Last updated September 28th, 2024.

Most Asian currencies, with the exception of a rare few, have gone through a period of depreciation over the past few years.

The decline was broad-based with almost every currency in the region falling by at least 10% against the US dollar and other major currencies.

One notable, heavily-traded currency is an exception though: the Singapore dollar.

Many investors consider Singapore as a safe jurisdiction to store their wealth. It’s Southeast Asia’s unofficial financial hub and among the richest nations on the planet too.

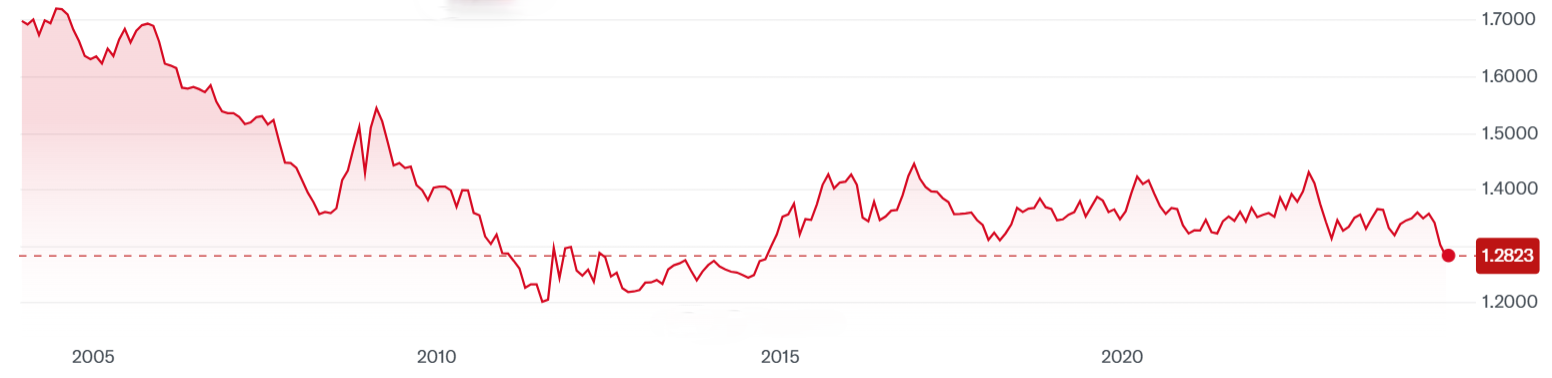

The Singapore dollar increased from recent highs of 1.42 per US dollar to 1.30 as of late-2024. That’s a rather significant appreciation of more than 10% in a short period of time.

With that said, we’re bullish on the Singapore dollar’s future after years of relative flatness. It’s now on an uptrend and should continue its rise well into the new decade.

Keep reading to learn more about the Singapore dollar, which is ranked among Asia’s best currencies, and why you might want to consider owning it.

Singapore Dollar’s Strong Record of Growth

A robust economy directly helps a nation’s currency. The good news is that both the Singapore dollar and Singapore itself enjoy an established history of growth and stability.

Most readers are likely familiar with Singapore’s story. In the 1800s, they were a British colonial backwater infested with malaria and filled with opium dens. Today, Singapore boasts the sixth highest GDP per capita on earth.

Singapore has kept up a rather impressive growth rate despite becoming a developed country decades ago. The city-state’s GDP growth exceeded 5.0% since 2010.

Now, compare that to 2% in the United States and barely over 1% in the European Union.

This record-breaking growth, especially considering Singapore is a fully developed nation, wasn’t without occasional hiccups. Every economy has problems. Yet Singapore’s long-term trends are very clear.

Here’s a 20 year chart of USD/SGD. Those who held onto Singapore dollars since the beginning of the 21st century is now sitting on gains exceeding 30% against the Euro and US Dollar.

Once you consider other factors like strong export numbers and Chinese capital flight towards areas outside of Beijing’s influence, there’s a bullish case for Singapore’s dollar.

Few Safer Alternatives Than SGD

Forex markets are a zero-sum game for the most part. A single currency’s performance largely depends on the movement of others.

Because of this, let’s take a look at the two most commonly traded currencies: the U.S. dollar and Euro.

The United States is going through a period of rate hikes for the first time since the 1980s. As a direct result, bond yields and the U.S. dollar began plummeting. Those trends should continue if the Federal Reserve follows through with its rate hike plans.

Back in 2019, the European Union lost its second largest member. Global confidence in the Eurozone is thus shaky while respected geopolitical think-tanks are now warning about its inevitable collapse.

Meanwhile, other Asian financial hubs can’t with Singapore compete either. Hong Kong’s dollar is pegged against the US dollar.

The yen is backed by an indebted, weak economy. The yuan is stuck between poor export numbers, allegations over currency manipulation, and a trade war.

The Singapore dollar is Asia’s only major currency left standing. Its regional competitors simply can’t compare.

Singapore Dollar Backed by Blockchain?

Most nations hate the very concept of cryptocurrency and the type blockchain tech they’re based on. Quite frankly, governments consider them a threat to their own system.

Yet Singapore is one of the friendliest places in the world towards crypto. They even have a goal of putting the Singapore dollar on blockchain.

Blockchain’s self-correcting, incorruptible nature would install even greater confidence in the Singapore dollar’s stability.

You may or may not think crypto assets like Bitcoin and Ethereum warrant a price of more than US$100,000.

Regardless, the tech behind blockchain is here to stay. The first country to adopt blockchain will benefit immensely and Singapore’s dollar leads the pack.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.