Last updated December 18th, 2023.

People are often surprised to learn that some countries completely skipped the 2008 Global Financial Crisis.

It’s even more shocking that several places have managed to avoid recession for over two decades. Even when the latest recession of the 2020s hit, they still managed to thrive.

A select few markets, many of them in emerging Asia, have a long track record of skipping recessions.

Not only did such countries miss the economic downturn of 2018, but also the 1997 Asian Financial Crisis and even the tech bubble during the early 2000s.

Of course, a recession-immune economy doesn’t exist. “Past performance is no guarantee of future results,” as they say. Every type of investment has risk.

With that said, our list covers three places that, looking at their history, are about as you’ll ever get to meeting the standard of a “country that skips recession”.

Allocating at least a small percentage of your portfolio to them to achieve maximum diversification isn’t such a bad idea.

Vietnam

Manufacturers are leaving China as labor and upkeep costs rise to the point where it’s too high. With minimal regulations and lower prices, Vietnam is emerging as a new favorite.

This trend will boost Vietnam’s economy in the future. Samsung, Nike, and several other large multinational firms are already building large manufacturing plants.

Apple’s iPad production is now in Vietnam. Through its Taiwanese-based partners, it has over a dozen factories and is constantly expanding.

Especially with the ongoing U.S.-China trade war, more companies are following these large multinationals into Vietnam over time.

Stock investors will especially find Vietnam interesting. Hanoi and Ho Chi Minh City each have their own exchange. Combined, both of them total around 700 listed equities and a market cap of around US$500 billion.

Many of them are small-cap stocks that barely see analyst coverage. Because of this, Vietnam and its stock market host tons of hidden gems with great valuations.

How do you buy stocks in Vietnam? Well, if you don’t have an account able to trade stocks here, you’ll probably need a local brokerage account.

Getting a brokerage account in Vietnam isn’t easy without traveling here. As such, ETFs listed abroad including VanEck Vectors Vietnam (BATS: VNM) in the US or Vietnam Enterprise Investments Limited (LON: VEIL) are your next best options.

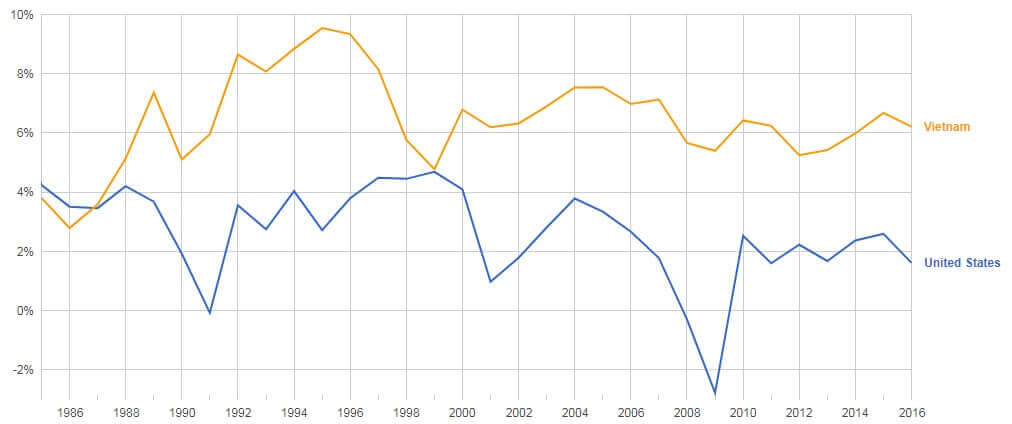

A graph showing Vietnam’s GDP growth since 1985 compared to the United States. We won’t clutter this article with charts, but other places on this list have also avoided recession.

Cambodia

Cambodia has economically moved on a dark period in the 1970s, and is now one of the fastest-growing economies on the planet.

The Khmer Rouge obviously didn’t keep track of statistics like GDP. With that said, Cambodia averaged growth of over 7% since Pol Pot’s regime was dissolved in the early 1990s. They have also skipped every single recession since then.

Cambodia is probably the easiest frontier market to conduct business in. Foreigners can own 100% of a local business – something that wealthier countries such as Thailand don’t even allow.

Furthermore, Cambodia uses the U.S. Dollar as its main currency. We aren’t exactly fans of the dollar, but compared to others in the region like the Vietnamese Dong and Malaysian Ringgit, it’s far more stable which limits currency risk.

If you want to buy stocks or real estate in Cambodia, you’ll need to visit the country, as it’s required to set up a local brokerage account or transfer real estate.

Phnom Penh, Cambodia, is among the few capital cities in the world where you can buy real estate in the city center for below US$1,000 per square meter.

Laos

This landlocked country shares borders with five others – Myanmar, Cambodia, Thailand, Vietnam, and China to be exact. This means Laos has more land borders than anywhere else in Southeast Asia.

Naturally, this makes Laos prime territory for a logistics and transport hub. And China is leading the Lao infrastructure boom.

High-speed rail will soon connect Kunming with Bangkok, running through Laos along the way.

Already, a new bullet train line runs between the two Lao cities of Vientiane and Luang Prabang. It’s just one hub in the overall China-ASEAN high-speed rail system.

Investing in Laos isn’t easy for most people, though. The Lao stock exchange barely exists, with just eleven listed companies. Foreign property ownership isn’t allowed, either.

Starting a company in Laos is the only realistic option if you want to invest in Laos. That’s a bureaucratic headache, to say the least.

How Do These Countries Avoid Recession?

You might have already noticed that each of the three places listed above share something in common. Sure, they are all located in Southeast Asia. More important is that they’re all frontier market economies, too.

Frontier markets are a step below emerging markets in terms of development. However, they tend to avoid recession since they’re less exposed to the international financial system and its whims.

The global economy is now fully interconnected. Starbucks and IKEA are found anywhere in the world, from China to Peru. This means practically all nations need continued investment from these multinational firms to sustain their growth.

The problems arrive when a global recession hits, and multinationals cut back their expansion plans.

Without foreign investment flow, everyone else gets sucked into economic crises that originate in large economies like the US, EU, or China.

Yet frontier markets are often an exception. Laos and Cambodia don’t depend on investment from McDonald’s because they don’t even have McDonald’s. When you’re less dependent on the global economy, it’s less likely to affect you.

Of course, they’ll inevitably get a boost when large investors expand into their countries and set up shop.

You should consider investing in frontier markets for those reasons. They don’t just have rapid growth potential but offer unparalleled diversification benefits as well.

Indeed, history shows that allocation to frontier markets can even help your portfolio avoid recession.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.