We should start off by clarifying: there’s no such thing as a truly recession proof country!

This should be rather obvious. Every investment has its risks. Anywhere can plunge into a recession with little notice.

With that said, a few places have managed to avoid recession for over two decades. Many of them are in Asia and are frontier markets – countries which are often less correlated with the overall global economy.

They were able to skip the Asian Financial Crisis, the tech bubble of the early 2000s, along with the Global Recession of 2008. That’s all while achieving GDP growth that exceeds 6% on average.

Granted, that doesn’t mean these places will continue to dodge recessions in the future. “Past performance doesn’t guarantee future results”, as everyone says in the industry.

Still though, here are three nations which have a great track record of being recession proof. You might want to consider investing in them to diversify your portfolio and lower its overall risk.

Just like investing in a single stock is risky, relying on the growth of a select few countries isn’t a great idea either. That’s true whether you’re investing at home or in Kazakhstan!

Mongolia

Mongolia is very large in terms of land size. But it also has the lowest population density on the planet with just over 1.5 million inhabitants. The nation is rich in raw materials such as copper, coal, and, tin and tungsten.

Perhaps more notable is that Mongolia shares its 4677 kilometer southern border with China. China is starting to deplete its own natural resources – so they’re now heading for Mongolia’s.

Chinese investment is now surging into its smaller neighbor, in some ways overwhelming them with foreign capital. The result has been GDP growth exceeding 7% over the past several years.

Demand for practically all sectors in the whole country are skyrocketing. As such, owners of everything from stocks, to business, to real estate in Mongolia’s capital of Ulaanbaatar have benefited from an increase in value.

Like other frontier markets, Mongolia also enjoys a track record of skipping recessions. In fact, they only had two years of recession over the past three decades.

The most recent occasion, besides 2020, was back in 2009 when the Mongolian economy contracted by 1.3% and it quickly recovered less than a year later.

Mongolia isn’t exactly recession proof in the true sense (nor is anywhere really), but still boasts an impressive record.

Yet Mongolia has started to slow down a bit recently. Will it continue growing in the future? The answer to this question largely depends on China and its demand for raw materials.

Kazakhstan’s strategic location on the map, taking up a large swath of mineral-rich land directly between China and Russia, naturally gives them an economic boost.

Kazakhstan

Kazakhstan is an obscure investment destination (even compared to other frontier markets) located in Central Asia.

However, they’ve arguably performed better than any other country in the former Soviet Union.

Kazakhstan’s GDP per capita is quickly catching up with Russia’s – a testament to its success.

The local economy, which is similar to Mongolia’s in terms of its resource wealth, only suffered through a single year of recession in the past two decades.

Kazakhstan’s growth skyrocketed in the late 1990s as the nation began to capitalize on its vast oil and mineral deposits. It never really slowed down.

Moreso than any other place on this list, Kazakhstan will benefit immensely from China’s New Silk Road initiative. It aims to finance and construct infrastructure across dozens of countries in Eurasia.

The end result? A modern reconstruction of China’s historic Silk Road.

The fact that Kazakhstan shares long borders with Russia and the Caspian Sea – two of China’s easiest routes to Europe – means that there should be a lot of business between the two in the future.

Yet foreign property ownership laws here are stricter here than in other places on this list. Only resident foreigners can buy real estate in Kazakhstan.

That shouldn’t stop you from starting a company or buying stocks here, but you might want to look elsewhere besides Kazakhstan if you’re a foreign property investor.

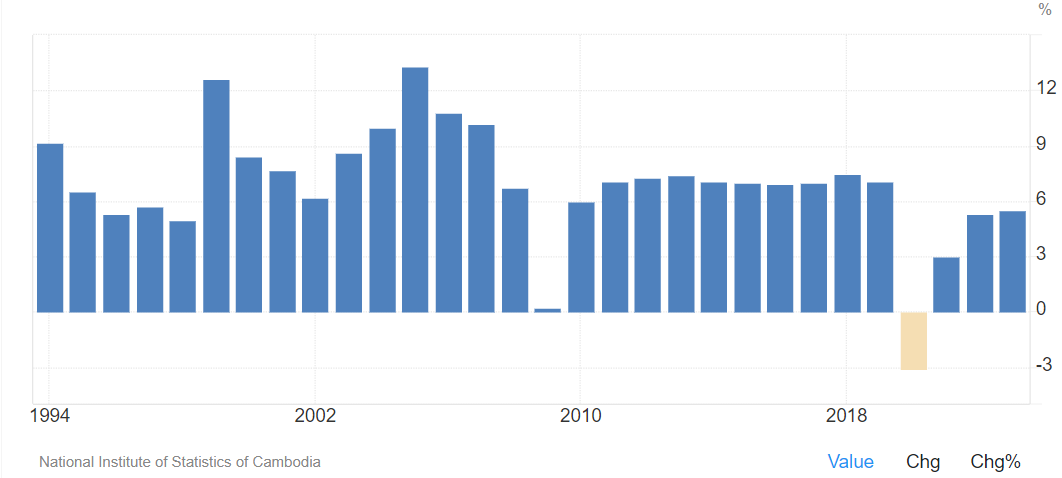

Here’s a 30-year chart showing Cambodia’s GDP growth rate since they began tracking the statistic. Besides a minor contraction in 2020, Cambodia has largely managed to avoid recession ever since the 1990s.

Cambodia

Many people think about genocide and Pol Pot when the word “Cambodia” enters their mind. However, it’s been on an upward trajectory since the mid-1990s. The nation’s best days seem like they’re ahead of it.

Cambodia is one of our favorite places to invest right now. Its economy has averaged growth of over 7% for the past decade, making it one of the world’s top ten fastest.

Not only that, but Cambodia has proven itself very resilient against global recessions.

Skyscrapers are now rising in the capital of Phnom Penh while the Cambodian economy keeps climbing by over 7% per year. Expats who have been in Southeast Asia for years are saying that Cambodia looks similar to Thailand back in the 1980s.

They’re absolutely correct! Cambodia will almost surely develop itself into an emerging market like Thailand by following similar economic trajectory.

Why do we say that? Well, Cambodia has something that few other frontier markets do: a tourism sector.

With highly-visited attractions like Angkor Wat, the largest religious structure in the world, Cambodia draws millions of tourists per year.

As of the middle of 2024, the number of visitors to Angkor Wat increased by 41% during the first four months compared to the previous year.

Tourism serves as a catalyst for the type of foreign capital which frontier markets need to grow.

In fact, this is crucial. Developing economies enjoy a great deal of potential but they often need a core industry to jumpstart things in the first place. Sometimes, this is in the form of commodity exports or manufacturing.

In Cambodia’s case, their catalyst is not based on the price of oil, coal, or any other raw material. The nation will be part of a well-established tourism trail in Southeast Asia, and keep bringing in money, for as long as Angkor Wat exists.

Hopefully you now understand more about your global investment options – and how you can potentially avoid the next recession!

Nothing is guaranteed when making an investment. Regardless, the countries mentioned above can all claim impressive track records of being recession proof so far.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.