By investing in Cambodia, you’ll gain unique access to one of the world’s fastest growing countries.

Stocks and real estate prices are a bargain here. Plus, it certainly helps that Cambodia is one of the easiest frontier markets to invest in Asia as a foreigner.

Multinational firms such as Samsung and 7-Eleven have just recently started to invest in Cambodia themselves, seeing the potential behind an untapped consumer market.

Meanwhile, foreign investors are entering Cambodia’s property market where property in the nation’s capital of Phnom Penh is priced at only US$1,000 per square meter – although this range is getting harder to find.

The Cambodia stock market is similarly more accessible than ever, with the government taking action to raise awareness among local and foreign equity traders.

Below we’ll cover the best ways to invest in Cambodia, including how to trade stocks and buy property here.

First though, it’s worth giving a quick overview of the Cambodian economy to show why it’s one of Asia’s fastest growing countries.

Why Invest in Cambodia?

Lots of foreign investors are buying stocks and property in emerging markets like Thailand, all while thinking they’ve successfully diversified offshore.

They’re missing an uncorrelated investment right next door though. Perhaps they should be trading stocks in Cambodia instead if they’re looking for asset diversification.

Don’t get us wrong: Thailand is a great country and it’s not impossible to make money on stocks or real estate there. But its annual GDP growth rate is among Southeast Asia’s weakest.

Thailand’s economy depends heavily on foreign capital, whether through tourism or FDI. People may assume that an emerging Asian market would be resilient to a financial crisis originating in Europe or the Americas, but that’s not necessarily true.

Cambodia’s economy, in stark contrast, averaged GDP growth above 6% per year during the past decade.

The average age in Cambodia is 25 years old compared to 40 in Thailand. In order words, Cambodia’s population will continue to urbanize and grow while its neighbor becomes older.

While almost every other country is frequently revising their GDP projections downward, Cambodia raises it upwards and often exceeds already high expectations.

Cambodia’s Economy is Uncorrelated

Diversification is crucial for wealth preservation. That’s why we suggest allocation to frontier markets such as Cambodia as a small percentage of one’s overall investment portfolio.

