Buying real estate is one of the most common ways to make an offshore investment. It also comes with valuable and unique perks that other types of investments won’t give you.

Foreign property investments give you rental income along the ability to turn your asset into a second home. Depending on personal circumstances, your government might not force you to report global real estate to the tax department either.

It’s important to note that in many Asian countries, foreign individuals are not permitted to own real estate. The common practice is long-term leasing of properties for a period ranging from 50 to 99 years.

However, achieving true freehold ownership as a foreign investor in Asia can be challenging at times.

With that said, here are five countries in Asia where foreign property ownership is possible, and in some cases, even easy!

Keep in mind that we’ll only mention places which are worthy of investment. Sure, you can own real estate in Taiwan on a freehold basis. Why would you want to though?

Thailand

Thailand, along with everywhere else in this article, lets foreigners own freehold condominium units under their own name. Although buyers must closely follow some regulations, things are pretty straightforward for the most part.

First off, foreigners may only own up to 49% of the total floor space in a single condo building in Thailand.

Breaking this rule is hard in reality – Thailand does not have many condos that even approach this 49% threshold. You’re probably safe unless you’re looking at resort areas such as Pattaya. Or if you’re otherwise buying into a project that’s heavily marketed toward foreign investors.

Second, all money used to purchase real estate must be transferred into Thailand as foreign currency and converted into Thai baht at a Thai bank.

This isn’t a big deal. However, make sure to check your wire transfer forms very carefully when buying a condo in Thailand. You would have transfer all over again, wasting precious time and money if your sending bank does the currency exchange rather than a Thai bank.

One more note: Thai law also allows foreigners to own physical land for residential purposes with an investment exceeding 40,000,000 baht (US$1,200,000).

In practice, foreign land ownership in Thailand is a bureaucratic process and few people have actually been approved.

Cambodia

Cambodia is the least developed yet fastest-growing nation on this list. A rare combination of sustainable, rapid growth and business-friendly laws makes Cambodia among the top frontier market economies in the world.

You can buy a condo in Cambodia on a freehold basis as a foreigner. It’s done through a strata title, which effectively gives the owner rights to the piece of sky their property is situated upon. Newer condominium buildings are usually based on strata titles.

