Last updated March 31st, 2024.

Like moths to a flame, foreigners are flocking to invest in Qatar and elsewhere in the Gulf region.

Yet while some places in the region have solid long-term prospects, investment in Qatar should be avoided. Especially the in country’s real estate market.

As a major host of the World Cup, Qatar spent over $300 billion preparing for the event, equivalent to 10 times its GDP.

Yet the World Cup delivered few long-term benefits and Doha’s economy is now facing a slowdown.

This mirrors the experience of past host nations Russia and Brazil, where a short-term boost from hosting mega events evaporated with an economy tilting into recession and few options to diversify,

Qatar makes for an unappealing investment destination. We have every reason to believe that speculators will only find fool’s gold in Doha and elsewhere in the country.

Qatar is Overexposed to Oil

Qatar owes its wealth almost entirely to oil and natural gas, which account for over 60% of GDP, 85% of export earnings, and 70% of government revenue.

With the majority of state income and jobs resting upon carbon energy exports, Qatar’s economy moves in lockstep with fossil fuel price swings.

Granted, the IMF does expect Qatar will outperform later this decade. Let’s face it though: who has ever reliably predicted GDP growth 5 years beforehand? Especially an economy that depends heavily on oil prices.

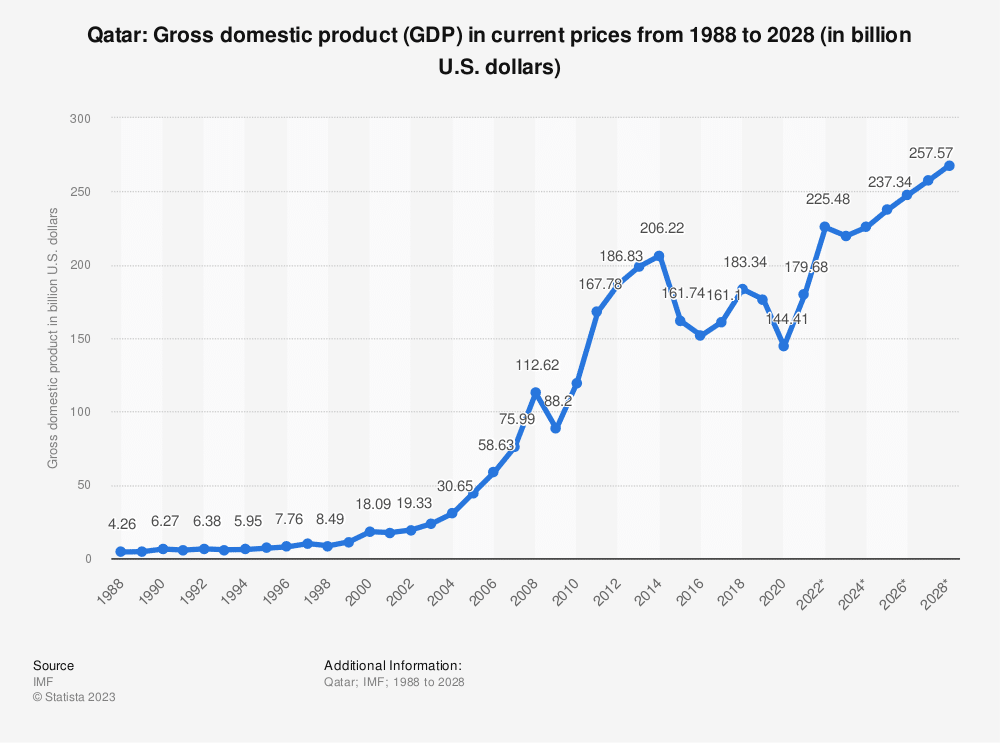

The Qatar economy boomed from the 1980s until 2014. Over the past decade though, growth was mostly flat.

Already, declining gas prices from their peak have erased Qatar’s windfall. The economy was only able to achieve 2% GDP growth in 2023, down from the previous year.

Meanwhile, the Qatar economy posted its first quarterly contraction in nearly a decade as LNG prices plummeted.

With the world accelerating its shift toward renewable energy, demand for Qatari oil and hydrocarbons will only shrink.