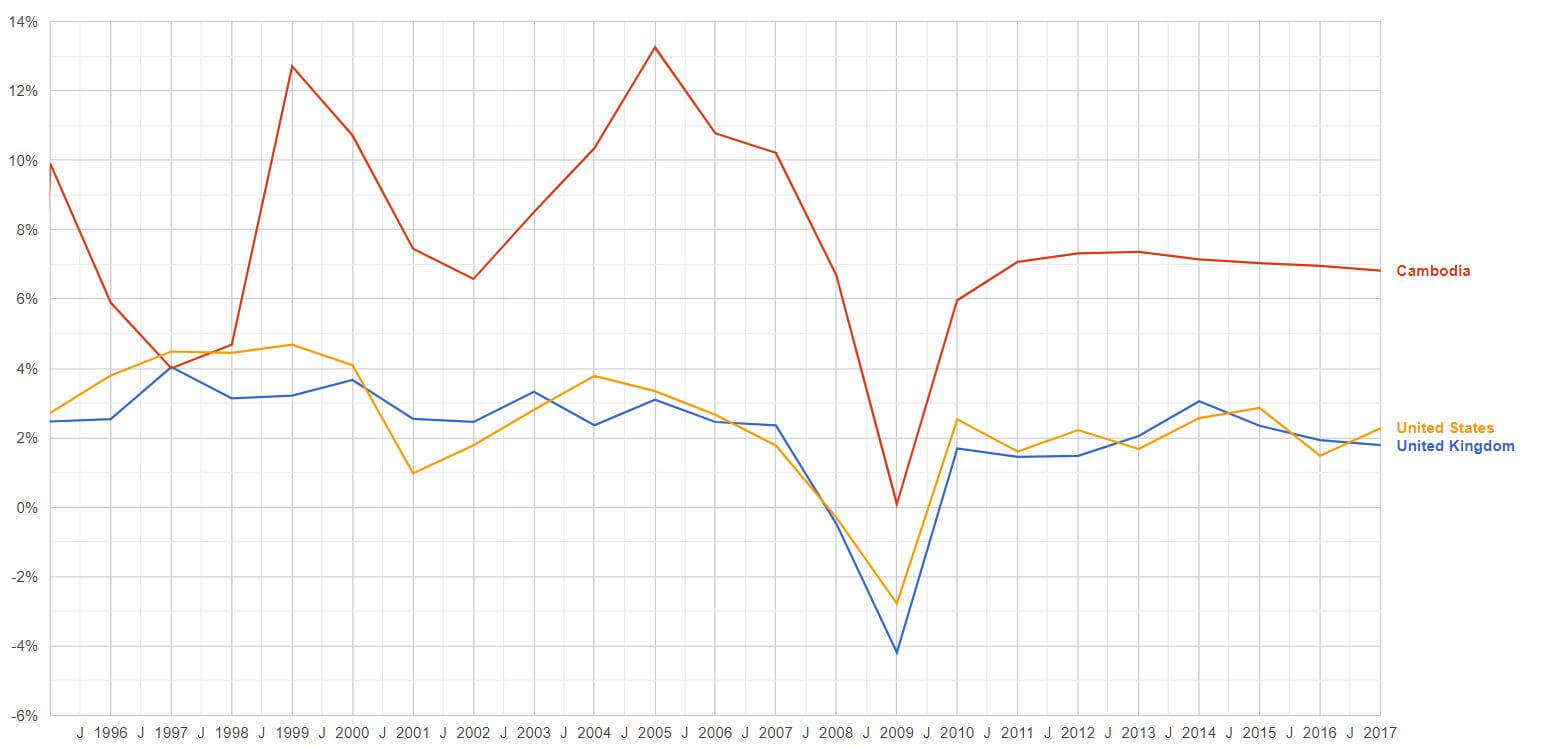

Cambodia is skipped the Asian Financial Crisis during the 1990s, missed the tech bubble of the early 2000s, and outgrew the recession in 2008.

In fact, Cambodia skipped practically every single recessions in the past three decades!

Because of its status as a frontier market, Cambodia isn’t anywhere near as dependent on foreign capital or investment from abroad. Natural growth drivers like rapid urbanization and the formation of new industries are more important.

A chart showing Cambodia’s GDP growth in the first two decades after it started being tracked.

Cambodia isn’t reliant on McDonald’s offshore expansion, or any other large corporation for that matter, to maintain continuous growth though.

After all, McDonald’s isn’t even operating here in Cambodia. Yet they’ll almost inevitably expand into Cambodia themselves one day, just like competitors including Yum! Brands already have.

This ongoing expansion of multinational companies serves as a major source of economic growth in Cambodia over the long term.

Furthermore, real estate in Cambodia enjoys a source of growth that few other frontier markets are able to benefit from: tourism money.

Millions of tourists visit Angkor Wat, the world’s largest religious structure, every single year. This number is expected to grow exponentially.

The world’s other frontier markets don’t have the benefit of an 1,000 year old temple or the visitors it brings. Places like Mongolia or Kenya must work their way up the economic ladder “the hard way” compared to Cambodia, which has it much easier.

Frontier markets can indeed grow rapidly. Yet they require a catalyst to propel growth in the first place. Oftentimes, this is through oil exports or a tourism industry.

During a typical year, over five million tourists visit Angkor Wat which is the world’s biggest temple.

Cambodia’s economy is fortunate in this regard. They have foreign tourists, investors, and the strong demographics needed to help fuel a multi-decade economic boom.

Indeed, a healthy tourism sector gives even further credence to the idea that Cambodia’s economy today is in a similar position to Thailand’s two decades ago.