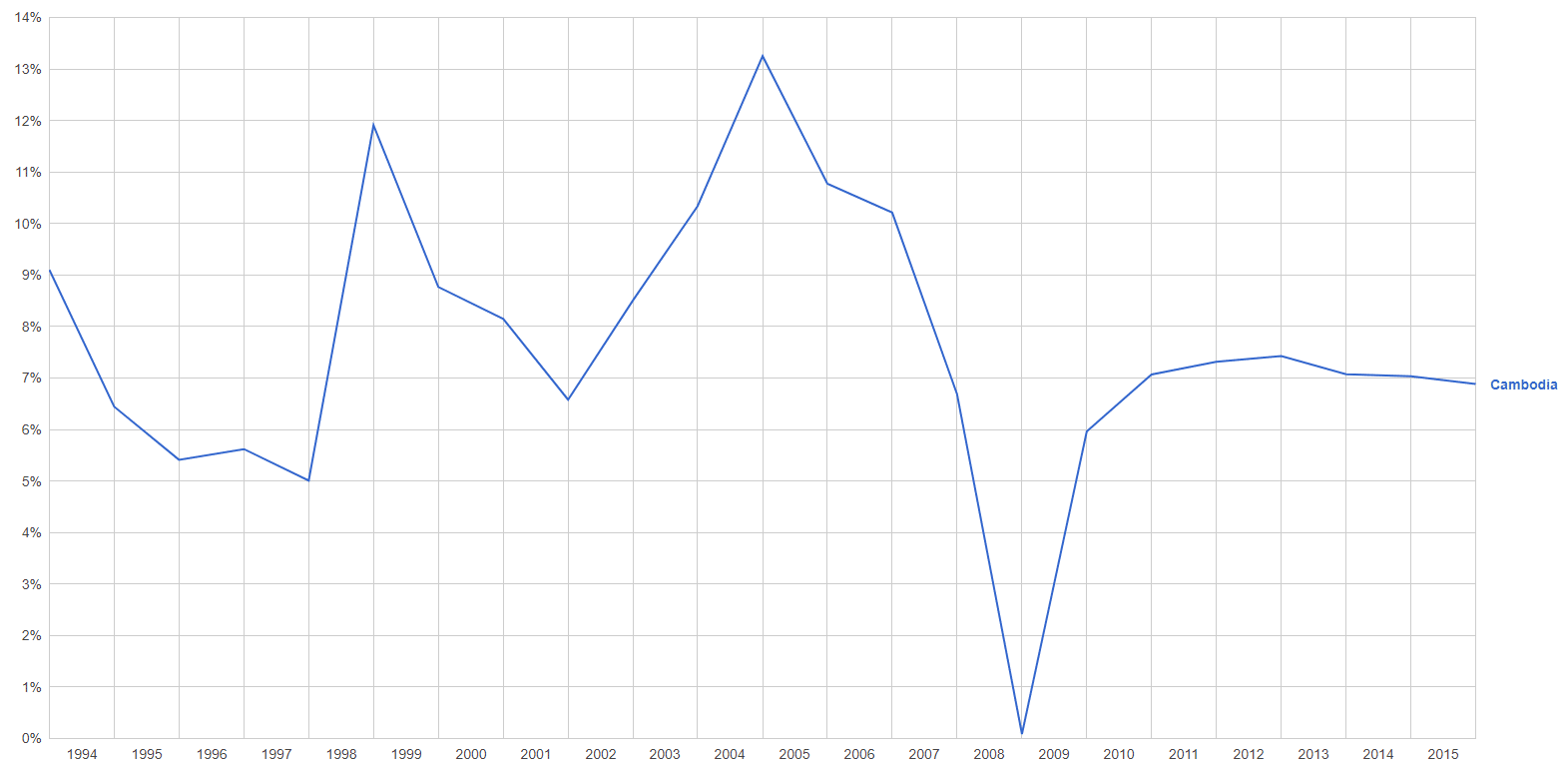

A chart showing Cambodia’s GDP growth rate since 1994. Like other frontier markets, they haven’t suffered a recession in over two decades.

Back in 2016, Cambodia’s government officially stopped letting individual foreigners purchase traditional shophouse apartments. Nonetheless, district offices retain significant autonomy in practice.

You can start a Cambodian land-holding company and buy physical land through it as well. Arguably, this is the safest way to go about foreign property ownership in Cambodia.

This does require incorporation, some specialized contracts, and about US$2,000 worth of monthly upkeep costs. But it’s ultimately a safe and effective way for larger investors to buy land in Cambodia.

Besides that, a lower cost option is buying property in Cambodia through a nominee structure. This is considered safe, unlike in most neighboring countries, and lawyers routinely suggest a nominee structure if you’re spending below US$1 million on real estate.

Singapore

The polar opposite from our last country, Singapore is the third wealthiest nation on the entire planet. One out of every ten households in the city has a net worth above US$1 million, in fact.

As such, real estate in Singapore is among the world’s most expensive. Yet there is still value in the market even though property prices often exceed US$15,000 per square meter (US$1,600 per square foot).

That’s because Singapore boasts impressive growth despite having a developed, prosperous economy. Property values are also lower than Hong Kong, for example, which isn’t as wealthy per capita and has greater availability of land compared with Singapore.

Foreigners can purchase freehold condos in Singapore with few ownership restrictions. That said, the government put forth cooling measures which substantially raise transfer fees on non-local buyers.

Specifically, as of 2024, Additional Buyer’s Stamp Duty (ABSD) is now a whopping 60% extra on top of the purchase price if you’re a foreign buyer!

Even if you’re a Singaporean citizen or PR, you can expect to pay at least 20% extra if you’re buying a second home.

Our full guide to buying property in Singapore has more information about the city’s cooling measures and similar developments.

Technically, foreigners can own landed houses in Singapore too… after going through a highly expensive and bureaucratic process.

You must generally invest S$50 million at the minimum, already be a permanent resident, and obtain special approval from the Land Authority before you’re allowed to own land in Singapore as a foreigner.

Few people have ever been approved in practice though. Condos remain a far more viable method of foreign property ownership in Singapore if you aren’t a billionaire real estate investor.

The Philippines

The Philippines is now growing at a rapid pace of greater than 6.0% annually. Future prospects are very positive despite recent press coverage regarding their internal affairs and failed drug war.

From a business standpoint, the amount of skilled, English-speaking, and low-cost labor in the Philippines is rivaled only by India. It gives them a huge competitive advantage and will boost the nation’s economy well into the future.

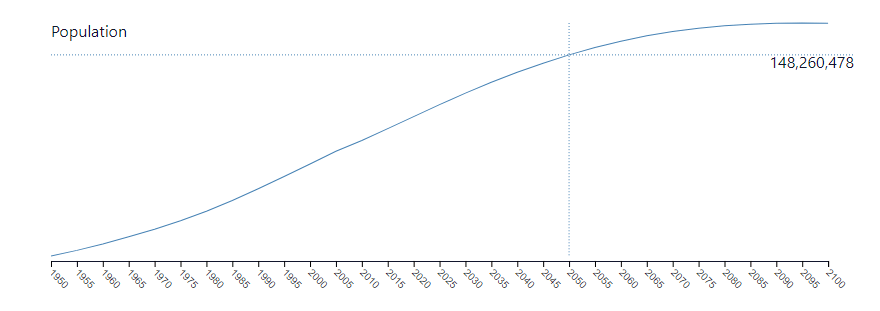

The Philippines’ population will grow from 117 million at present to almost 150 million by the year 2050.

