Sembawang.

Jurong is reasonably priced compared with Orchard and Marina Bay. Two of Singapore’s top universities, NTU and NUS, are also based in Jurong which helps drives housing demand nearby.

Jurong

Jurong comprises a loosely defined area in West Singapore, which is known for its universities, industry, and dense population. Jurong also houses Singapore’s only major port.

While you may initially recoil at living in an industrial area, you should keep in mind that Jurong is still in Singapore – among the world’s cleanest cities. Thanks to Singapore’s heavy abundance of parks and greenery, smog and pollution aren’t an issue even in more industrial zones.

Jurong is an education hub as well. Top universities such as Nanyang Technological University and the National University of Singapore are housed in the area.

Investors seeking a profit on their condo may want to consider buying property in Jurong, renting it as student housing.

Serangoon/Ang Mo Kio

Serangoon and Ang Mo Kio are situated in the northeast between Central and Changi Airport, making these neighborhoods ideal for both commuters and frequent travelers.

Such areas are perhaps best for people who wish to be close to the city center without actually being in the thick of it. Both are just a few stops on the MRT away from Central, and they enjoy plenty of shopping and nightlife options.

Prices in Serangoon and Ang Mo Kio aren’t as high when compared to Central. Still, you should expect to pay a considerable sum for a condominum here. These neighborhoods are distinctly upper class, and proximity to Central makes them desirable places to live.

Fees and Property Taxes in Singapore

While Singapore is largely considered to be a tax-friendly state, its property taxes can be quite high for foreigners, and recent cooling measures have raised Singapore’s property taxes even higher.

Property taxes in Singapore come in two forms – an Additional Buyer’s Stamp Duty (ABSD) due upon the purchase of your condo and annual property taxes. As a foreigner, these taxes will be much higher for you than for citizens or permanent residents.

As a foreigner, you can expect to pay 60% of the total value of your condo as ABSD! This rate has been continuously raised over the past decade.

ABSD is payable upon the purchase of your condo. So, you should factor this cost in when making your decision.

If you’re a Singapore permanent resident, then you will pay 5% on your first property purchase and 10% on subsequent purchases. But if you’re a Singapore citizen, then you won’t pay tax on your first home.

On top of that, you’ll also need to pay an annual property tax that is based on the rental value of your home. You may not plan to rent out your apartment. Regardless, rent value is used as a valuation metric to calculate the annual property tax that you must pay.

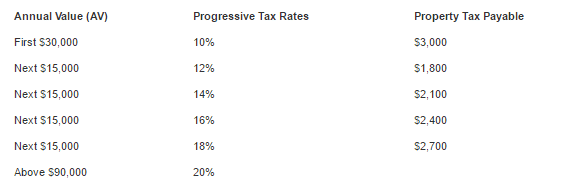

Unlike the flat ABSD tax, Singapore’s property tax rates are progressive. The table below shows a breakdown of this tax progression.

As a foreigner, however, you’ll pay an extra 10% on top of each rate. You’ll need to add an additional 4% if you occupy the home – and if you rent your condo out, you’ll pay an extra 10% instead. Separately, there’s a 20% tax on rental income when leasing your condo.

Needless to say, all of this adds up quickly. Property taxes in Singapore are a lot easier to deal with as a local (or even a permanent resident!) than as a foreigner.

A table showing the progressive property tax rates in Singapore. Several additional taxes apply to foreign condo owners.

Singapore Property Agents and Developers

One of the largest benefits of buying a condo in Singapore is that there is no shortage of high-quality property developers and agents.

In Singapore, locals and foreigners alike often use real estate agents to help them find the best properties for their needs. Many agents provide excellent services while accepting much lower commission rates of just 1%.

That’s in contrast to many other Southeast Asian markets, where agents are typically only used by foreigners to overcome a language barrier and often charge much higher fees.

Hiring an agent might be helpful, though it isn’t always necessary. Sites such as PropertyGuru and iProperty allow users to easily browse property listings. Meanwhile, setting appointments with sellers is simple – particularly given that Singapore’s primary language in English.

You’ll be hard-pressed to find a truly bad property developer in Singapore. Given the country’s strong reputation for quality, poor developers simply don’t last long here.

Plus, you won’t need to perform the extensive vetting that you would need in countries like the Philippines or Vietnam.

If you aren’t sure where to start though, you might want to see our ranking of the best property developers in Singapore.

Is Buying a Condo in Singapore a Good Investment?

As mentioned earlier, Singapore’s real estate market is one of the world’s most expensive. Yet this doesn’t necessarily make it a bad investment: just be aware that you’ll pay at least S$2,000,000 for a two bedroom, freehold condo in a prime location.

Rental yields in Singapore remain low, and you should expect to achieve 3% gross returns at best. There are multiple factors which work in the city’s favor regarding capital appreciation though.

Singapore’s status as a global financial hub practically assures healthy demand among prospective tenants and buyers in the future. Meanwhile, a scarcity of available land guarantees a hard cap on supply in the real estate market.

You might consider buying a condo in nearby cities with higher rental yields, like Manila, Phnom Penh, or even Bangkok, if your goal is cash flow. Each of these cities enjoy average yields in the 5%+ range.

But if you’re seeking a capital appreciation play in Southeast Asia’s de-facto financial center, along with exposure to the region’s most stable currency, then there’s no other place quite like Singapore.

Buying a Condo in Singapore: FAQs

How Much Does a Condo in Singapore Cost?

Condos in Singapore are quite expensive, with the average price just under S$875,000. For a larger unit or one in a prime location like Central Singapore, expect to pay over S$1 million. A two-bedroom condo in the city center averages S$1.6 million.

While prices are sky-high, Singapore's real estate market is very stable. Just don't expect huge returns, as rental yields hover around a modest 2-3%.

Can Foreigners Own Condos in Singapore?

Yes, foreigners can purchase condos rather easily in Singapore. Foreign owners can buy a condo in their name with a freehold title, enjoying the same property rights as Singaporean citizens. The only major difference is that foreigners pay higher property taxes than locals.

While foreigners are legally allowed to own freehold condos, some developers may only sell leasehold units, especially for prime properties in Central Singapore. So finding a freehold condo could require additional searching.

What are the Risks of Buying Property in Singapore?

The biggest risk is the astronomical real estate prices in Singapore. It has the second most expensive housing market in the world after Hong Kong. A prime condo will cost at least S$2 million, yet rental yields are a paltry 2-3%. Heavy additional taxes on foreign buyers of 60%+ also eat into returns.

However, Singapore's strong rule of law, efficient business practices, strategic location and land scarcity make it a relatively low risk market for capital appreciation compared to cheaper, higher-yielding alternatives in Southeast Asia. The entire buying process is straightforward for foreigners.