The past several years have been full of surprises, and for anyone looking to invest in 2024, this one will likely be no different.

With ongoing geopolitical tensions and economic uncertainty, it’s crucial for investors to carefully consider where to deploy capital globally.

Yet on a positive note, we’re opening 2024 with clear evidence of eased inflation and global supply chains having normalized. Major stock indices are once more near their record highs as liquidity shows signs of returning.

This macroeconomic backdrop could provide a catalyst for stocks and real estate in Asian markets to continue rebounding. Still, risks remain so diversification and careful country selection are key.

The best places to invest in 2024 share a few things in common. First, most of the top investment destinations are geopolitically secure with minimal risk of conflict.

Places like Singapore and Indonesia are located far away from potential conflict zones and offer stability amidst global turmoil.

Demographic factors are also ideal in many of our picks. Countries with young, growing populations like Cambodia and the Philippines will see rising consumer demand.

Without further ado, here’s our list of the best countries to invest in 2024. They aren’t ranked in any particular order – the ideal place for each person will depend on their own personal objectives and set of circumstances.

Singapore

While it’s far outside the price range of most people, Singapore is the only option that makes sense for a certain group of UHNWIs.

Ranked among the most expensive markets in the world, buying a condo in Singapore’s central areas will easily cost you US$20,000 per sqm.

That doesn’t necessarily mean prices here are too expensive though. Nor does it mean they won’t rise further.

Indeed, many people in the industry have said that property values in Singapore are “too high!” for over a decade. You could go back and read old forum posts that insist a crash is imminent. Yet prices have just kept on rising ever since.

Recently, one of Singapore’s most expensive condos in sold. The penthouse residence at Klimt Cairnhill was sold to a Chinese buyer for S$30 million.

The simple fact is: Singapore offers a type of stability that few other places do. That’s why it’ll always be in demand.

Singapore’s three largest banks – DBS, UOB, and OCBC – are all consistently ranked among Asia’s most well-capitalized. Likewise, the Singapore dollar has been one of Asia’s top performing currencies for decades.

Don’t forget Singapore’s low taxes. Corporate income is taxed at a flat 17% rate… and there isn’t any capital gains tax at all.

It’s little wonder that wealthy people from around the world moving here in droves.

But you don’t need to be part of the 0.1% to own assets in Singapore. There are plenty of ways to make Southeast Asia’s financial hub part of your portfolio.

The easiest way to invest in Singapore directly is by opening a brokerage account here. It’s still possible to get one as a foreign non-resident, although it’s getting harder over time.

The best part? Getting a brokerage account in Singapore also gives you access to plenty of other stock markets across Southeast Asia. It’s not merely about Singapore itself.

For example, most brokers in Singapore support trading in nearby emerging markets like Thailand and Malaysia. You couldn’t access these countries with a Fidelity or IBKR account though.

Cambodia

Cambodia had a tragic past. For those part of the older generation, the mention of its name often brings about a mental image of war and genocide.

Today, Cambodia is one of the world’s fastest-growing economies with GDP consistently rising by over 6% annually.

Cambodia’s capital city of Phnom Penh is filling up with skyscrapers as multinational firms enter the market. 7-Eleven, The Habit, and Marriott are just a handful of companies which have set up operations in the past few years.

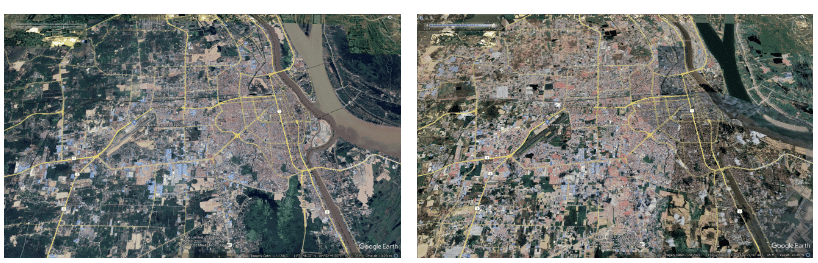

A satellite image of Phnom Penh back in 2013 compared to 2024, showing the significant expansion of its urban area. The city’s population is expected to grow from 3 million now to 5 million by 2035.

Legendary investor Jim Rogers is on record saying that, by investing in a country shortly after the end of a war, you’ll usually do well.

At this point, it’s been about 50 years since the Khmer Rouge was at its peak during the 1970s. Cambodia began modernizing its economy in the late-1990s. So, this isn’t a country fresh out of war by any means.

We think that Cambodia benefits greatly from having had several decades to establish stability.

They’ve already gone through three decades of building systems and refining upon them. It’s in stark contrast to Myanmar, for example, which “opened up” in the early 2010s only to collapse less than 10 years later.

Frontier markets have the potential for rapid growth but often need a catalyst to support it in the first place. In many cases, it’s oil or some other natural resource. Other times, it’s logistics or manufacturing.

