Thailand’s stock market usually isn’t the first one investors would consider when they first invest in Asia.

Granted, Thailand is one of the world’s most visited countries. In a typical year, Bangkok sees more tourists than any other city on the planet.

Because of this very reason, the country is often people’s first experience with emerging Asia. Visitors notice more construction, workers on the move, and economic activity than they might have seen in their entire lives.

This naturally makes them want to participate in the growth by investing in Thailand. While there almost certainly better places to invest in Asia, the country’s appeal and accessibility are hard to deny.

One way to invest here is through buying property. We’ve already covered that route extensively in our guide about real estate in Thailand.

The other most common method of investing here is though the Thai stock exchange.

Below, we’ll cover all your options when it comes to setting up a brokerage account and trading stocks in Thailand.

Step One: Get a Thai Brokerage Account

The very basics of investing the Thai stock market are similar to anywhere else in the world. As such, a brokerage account is the first thing you’ll need.

We strongly recommend setting up a local brokerage account in Thailand instead of using one based in another country. There are two good reasons for this.

First, international brokers rarely grant you access to the Thai stock market or let you buy stocks in Thailand. Firms based in the United States or Europe will usually let you trade on only the world’s top dozen or so stock exchanges, which, unfortunately, Thailand’s isn’t one of those.

But you aren’t entirely out of luck if you cannot get a local account. A select few brokers, like Boom Securities in Hong Kong, will let you trade on the Thai stocks.

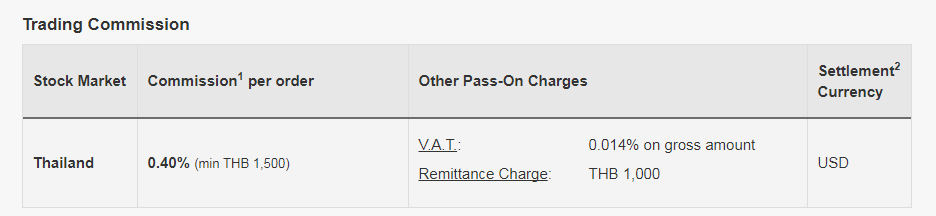

This brings us to our second reason: you’ll save a lot of money in brokerage fees by opening a local account. It’s something that’s true when purchasing foreign equities anywhere in the world, not just on the Thailand stock market.

International trades often equal high fees. You can save money by using a brokerage based in the country you’re buying stocks in.

For example, Boom Securities will charge you a minimum of 1,500THB (~US$50) per trade. The same commission costs closer to 60THB (~$2) through a Thai brokerage account.

Large commissions might be fine if you’re making sizable trades. Otherwise, round-trip transaction costs of US$100 are a deal-breaker for many people.

With all that said, to access to the Thai stock market, you’ll also need a long-term visa. You cannot open a stock brokerage account in Thailand without such visa.

Having a tourist stamp won’t cut it. There are several exceptions and it depends on the specific bank. Yet we wouldn’t ruin things by telling everyone where to go on a public article!

Simply put, buying stocks in Thailand is far easier if you’re already a resident with a long-term visa. Just go to Bangkok Bank’s head office on Silom Road and open a Bualuang Securities account. They’ll walk you through the process.

Non-residents have two main options. First, you can deal with higher brokerage fees and open an account outside of Thailand. Second, you can buy mutual funds in Thailand using a regular bank account rather than a separate brokerage account.

A few Thai banks will let foreigners open a bank account with a tourist visa. But you must open an actual trading account, which requires long-term residency, in order to buy individual stocks and ETFs.

If you prefer managed funds or simply aren’t a resident, Bangkok Bank has the largest selection of mutual funds and ETFs in Thailand.

Whether they’ll let you open a bank account as a tourist seems to depend on the branch and the employees though.

Aberdeen Asset Management enjoys some of Thailand’s best-performing funds. Unfortunately, their current policy doesn’t allow non-resident foreigners to open accounts.

Besides that, Kasikornbank (KBank) and Siam Commercial Bank (SCB) are solid banking options. Of those, KBank is generally easier to open an account as a foreigner compared to the latter.

Step Two: Trade Stocks in Thailand

The hard part out of the way, you’re now ready to buy Thai stocks with your new, shiny brokerage account.

We won’t cover trading strategies or recommendations here. This article is about setting yourself up with a brokerage in Thailand, more than specific investment advice or the best stocks to buy in Thailand.