So far, there’s little sign of meaningful reforms to diversify the Qatari economy away from its resource dependence.

Doha’s Big Event Led to Few Gains

Seeking to enhance its global prestige, Qatar spent over $300 billion on hosting the World Cup, which is equivalent to 10 times its GDP. This fueled an infrastructure boom… at first.

However, past World Cup hosts saw only fleeting gains. After Russia hosted back in 2018, its economy stagnated with just 1% growth. Brazil saw its economy contract 3.5% in the year after its own World Cup.

Qatar is already following the same pattern, with its economy slowing down over the past year. The World Cup offered only a temporary boost.

In the meantime, real estate investment in Qatar faces a supply glut with long-term lease demand unclear.

The commercial property sector is particularly in a tough spot. Vacancy rates for offices in Doha’s desirable West Bay area, for example, are now between 20% and 25%.

Limits on Foreign Property Investment

Despite the Gulf’s reputation as a free market oasis, Qatar prohibits foreign expats from owning real estate in much of the country.

Non-citizens can only buy property in Qatar if it’s located in a small handful of designated zones. Nearly all of them are in Doha, and they’re generally far away from central areas or cheaper housing.

Because of these major restrictions, you probably shouldn’t buy real estate in Qatar as a foreigner.

Here’s a list of the 16 designated areas where foreigners can involve themselves in Qatar’s property market. Freehold ownership is only allowed in 9 of them though.

Similarly, opening a brokerage account and trading stocks in Qatar as a foreigner is an arduous process to the point of near-impossibility.

The picture for setting up and operating a business in Qatar is also unattractive. Qatar ranked 83rd in the World Bank’s latest Ease of Doing Business rankings, lagging behind Saudi Arabia, Oman, and distant from the UAE.

Likewise, the private sector remains dominated by a small number of firms, many of them owned by royal family members.

Such monopolies don’t make for a competitive business environment in Doha – especially if you’re a foreigner.

Qatar’s Economy Doesn’t Innovate

Looking to the future, Qatar falls behind regional competitors on innovation. The country spends below 0.6% of GDP on research and development, less than half of the proportion in Saudi Arabia or Israel.

Quite frankly, Qatar is a huge digital laggard compared to other rich nations. Smartphone penetration reached only 85%, ranking near substantially poorer countries like Kenya and Ghana.

Qatar’s outdated regulations hamper emerging sectors such as fintech and e-commerce. There’s always a lot of lip-service about innovation, especially by government, but nothing truly groundbreaking can develop when your laws don’t support it.

By comparison, other Gulf states like the UAE and Bahrain moved early to build tech hubs attracting investment and talent. Qatar has no comparable ecosystem.

Verdict: You Shouldn’t Invest in Qatar

Qatar’s post-World Cup recession reveals its short-lived investment appeal.

Put simply: you should stay away from Qatar’s real estate and stock markets. Foreigners wanting to invest in Doha should look elsewhere.

With GDP forecasted to increase by just 2% this year, Qatar’s economic prospects pale against emerging countries further into East and Southeast Asia.

Any decline in oil revenue hampers Qatar’s ability to invest in emerging sectors, and Doha doesn’t offer many unique advantages to foreign investors beyond its close proximity to other Gulf states.

Savvy investors will consider markets with a greater variety of growth drivers and fewer ownership barriers. Don’t be lured in by fool’s gold in the Qatari desert.

FAQs

Can Foreigners Buy Property in Qatar?

Foreigners can only buy property in Qatar if it's located in a few specific areas. These include West Bay, the Pearl, and Al Dafna.

Specifically, there are 9 zones where foreign freehold ownerhip is allowed and 16 zones where leaseholds are permitted.

Can Foreigners Trade Stocks in Qatar?

Technically, it's possible to open a brokerage account in Qatar if you're a citizen, expat, or local company.

In practice though, it's almost impossible to get an account as a foreign expat. Most Qatari brokers won't deal with anyone other than a local citizen when it comes to trading stocks.

There are also very few (if any) foreign brokerage firms based outside the country that support trading on the Qatari stock exchange.

How Much Does Property in Qatar Cost?

On average, the price of an apartment in Qatar is QAR 15,000 per square meter, which equals about $4,000.