Last updated June 2nd, 2023.

Just about every investor is aware of the innovation coming out of Silicon Valley, which enjoys the top “brand name” out of any global tech hub.

Startups in Asia arguably have greater untapped potential than anywhere else in the world though.

Tech firms based in Asia enjoy access to billions of consumers nearby. Meanwhile, Asian startups benefit from superior economic growth prospects compared to the United States and Europe.

Online spending in Asia is rising at an extraordinary pace – especially across the region’s developing economies in Southeast Asia, including Vietnam and Indonesia. Asian startups will continue gaining from the region’s increased internet usage in the future.

In fact, Southeast Asia added over 70 million new online shoppers since the beginning of 2020. The ASEAN region will continue adding tens of millions of online shoppers to its ranks throughout the 2020s.

Meanwhile, China’s global e-commerce sales surpassed US$2 trillion in 2022, primarily driven by the growing use of mobile apps developed by startups.

Every single industry – from tech to retail – benefits from a society where people are using mobile devices with improved networks and increased application usage. It results in a compounding effect that develops Asia’s startup and VC environments as a whole.

Asia Startups Target More Consumers

One convincing reason why you should invest in Asia startups is because of the region’s immense market size.

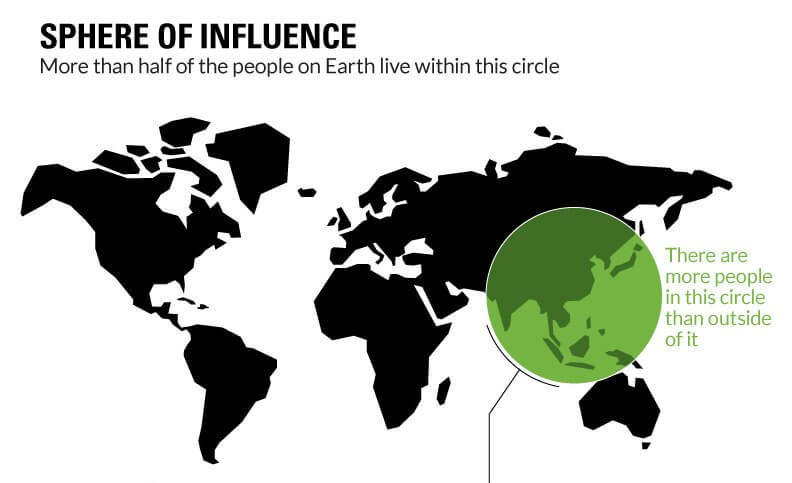

There are almost 5 billion people living in the Asia-Pacific area representing 60% of the world’s entire population. Perhaps more importantly, Asia consists of a large pool of untapped talent and middle class consumers.

You may ask yourself: “why does more people necessarily mean greater investment prospects?”. Yet the number of consumers living in a specific region (along with its economic output) absolutely does have a huge impact on its overall growth.

A greater density of people facilitates an efficient flow of resources, goods, and labor. In the same way a city is more conducive to economic activity than a small town, forming a successful startup is easier in a region with billions of inhabitants compared to elsewhere in the world.

Why would a multinational company waste their time in Latin America, a comparatively out-of-the-way continent with less than 500 million people, when they can sell to 5 billion consumers in Asia?

Closer proximity to supply chains matter a lot too. It’s easier to create services and products, sell them to consumers, and ship them (if necessary) when everything is based in a similar time zone.

A majority of the world’s production, shipping ports, and consumers are now located in Asia. So it makes perfect sense to form a startup in Asia while selling to on buyers in the region.

Part of Asia’s strength lies in its dense concentration of consumers, talent, and startups all located in a single place.

The point is: population growth, along with far easier access to an evolving tech industry, will inevitably help form talent in fields like engineering and design. Startup opportunities in Asia are plentiful due to the continent’s promising demographics and future talent pool.

Likewise, there’s still lots of room left for innovation in frontier markets such as the Philippines, Cambodia, and Vietnam.

Startup ecosystems throughout most of Southeast Asia are not yet in a mature stage, which means you’ll generally face less competition.

India Ranks as Best Asian Country for Tech

Asia’s startup ecosystem is growing at an incredible pace, making it a dynamic place to conduct business.

But specifically, India is the fastest growing startup environment in the world. At least, that’s according to a study by its National Association of Software and Service Companies.

India is currently launching nearly a thousand startups each year. The nation’s startup sector is rising at a rapid pace and should continue well into the future. Especially since India is now the world’s most populous country.

Similarly, most large Asian cities are now equipped with world-class infrastructure which helps business creation and enables strong startup growth.

Even frontier markets such as Vietnam and Cambodia are enjoying fast internet speeds along with an improving quality of public transportation.

Asia gets tons of foreign investment in both its economic and social infrastructure – something which has clearly paid off in different ways.

There’s always some risk when investing in startups… and Asia certainly isn’t an exception. Just like everywhere else in the world, a few firms have unrealistic valuations as more people jump on the “startup bandwagon”.

With that said, an increasing trend of liberalization, untapped pool of consumers, good quality infrastructure, and a dynamic startup scene all bode well for Asia’s future.

Want to invest in Asia’s growing tech industry? Startups in Vietnam and Thailand are two of the best countries to get started. Both countries recently claimed their first unicorns.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.