Last updated July 14th, 2025.

Recessions are a fact of life in most countries. They seem to arrive every 7 years or so on average, leaving unemployment and stock market collapses in their wake.

Many people have tried to avoid recession, and attempts to bypass them aren’t anything new.

Indeed, planning for recession is one of the hardest parts of investing. Wouldn’t it be nice if we could simply park capital in stocks or property and watch its value climb each year?

Of course, nobody can promise such a feat. “Past performance is no guarantee of future returns” as the financial sector constantly reminds us.

Still, several emerging markets in Asia didn’t see any of the recessions that the rest of the world suffered through.

Welcome to Vietnam: a country with a long history of avoiding recession. Indeed, they’ve managed to skip every single financial crisis for over 30 years.

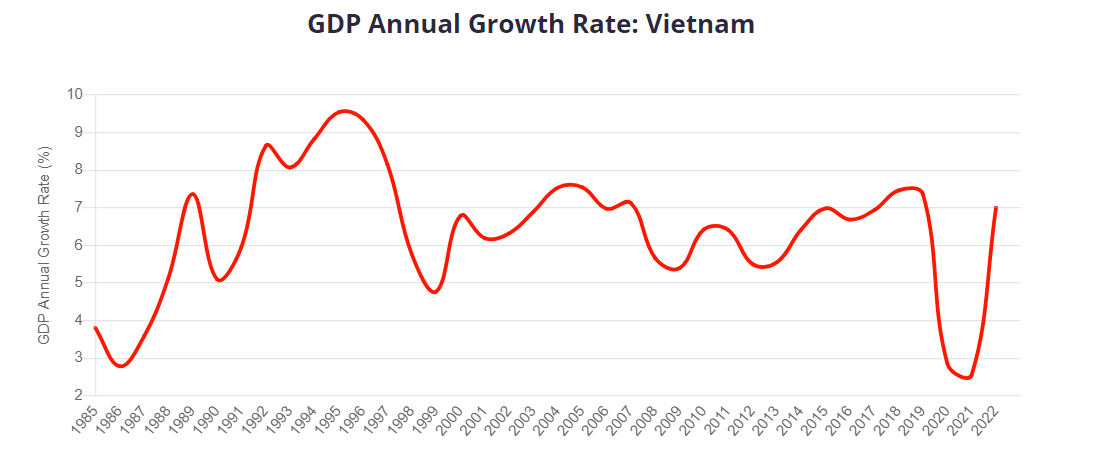

A long-term graph showing Vietnam’s historic annual GDP growth rate, going all the way back to the 1980s.

It’s one of about five countries in Asia that missed the Asian Financial Crisis in 1998, skipped the tech bubble of the early 2000s, and outgrew the Global Financial Crisis in 2008.

Despite the war that happened last century, Vietnam today is home to a rising middle class of 97 million inhabitants and growing.

The manufacturing sector is booming while Vietnam’s two different stock exchanges, one in Saigon and another in Hanoi, have more than 800 listed companies between them.

Vietnam is technically communist. Regardless, you might be surprised to learn that Pew Research shows they have more favorable views of capitalism than any other country – even above Germany and the United States!

Why Did Vietnam Avoid Recession?

Frontier markets in general are less correlated with the rest of the world economy. Vietnam is certainly no exception.

Why are frontier markets likely to avoid a recession? Well, their growth depends much more on internal factors than global economic whims.

For example, you can now find IKEA and Papa John’s Pizza on practically every corner of the globe. But one negative result of globalization is that when an economic crisis hits any major country, it has a domino effect.

Multinationals stop investing abroad when they’re having problems at home. Thus, the whole world suffers when a recession strikes the United States, China, or Europe.

Places like Vietnam are less exposed because they don’t have IKEA or Papa John’s yet.

Both these chains already have plans to expand into Vietnam soon though. Fast-acting investors will benefit by owning frontier market assets before multinationals inevitably expand here.

