In the past several years, offshore bank account interest rates across the world have risen significantly. They’re now a viable way to make passive income.

Gone are the days of near-zero interest rates! We all have inflation to thank for that.

In some countries, rates are better compared to others though. Does 7% interest rate per year sound attractive? Because offshore bank account rates can get even higher than that, depending on which currency you’re willing to hold.

Relatively stable currencies such as Armenia’s dram are paying interest rates higher than 10% per year.

And you can expect bank deposit rates in the 15%+ range if you’re willing to take on a greater amount of currency risk in places like Mongolia and Turkey.

Mind you, not all of these places have stable currencies which will hold their value. Yet several of them have banks which are surprisingly well-capitalized, and a few even allow USD term deposits.

Below is our list of five countries with best offshore interest rates on savings accounts and fixed deposits.

Mongolia

One of Asia’s smallest countries in terms of population size, Mongolia’s economy is nonetheless one of the region’s fastest growing. This is largely because of Mongolia’s vast resource wealth, combined with its proximity to China and Russia.

Mongolia’s currency, the tugrik, is also one of the highest-yield currencies in the world. It’s very possible to achieve 15% or higher interest if you deposit tugrik into a local bank account.

Just be aware that the tugrik is not a stable or easily exchangeable currency at all. In fact, it’s steadily deprecated against major world currencies for well over a decade. You may lose substantially more in real terms than the 15% interest they’re paying you.

You’ll need to fly to Mongolia in order to open a bank account here. Generally, it’s not a requirement to be a resident, although whether or not they’ll open an account for a tourist depends on the bank and specific branch.

It’s difficult, but possibly worth it to open an account at a bank with the highest interest rates in the world.

Consider checking one the country’s top banks such as TDB, Golomt, or Khan Bank to increase your chances of success with opening an account in Mongolia.

Turkey

Home to 80 million inhabitants and rising, Turkey is a regional powerhouse, and its economy is the biggest on our list by far.

Turkey is also one country with the highest interest rates in the world. It’s possible to get interest rates above 10% on lira bank deposits!

Unfortunately, Turkey’s currency is rapidly depreciating with no-end in sight. The lira held at around 3.00 to the US Dollar back in 2016 but lost over five times its value since then. Nowadays, it’s trading at roughly 30.00 to the greenback.

The reasons behind the lira’s weak performance are many. If you’re interested, we write about Turkey’s dire economic situation in greater detail here.

High corporate debt levels, poor policy management, an ongoing trade deficit, and lack of foreign investor confidence are leading to the Turkish lira’s multi-year depreciation.

You’ll find some of the best interest rates in the world here. Still, the question remains even at 10%+ annual rates: is it worth making an investment in the Turkish lira given the currency’s problems?

Our suggestion is to consider a lower interest rate in a better currency. The lira just isn’t worth taking a position in right now considering its multi-year depreciation and lack of a floor.

Before taking any sizable position in lira bank deposits, we recommend waiting for a long-term upper resistance level to form. Otherwise, if you insist, you’ll need to visit Turkey and get a residence card before opening a bank account.