Here’s a quick overview of what you can expect, though: the Stock Exchange of Thailand has about 600 listed companies. In fact, it’s Southeast Asia’s second biggest in terms of market capitalization after Singapore’s.

The Thai stocks exchange’s current market cap is about US$600 billion – not a small equity exchange by any means.

A few of Thai stocks worth looking into are those of the biggest public companies in Thailand include PTT, Airports of Thailand, and Siam Cement, each of which is worth between US$15 billion and US$30 billion respectively.

Concerning the exact mechanics of the stock exchange, you should feel comfortable trading on the Thai stock market if you’ve traded anywhere else in the world.

Market orders, limit orders, stop loss orders, and other types of transactions that you’re likely familiar with in your home country are all supported in Thailand.

The Thai stock exchange’s operation hours are between 10 AM and 4:30 PM. They have a generous lunch break between 12:30 PM until 2:30 PM.

Trading Thai Stocks with a Foreign Brokerage

While opening a local Thai brokerage account is the most cost-effective way to invest in Thailand’s stock market, it’s not the only option for foreign investors.

If you’re not a resident of Thailand or don’t have a long-term visa, you can still get exposure to Thai stocks through brokers based in Hong Kong and Singapore.

Many of the top brokerage firms in these two Asian financial hubs provide access to a wide range of regional markets, including Thailand.

By opening an account with a Singaporean or Hong Kong broker, you can trade stocks not only in their local exchanges but also in Thailand and other Southeast Asian countries.

Keep in mind that trading Thai stocks through a foreign broker will involve higher fees. As such, frequent traders and those with less capital may find it cost-effective to open a local Thai brokerage account if they meet the visa requirements.

Nonetheless, using a brokerage in either Singapore or Hong Kong offers an alternative for foreign investors who want to tap into the growth potential of Thai stocks without the need for establishing residency in Thailand.

With the Stock Exchange of Thailand boasting a market cap of $500 billion and over 550 listed companies, it’s an option worth considering for diversifying your portfolio into this dynamic Southeast Asian market.

FAQs: Buying Stocks in Thailand

Can Tourists Get a Brokerage Account in Thailand?

No, tourists on a short-term visa cannot open a stock brokerage account in Thailand. You will probably need a long-term visa to open an account, as a 30-day tourist stamp won't cut it.

A few Thai banks may let foreigners open a bank account with just a tourist visa, but an actual trading account requires long-term residency in order to buy individual stocks and ETFs.

If you are a tourist or short-term visitor, your only options are to either deal with higher brokerage fees and open an account outside Thailand that can trade on the Thai stock exchange, or buy into Thai mutual funds using a normal bank account rather than a brokerage account.

How Many Stocks Are Listed in Thailand?

The Stock Exchange of Thailand (SET) has about 600 listed companies, making it Southeast Asia's second largest stock market in terms of market capitalization after Singapore.

You'll find plenty of investment opportunities across various industries and company sizes among the over 550 firms listed on the SET. The SET's total market cap is around US$500 billion.

What is the Biggest Stock in Thailand?

Delta Electronics, a maker of power supplies and electronic components, is the largest stock on the Stock Exchange of Thailand by market capitalization.

Other major companies listed in Thailand include energy giant PTT, Airports of Thailand, and Siam Cement Group, each of which has a market value between US$15-30 billion.

Can Foreigners Trade Stocks in Thailand?

Yes, foreigners can trade stocks in Thailand, but the process is more complicated compared to locals. If you're living in Thailand on a long-term visa, you can go to the head office of any large local bank and they will set you up with a brokerage account, though it may be slightly more difficult if you're an American.

If you are not a resident of Thailand, your only option is to open a brokerage account in another country that allows you to trade on the Thai stock exchange. A few banks in Singapore can do this, as well as BOOM Securities in Hong Kong which can open an account for you remotely.

How Can I Open a Thai Brokerage Account?

If you're a resident of Thailand with a long-term visa, you can open a local brokerage account by going to the head office of a large Thai bank like Bangkok Bank or Kasikornbank. Bangkok Bank's Bualuang Securities at their Silom Road headquarters is a recommended option.

However, if you are a foreigner without a long-term Thai visa, you cannot open a brokerage account with a Thai bank or broker. Your only choice is to use an international broker based outside Thailand, such as in Singapore or Hong Kong, that allows you to trade on the Thai stock exchange.