Cambodia, for its own part, is unique among frontier markets because it has a tourism sector. It’s part of a well-established trail in Southeast Asia with millions of foreign tourists visiting Angkor Wat, the world’s largest temple, every year.

Tourism and manufacturing bring a substantial amount of foreign capital into Cambodia, giving credence to the idea that its future economic trajectory could follow a similar path to neighboring Thailand’s.

For these reasons, we think Cambodia is worth mentioning as one of the best places to invest in 2024.

Japan

Are Japan’s “lost decades” finally over?

With prime real estate values and the Nikkei index both hitting all-time highs, some analysts are turning bullish for the first time in a long while.

Japanese assets are on a winning streak lately, and indeed, they still seem like a bargain when compared to nearby countries.

Real estate prices in central Tokyo are about US$10,000 per sqm. That’s a fraction of $20,000 in nearby Seoul and almost $30,000 in Hong Kong! Not to mention, the yen is near its lowest level since the early-1990s.

A multi-decade chart of the Japanese yen compared to the US Dollar. Anyone buying stocks or property in Japan in terms of foreign currency is getting the best deal in three decades.

Wealthy foreign investors from China and elsewhere have noticed the relative value and started buying up property in Japan. In particular, high-end condos saw their prices soar ever since the lifting of travel restrictions.

That said, it’s worth remembering that the Japanese property market doesn’t function like the rest of the world’s. Only land retains any sort of long-term value.

Meanwhile, structures rapidly depreciate here. It’s the result of strict building codes along with frequent natural disasters.

Japan’s real estate market still has plenty of opportunity though. Major cities like Tokyo and Osaka won’t see their populations decline anytime soon – it’ll be the rest of the country that’ll first see a steep drop in demand.

Philippines

The Philippines’ favorable demographics are a major advantage, with its population exceeding 110 million and growing.

As Southeast Asia’s youngest country, the average age is just 25 years old, tied with Cambodia. This youthful population fuels rapid urbanization, as hundreds of thousands migrate annually from rural areas into cities in search of jobs and opportunities.

As a foreigner, the easiest direct investment option in the Philippines is stocks. Purchasing real estate or starting a business face more hurdles.

To trade on the Philippine Stock Exchange, investors typically must open a brokerage account in Asia – large US or European brokers don’t offer access.

Accounts in Singapore or Hong Kong, on the other hand, do provide the ability to invest in Philippine stocks and other emerging Asian markets. It’s certainly worth getting one if you want to trade in this part of the world.

Property ownership still poses challenges in the Philippines, especially if you’re a foreign buyer. Only citizens can fully own land, while foreigners are restricted to long-term leases or condominium purchases.

Unfortunately, the condo market is in a bubble with values in Manila’s CBD easily reaching $4,000 per square meter. That’s about the same price as Bangkok or Kuala Lumpur, both of which are far more developed cities by comparison.

In short: you’ll find plenty of great picks on the Philippine stock exchange. There are also opportunities in private equity and VC. Buying a condo in the Philippines isn’t a great idea though.

Regardless, we rank the Philippines as one of the best places to invest in 2024 because of its strong demographic trends.

Indonesia

The world’s three most populous countries are pretty common knowledge: India, China, and the United States in that order.

Less widely known? Indonesia is the world’s fourth largest country in terms of population with over 270 million inhabitants – and that number is rising fast!

Of course, Indonesia’s massive population means that there’ll be huge demand for consumer products. Multinational firms have taken note of the fact that there’ll soon be 300 million people living here.

Many of them are part of an increasingly-affluent middle class. And they’ll want to buy everything from tissue paper to designer handbags.

Indonesia’s capital city of Jakarta is home to over 30 million inhabitants in the metro area, which makes it one of the largest cities on earth. Could it be the “Tokyo of the 21st Century”? We think there’s a chance.

The auto industry is especially ripe for investment. We’re seeing a noticeable trend of factories from China, Thailand, and elsewhere in the region relocating to Indonesia because of its lower costs and relative ease-of-doing business.

However, if you’re solely interest in real estate investment, Indonesia poses significant challenges for foreigners compared to other countries in Southeast Asia.

The main issue is that foreigners are unable to own freehold property in Indonesia – not even condo units. Instead, foreigners are limited to obtaining right-to-use titles, which are essentially leaseholds granted for 25 years that can be extended for another 45 years.

Some workarounds exist, like purchasing shares in a REIT/property fund, or simply dealing with the hassles of a 70-year leasehold. None of these options provide the same benefits of actual freehold ownership though

While there are hopes that Indonesia will eventually reform its property laws to allow foreign ownership, for now, these limitations on real estate investment will likely persist.

That concludes our list of the top countries to invest in 2024. Hopefully we gave you some ideas to start off the new year!