How to Trade Stocks in Cambodia

You can understand why we suggest Cambodia. There isn’t any other frontier market in Southeast Asia with the same accessibility and growth potential.

Now, it’s time to learn different ways you’re able to invest in Cambodia as a foreigner, whether through buying real estate or trading stocks.

You’ll just barely has a stock market here. In fact, there are exactly 12 public companies listed on the Cambodia stock exchange.

Many of them are quasi-public corporations such as the local water utility provider and port operator. There are also banks, property developers, and other listed companies in Cambodia though.

You don’t have many options to buy stocks in Cambodia as a foreigner. Plus, the only to open a brokerage account in Cambodia in the first place is if you’re living here with a long-term visa.

No other brokerages outside the country support trading stocks in Cambodia either. At least for now.

We’re talking about a difficult place to access – and there’s no such thing as a Cambodia ETF yet.

Buying Property in Cambodia

Real estate in Cambodia is a better bet – if you know what you’re doing. Most of the new condo projects are overpriced, but shophouse apartments are incredible deals in certain areas.

Phnom Penh is also one of few capital cities in the world where you can find property for sale that costs below $1,000 per square meter. Our strong belief is that real estate prices in Cambodia will only increase from here.

Just be careful if you’re buying property in Cambodia, because it’s often challenging and labor intensive.

Between doing local market analysis in Khmer language, navigating an unfamiliar legal system and finding reliable contractors, the Cambodian real estate market isn’t an easy place as a foreign investor.

Things are almost never easy in frontier markets. Property investment in Cambodia isn’t any exception.

You should ideally spend time in Cambodia each year, at the very minimum, if you want to buy and maintain your own house here.

There are opportunities in venture capital as well. However, getting into the Cambodia private equity sector is arguably even harder than buying real estate.

You certainly must commit to plenty of due diligence and research if you’re wanting to get involved with VC in Cambodia or any other frontier market for that matter.

To summarize: investing in Cambodia (or any foreign country for that matter) is difficult. Nonetheless, barriers to entry are a good thing if you’re willing to break them down.

Entry barriers keep stock and real estate prices fair, at least for a certain amount of time, which it possible to invest in “under the radar” countries like Cambodia in the first place.

Perhaps somebody will create a Cambodia ETF listed on a major stock exchange one day. For the time being though, it’s still an unexplored frontier market with lots of opportunity.

FAQs

Does Cambodia Have a Stock Market?

Yes, the Cambodian Stock Exchange has twelve listed companies and a market capitalization of about $200 million as of 2024.

Can Foreigners Buy Property in Cambodia?

Foreigners can own condo units in Cambodia on a freehold basis, under their own name. The process gets far more complicated, and expensive, if you want to buy land in Cambodia as a foreigner though.

How Can I Trade Stocks in Cambodia?

You'll first need to open a brokerage account in Cambodia in order to trade stocks here. This can be done at one of a few large banks, such as Acleda or ABA.

Buying stocks in Cambodia as a foreigner is possible, but you'll need a long-term visa in order to open a brokerage account that'll let you trade stocks in the first place. Large banks in Cambodia generally won't open accounts if you're on a tourist visa.

How Much Does Real Estate in Cambodia Cost?

You can buy shophouse apartments and landed property in Phnom Penh's city center for only about $1,000 per square meter. Real estate values are even less expensive if you venture out into the suburbs or in Cambodia's smaller cities like Kampot and Siem Reap.

However, prices are closer to $3,000 per square meter if you're buying the type of condo units that foreigners can easily own. We think condos in Cambodia are overpriced, since they have developer profit, marketing costs, and other expenses built in.

In fact, you'll pay about as much for a condo in Phnom Penh as you would in developed cities such as Kuala Lumpur or Bangkok.

Can Foreigners Own a Company in Cambodia?

Yes, foreigners can own up to 100% of shares in almost any type of company in Cambodia. It's relatively straightforward to start a company in Cambodia as a foreigner compared to other countries in Southeast Asia.