Foreign real estate buyers can own freehold condos in the Philippines under their own name. The rules are similar to Thailand’s, with up to 40% of floor space in a single building able to be foreign owned.

Again, breaking that threshold is difficult in practice. Especially since foreign property ownership isn’t too common in the Philippines compared to Thailand or Singapore.

A major drawback in the Philippines is that foreigners cannot own land. Unlike in Cambodia, a nominee structure isn’t viable because of the Anti Dummy Law and a constitutional prohibition that clearly forbids foreign land ownership in no uncertain terms.

Malaysia

You may own condounits in all of the countries listed above. However, Malaysia stands out as the only real estate market in Asia where foreigners can directly buy landed houses, in their own name, without needing any type of corporate structure or special approval.

There are nonetheless a few limitations. Most notably, each Malaysian state imposes its own minimum purchase price on foreign property buyers. They start from RM400,000 (US$100,000) in Sarawak, ranging as high as RM2,000,000 (US$500,000) on Penang island.

Furthermore, some states restrict the locations where you can own land. The state of Selangor, for example, doesn’t allow foreign land ownership except in gated communities.

“Heritage properties” anywhere in Malaysia, such as older shophouses, are also limited to local buyers.

Those factors aside, Malaysia certainly ranks among the easiest places to buy land in Asia. Foreign property ownership doesn’t get much more straightforward than here.

FAQs: Foreign Real Estate Ownership in Asia

What's the Difference Between Freehold vs. Leasehold?

Freehold ownership gives the buyer full and permanent ownership of the property, including the land it sits on. The owner can freely sell, lease, or pass down the property to their heirs.

In contrast, leasehold means the buyer only has the right to use the property for a fixed period, typically 30-99 years, while the land ultimately belongs to the government or a private freeholder. At the end of the lease, ownership reverts back to the freeholder, unless the lease is extended.

Leasehold properties require a lower upfront investment but are depreciating assets with a finite ownership period. They may be more suitable for shorter investment horizons or budget-conscious buyers.

Can Foreigners Buy Property in Thailand?

Foreigners can own freehold condo units in Thailand. As long as the foreign ownership quota in the building is not exceeded, non-Thai citizens can directly own a condo unit in their own name.

Yet foreigners can't own land in Thailand under their own name. The only exception is through the Board of Investment (BOI) program which allows foreign land ownership in certain industrial estates or remote areas. However, this is only for large-scale business investments and not individual property purchases.

Is Foreign Land Ownership in Malaysia Legal?

Yes, foreigners can own land in Malaysia with some restrictions. Non-citizens are only allowed to purchase properties above RM1,000,000 (approximately $220,000 USD) in most states.

Additionally, foreign buyers must obtain approval from the relevant state authorities before purchasing landed properties like bungalows or villas. Despite these limits, Malaysia remains one of the few countries in Asia where foreigners can directly own land and houses, making it an attractive option for real estate investors.

Does the Philippines Allow Foreign Land Ownership?

No, the Philippine constitution prohibits foreign nationals from owning land in the country. The only way for foreigners to acquire land is through hereditary succession if they are legal heirs.

However, foreigners can own condominium units in the Philippines, as long as the foreign ownership in the building does not exceed 40%. Foreign nationals can also lease land for up to 50 years, renewable once for another 25 years.

Can Foreigners Buy Real Estate in Cambodia?

Foreigners can directly own freehold condominium units in their own name through strata titles. However, for land, shophouse apartments, or other types of property, foreigners must either set up a nominee agreement with a Cambodian citizen or form a land holding company (LHC).

An LHC provides more legal security but comes with annual licensing fees and monthly tax filing that can cost over $10,000 per year, so it's more suitable for larger investments exceeding $1 million. The process of buying other types of real estate can be more complicated, so many foreigners choose to purchase condo units instead.

Does Singapore Permit Foreigners to Own Land?

In theory, foreigners can own landed properties like bungalows or terrace houses in Singapore, but they must obtain approval from the Singapore Land Authority (SLA) first.

This is a highly bureaucratic process requiring the foreign buyer to have been a Singapore permanent resident for at least five years and demonstrate that their property ownership will significantly contribute to Singapore's economy, typically through a substantial investment of S$20-50 million or more.

In practice, very few foreigners have ever been approved to own land in Singapore due to these stringent requirements. The vast majority of foreign property buyers in Singapore opt for non-landed properties like condos instead, which they can own freely under their own name and with the same freehold ownership rights as Singaporean citizens.