Last updated December 20th, 2023.

Real estate prices in Malaysia’s two largest cities, Kuala Lumpur and Penang, remain stagnant.

The main reason? Oversupply in Malaysia’s prime condo market.

At the same time, the Malaysian ringgit has been hovering around its lowest level against the U.S. Dollar since the 1980s. Investors who bought property in Malaysia several years ago now sit on steep losses in other currencies.

Casual observers would probably arrive at the conclusion that, because of all this, they shouldn’t buy property in Malaysia.

Reaching that conclusion is understandable, considering the aforementioned issues and the intense competition from fellow Southeast Asian countries.

But with all that said, we still think Malaysian property is undervalued, especially in terms of most global currencies.

This means foreign buyers will have a more enticing entry point than they’ve ever seen in a while.

Malaysia absolutely faces critical challenges in the short-term. However, natural market forces can overcome these challenges with enough time and patience.

Demographics Drive Malaysia’s Property Market

Malaysia’s largest real estate markets, particularly Kuala Lumpur, Johor Bahru, and, to a lesser extent, Penang, suffer from an oversupply problem.

There are too many expensive condos and housing projects – more than any foreign or local investors want to buy. This is causing a surplus of unsold real estate inventory.

Malaysian property developers and re-sellers alike are facing difficulties finding buyers. In particular, condo construction has slowed to a halt in much of KL and Johor Bahru.

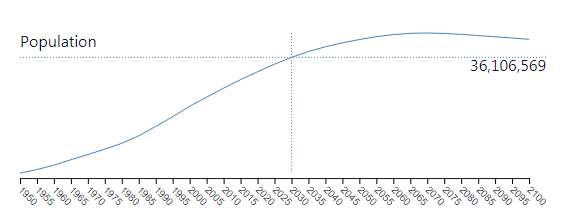

Yet this issue should eventually fix itself. Malaysia enjoys a growing population that will increase by 20% by 2030. The younger generation will ultimately step into the picture.

Unlike other Asian countries such as China, Japan, or even neighboring Thailand, demographic trends are in Malaysia’s favor.

Six million new Malaysian citizens, many of them part of a rising middle class, will drive real estate demand. Central locations in cities like Kuala Lumpur and Penang should benefit most from these demographic trends.

Malaysia’s increasing population will greatly help soak up excess supply in the long term. That’s especially true in desirable areas with limited space, such as KLCC and Georgetown.

Furthermore, Malaysia’s rising urbanization rate will also support demand as locals continue moving from rural areas into cities like Penang and Kuala Lumpur.

Strong Malaysian Economy Shows Promise

Ranked Southeast Asia’s third wealthiest nation on a per capita GDP basis, Malaysia’s living standards are similar to those of a developed country.

Yet their economy enjoys better performance than some emerging markets.

Falling oil prices and weak exports caused problems in the late 2010s. However, the Malaysian economy overcame this temporary stall in growth by further diversifying outside of its dependence on commodities.

The World Bank predicts Malaysia’s GDP will grow 4.3% in 2024. The country’s economy looks downright impressive as an investment destination compared to an expected rise of just 3% in Thailand.

Of course, a growing economy equals higher consumer purchasing power over time. This directly translates to a greater number of Malaysians having the financial means to afford prime real estate.

In turn, that means robust demand and rising home values in all cities nationwide. Kuala Lumpur and Penang both have their best days ahead of themselves.

Competitive Real Estate Prices in Malaysia

Malaysia is one of the wealthiest countries in the region. Property values are among Southeast Asia’s lowest, though.

You can still purchase city-center condos in Kuala Lumpur for under RM12,000 (about $3,000) per sqm. That’s even cheaper than in “less developed” cities such as Bangkok or Hanoi.

Meanwhile, the Malaysian ringgit is near multi-decade lows with few places left to go except upwards.

If the ringgit’s eventually rises against other global currencies, this could increase a foreign buyer’s gains even further in terms of their home currency.

It’s also worth mentioning the visa benefits. Malaysia My 2nd Home (MM2H) is one of Southeast Asia’s most popular long-term residence programs, and buying real estate can help you qualify.

Not to mention, foreigners can own land on a freehold basis here! Malaysia is one of few places in Asia where that’s the case.

The vast majority of nearby countries allow foreign condo ownership only – not land.

It’s true: Malaysia’s property market is a less obvious choice when compared to other places in the region. Thailand and Singapore have always been far more popular by comparison.

Nonetheless, Malaysia’s overall strong economy, demographic trends, beaten-down ringgit, and low prices make the country a solid option for investors.

In conclusion, Malaysia is a good place to buy real estate as a foreigner. It’s relatively user-friendly and prices have plenty of room left to appreciate.

Be sure to do a proper amount of research though. Take your time to discover the local property market, explore your options, and never jump into a purchase too quickly.

If you’re serious about buying property in Malaysia, our complete guide offers more detailed information.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.