Vietnam’s low correlation with global markets is combined with rapid population growth and surging FDI.

The result is an emerging economy that has not only missed multiple recessions, but also averaged 7% growth per year.

In fact, there’s an argument that the Vietnam War is a major reason for the economy’s subsequent boom.

A situation can only get so bad before the only direction left to go is upwards. The climax of a major armed conflict is certainly one of those cases.

Simply put, Vietnam’s economy started from a very low base and skyrocketed after the gunfire stopped.

However, war doesn’t tell the whole story about why Vietnam has skipped five recessions. You can’t really use the “reconstruction economy” as a reason for endless growth past the mid-1980s.

The fact is, Vietnam has something their peers don’t. It’s a rare combination of business-friendly policies, political stability, strategic location, and a well-developed tourism sector, all working together in tandem.

Countries That Skip Recessions

Several countries in Asia have gone awhile without entering recession. Not all of them have a record lasting three decades. However, even 10 or 20 years is a long time for a non-stop economic boom.

Nearby Bangladesh also boasts a strong history of skipping recession. They haven’t had a single economic downturn since the 1970s.

Bangladesh, a dense nation of 170 million people and rising, is further propelled by its strong demographics and pro-investment policies.

Add in a low cost of labor along with lax regulations, and it’s easy to understand why manufacturers are expanding into Bangladesh.

You can add Mongolia to the list of frontier markets that have skipped recession too.

With a population of just 3 million, Mongolia is one of the world’s least densely inhabited nations. Close proximity to China along with vast resource deposits will support its boom for years to come though.

Meanwhile, China is slowly depleting its own resources. They’re looking toward Mongolia’s ample supply of coal, uranium, and oil.

This support alone is all Mongolia needs to thrive. The size of China’s economy is roughly 1,000 times larger and needs to import from its neighbor.

The impressive skyline of Nur-Sultan, Kazakhstan’s capital and second largest city.

Looking toward Central Asia, Kazakhstan is yet another place that has grown for two decades straight. They’ve arguably fared better than anywhere else in the former Soviet Union with a GDP per capita higher than Russia’s.

Kazakhstan isn’t a poor country by any means. Similar to Mongolia, they’re lucky enough to have vast mineral deposits.

Oil is one of Kazakhstan’s top exports and they have the world’s 12th biggest reserves.

Why Frontier Markets Skip Recessions

Notice all the places we’ve mentioned are frontier markets. While these types of countries have their risks, they can also enhance a portfolio.

Because of these reasons, consider shifting a small part of your overall portfolio to these high-growth, uncorrelated markets if you haven’t already.

At worst, you’ll gain a more diversified portfolio and less reliance on your home country’s financial system.

In the absolute best case scenario, investing in frontier markets could help you avoid a recession in the future.

FAQs: Countries That Avoid Recession

How Has Vietnam Managed to Avoid Recessions for Over Three Decades?

Vietnam’s economy has consistently grown for over 30 years, skipping major global economic crises such as the 1998 Asian Financial Crisis, the early 2000s tech bubble, and the 2008 Global Financial Crisis.

This resilience is largely attributed to its low correlation with global markets. Vietnam’s economic growth is driven more by internal factors, such as rapid population growth, surging FDI, and a booming manufacturing sector.

What Other Countries in Asia Have a Record of Avoiding Recession?

Bangladesh has avoided economic downturns since the 1970s, thanks to its strong demographics, low labor costs, and pro-investment policies.

Similarly, Mongolia and Kazakhstan have experienced prolonged periods of growth due to their vast natural resources and strategic economic policies.

Do Frontier Markets Skip Recessions?

Frontier markets, like Vietnam, often have a unique ability to dodge global recessions. This is primarily because their economies are less dependent on global financial systems and more reliant on internal growth factors.

On top of that, many of these markets benefit from favorable demographics, rising urbanization, and growing middle classes, which naturally drive demand for housing, goods, and services.