Armenia

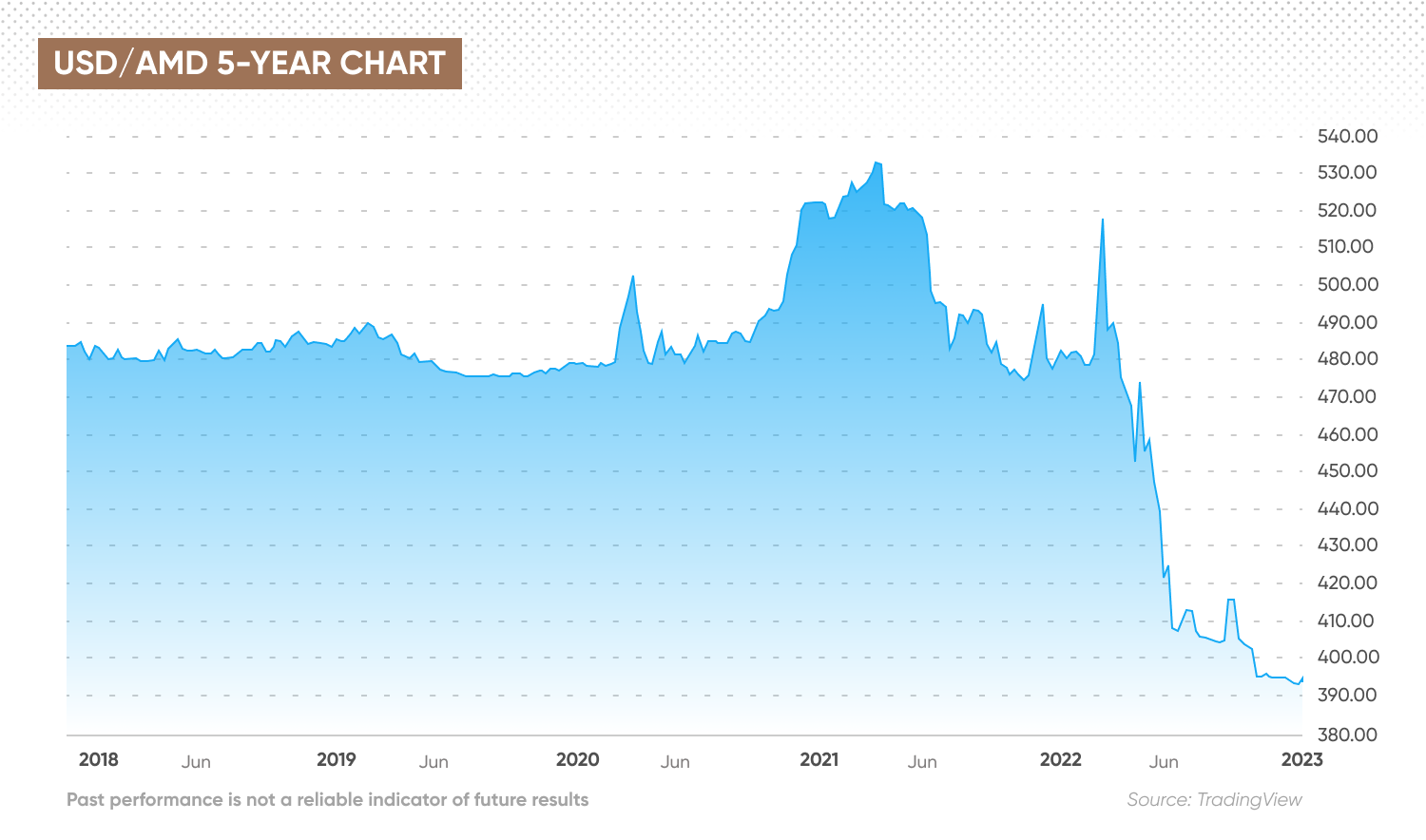

Despite its geographic location right next to Turkey, Armenia’s dram has performed surprisingly well over the past few years.

The dram’s stability owes itself partially to Armenia’s large diaspora population, which remits millions of dollars each year, along with the nation’s growing economy.

Armenia’s biggest banks, including Ameriabank and Inecobank, generally pay above 10% interest rates on dram deposits.

Like several other countries on this list, you will need to visit Armenia to open a bank account. Remote account opening procedures simply aren’t possible.

Additionally, it’s possible that the bank will require you to show a residency card – something which isn’t too difficult to get if you’re determined to achieve high interest rates in a rather stable currency.

The Armenian dram has performed well over the past five years, in stark contrast to nearby Turkey’s lira.

Cambodia

While Cambodia does have its own currency, the Khmer riel, its economy is highly dollarized in practice. A majority of the Southeast Asian country’s bank deposits are held in terms of US Dollars.

In the United States, you’re lucky to get above 1% annual interest on a term-deposit. Yet in Cambodia, banks often pay 5% or more on USD term deposits. Microfinance institutions can pay even higher rates in the 7%+ range.

So, why do Cambodian banks pay substantially higher interest rates on US Dollar deposits compared to those located in the United States itself? A main reason is because of higher interest rates on loans.

Getting a mortgage from a bank in Cambodia costs at least 5% interest annually, and because long-term capital appreciation is expected to surpass that, many people still decide to take a loan out.

Regardless, one consequence is that Cambodia is one country with the best offshore bank account interest rates.

You’ll need a long-term visa to open an account at most banks in Cambodia. A few of them, such as Canadia Bank, are known to open accounts for tourists.

However, financial institutions that pay higher interest rates in the 8%+ range like Prasac will require you to show a 6-month or 1-year visa. This thankfully isn’t too hard to obtain in Cambodia.

Georgia

Georgia is another country located in the Caucasus region. Like Armenia’s dram, The Georgian lari has remained fairly stable despite its geographic proximity to laggards Turkey and Russia.

Looking at a 10-year chart, the Georgian lari’s performance doesn’t seem great, falling from roughly 2.00 to the US dollar to well-above 3.00 before appreciating again.

With that said, the lari has shown resilience over the past five years, steadily rising in value from its 2020 lows of 3.50 per USD.

Not bad at all, especially considering it’s possible to achieve interest rates of above 5% on Georgian lari term deposits. You’ll find some of the highest interest rates in the world here.

Georgians commonly hold currencies besides the lari, and most major banks maintain USD and EUR deposit accounts. Compared to either currency’s respective home market, banks in Georgia will also pay you a higher interest rate.

You can expect 4%-5% rates on USD bank deposits in Georgia. Not exactly the 6%+ found in Cambodia, but nonetheless respectable.

It’s not required to have residency in Georgia to open a bank account here as a foreigner, and citizens of most countries will automatically get a 365-day visa stamp upon arrival. TBC Bank and Bank of Georgia are the nation’s two largest.

Why Seek the Highest Interest Rates at Offshore Banks?

In conclusion, for those seeking to maximize returns on their savings, exploring high-interest bank deposit opportunities in countries like Mongolia, Turkey, Armenia, Cambodia, and Georgia offers a compelling yet nuanced path.

These nations present some of the most attractive interest rates globally, ranging from 7% to over 15%, but they also require careful consideration of factors such as currency stability, economic conditions, and accessibility.

Mongolia, with its 15%+ interest rates, stands out as a high-reward option, albeit one that comes with the risk of its volatile tugrik currency. Turkey similarly offers rates above 10% on lira deposits, but the lira’s ongoing depreciation demands a cautious approach.

For those seeking greater currency stability, Armenia and Georgia provide more balanced options.

Armenia’s dram has shown resilience, and its banks offer rates exceeding 10%, while Georgia combines relatively stable currency performance with interest rates of 5%+ on lari deposits.

Both countries, however, require a physical presence for account opening, adding a layer of complexity for foreign investors.

Cambodia, with its dollarized economy, offers a unique proposition by providing 5%-7% interest rates on USD deposits, a rare find in today’s global financial landscape.

This makes it an attractive destination for those seeking higher returns without the risks of currency fluctuations. However, getting the necessary long-term visa to access the highest offshore bank account interest rates might require additional effort.

Ultimately, you should analyze factors like inflation, currency depreciation risk, and local banking regulations based on your own specific needs.