Last updated April 30th, 2024.

There isn’t any shortage of investment advice on the internet. A majority of the time, suggestions revolve around stocks or property that others think you should buy.

People saying where you should not invest are less common. The reason why is simple: nobody gets paid by dissuading you from buying assets.

Yet, we believe it is crucial to know where you shouldn’t invest as much as knowing where you should.

Below are the four worst places to invest in Asia. You’ll probably want to limit your portfolio’s allocation to these. Or perhaps even completely avoid them.

Brunei

The 2008 Global Financial Crisis happened over a decade ago. Yet Brunei is one of a few rare countries still stuck in recession.

In fact, Brunei has suffered through five straight years of economic decline. The reason for this small, oil-rich nation’s bad performance? Low commodity prices and noncompetitive policies.

While other oil exporters like the United Arab Emirates and neighboring Malaysia diversified their economies well enough to absorb the shock, Brunei never did.

Furthermore, unwelcoming policies towards foreign businesses along with Brunei’s transition toward Sharia law have pushed away most potential investors from around the world.

InvestAsian published a widely-read article about Brunei’s dire situation. So far, around 5% of their entire population saw it. The locals naturally gave us a lot of hate and some support, but we’ll absolutely continue telling the truth about noncompetitive countries.

Japan

The story about Japan’s “lost decade” is well known… although their weak economy has lasted closer to three decades.

Following rapid growth in the 1970s and 1980s, the Japanese economy was burdened by high asset prices and spiraling debt levels. It crashed in 1990 and suffered a second blow when the Asian Financial Crisis struck soon after in 1997.

Japan never really recovered from these two major, consecutive shocks. Their GDP climbed by over 7% on average for many years prior to 1990. Yet since then, they have grown by less than 2% annually.

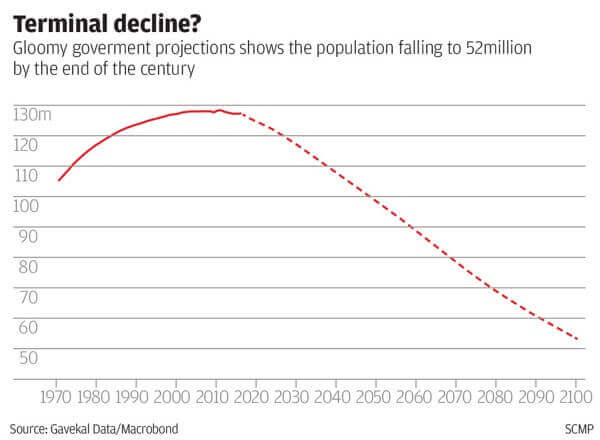

The nation’s demographic trends are even more worrisome today. Japan has the world’s oldest population, meaning an inefficient workforce and increasing amounts of public money spent on healthcare and pensions.

Eighty years might seem far away. Do you really want to own assets in Japan when a long-term trend of substantial population decline exists though?

Not only that, but Japan will certainly face a rapid population decline. Their current population will fall from 123 million at present to barely over 60 million before the end of this century.

Of course, this will naturally pressure the Japanese economy which ranks it among the worst places to invest in Asia.

Asia is the fastest growing region on the planet. Why waste that opportunity by investing in a terminally-ill market which is growing by just 1% per year?

Hong Kong

Alright, Hong Kong isn’t really a country. But they absolutely have different market dynamics and fundamentals compared to mainland China.

Hong Kong also has many things going for it – at least on paper. A strong rule of law, business friendly policies, low taxes, and proximity to mainland China have helped them become Asia’s de-facto financial center.

That’s all great. Meanwhile, inflated asset prices and wider geopolitical trends make investors more concerned than optimistic. You can have the best policies on the planet, but they won’t matter if asset prices are beyond reasonable levels.

Property in Hong Kong is still among the world’s most expensive. Rental yields are abysmal too, hovering around 1.5% on average which is below the rate of inflation. You can generate higher returns through a bank deposit minus the lack of liquidity.

Beijing’s increasing influence in Hong Kong’s (at least formerly) independent legal and political systems also puts both domestic and international investors on edge.

We certainly understand why some people may want to own assets in the world’s top financial centers. But you should consider investing in Singapore which is growing faster and has fewer of Hong Kong’s negative aspects.

Taiwan

Taiwan’s economy is the fastest growing on our list by far. However, their real estate market is perhaps Asia’s most overvalued. The nation’s stock market doesn’t fare much better.

Property values in Taipei are completely out of touch with reality. Real estate prices in Taiwan’s capital are higher than any other city in Asia when compared to the average local salary.

A two-bedroom apartment costs about US$700,000 while an average Taiwanese citizen makes barely US$1,200 monthly. That means saving up for almost 50 years! Rental yields in Taipei are among the world’s lowest at under 1.5% as well.

Many of Hong Kong’s same problems also exist in Taiwan to varying degrees – everything from unrealistic asset prices to mainland China’s expanding influence. Granted, the huge difference is that Hong Kong is a top financial hub with a lack of spare land. The same isn’t true in Taiwan.

Why Are These the Worst Places to Invest In?

Asia’s weakest stock and real estate markets, for the most part, all share several things in common.

First off, each of the four countries listed above are facing major demographic issues. Japan and Hong Kong are suffering from population decline, while Brunei and Taiwan possess limited growth capacity.

In a region with 4.5 billion inhabitants and rising, there’s no reason to limit yourself by investing in countries with aging populations which have already met their urbanization potential.

Secondly, all the worst places to invest in Asia have major entry barriers in some form. Such barriers are either enforced by restrictive immigration policies and anti-foreigner sentiment (like in Japan and Brunei), or high-start up costs (as in Hong Kong and Taiwan).

Finally, geopolitical risk is a ongoing concern in each of the markets listed above. The specific details vary between each jurisdiction, but they range from territorial disputes to “crazy neighbors” next door.

Would you rather learn about investing in places with a bright future? Here’s a different article about the fastest growing countries in Asia.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.