As a global investor, you’ve perhaps heard the terms “frontier markets” and “emerging markets” plenty of times before.

At a first glance, it might seem self-explanatory what these terms mean.

Sure, it’s common knowledge among investors that both frontier and emerging markets are less developed yet generally faster-growing compared to fully developed economies.

But more importantly, how does investing in frontier markets help ones’ portfolio? And what really are the differences between frontier markets and frontier markets?

We should start off by saying the definition of “emerging markets” and “frontier markets” can change depending on who you ask.

For example, MSCI includes places like South Korea, Qatar, United Arab Emirates, and Taiwan as “emerging markets”.

These are all among the most economically advanced nations on the planet though. They certainly aren’t emerging markets by other definitions. Not any more, at least.

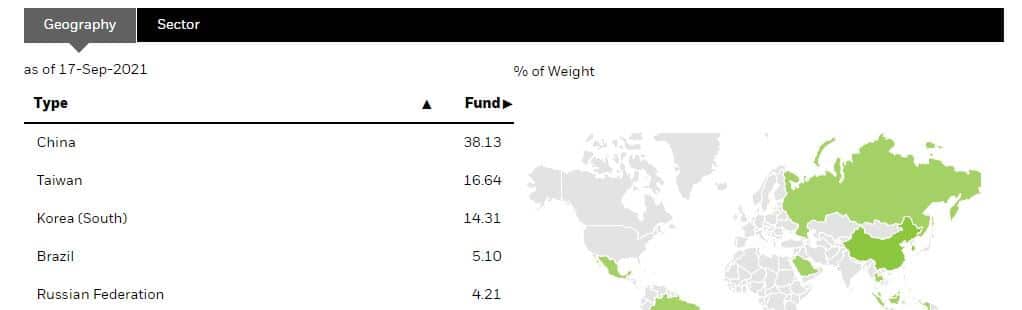

Top five holdings of the iShares MSCI Emerging Markets fund by country. Yet two of them are developed economies. Only three nations (China, Korea, and Taiwan) make up 70% of the ETF’s total holdings!

In our opinion, that’s a great reason why you shouldn’t buy an emerging market ETF. Or one of the very few frontier market ETFs that exist, for that matter.

That’s because emerging market ETFs rarely don’t even invest in the kind of stocks they’re named after. Such funds certainly aren’t ideal for diversification if you’re truly looking to hold emerging market equities.

However, that’s a topic for another post. We’re here to pit emerging markets vs. frontier markets and figure out which is better for your portfolio.

Keep reading to find out why these rapidly growing nations can help your portfolio… and whether emerging market investments is a right fit for you at all.

What is a Frontier Market?

Emerging and frontier markets are widely conflated. In fact, people often confuse the benefits they offer compared with each other.

The kind of benefits that many people would attribute to investing in emerging markets (recession avoidance, etc.) are often more true with frontier markets, and vice versa.

One of those misconceptions is that emerging markets are somehow less correlated with your home nation’s economy.

Quite frankly, emerging markets won’t protect you from a recession. They might even have worse performance than other types of investments during a global crisis.

You’ll find McDonalds and Ikea on practically all corners of the earth nowadays. Because of this, a recession which starts in the United States, Europe, or any other major economy will heavily impact emerging markets as well.

A financial crisis means declining business activity and falling exports around the globe, including for emerging economies.

In fact, global recessions are especially harmful for newly-industrialized nations that rely foreign investment and exports.

The auto manufacturing sector is one of Indonesia’s largest. What happens if American or Japanese consumers stop buying Indonesian car exports though?

But it gets more confusing once you realize the difference between frontier markets and emerging markets include a wide variety of different countries.

You can’t paint dozens of economies by using the same broad strokes.

For example, the Turkish lira and Malaysian ringgit currencies were crushed. Yet the Thai baht has enjoyed superior performance even when compared to developed economies.

All of those three countries are classified as emerging markets despite lack of correlation between them though.

The Difference Between Emerging and Frontier Markets

Sure, frontier markets are a step below emerging on the “economic development ladder”.

Yet they often claim high-growth economies that rely on internal factors, such as strong demographic trends, to a far greater extent than continued foreign investment.

Usually, frontier markets benefit from a low average age, rising urbanization rate, and growing middle class.

These places will almost inevitably see greater demand for real estate, and thus rising asset prices, by the mere reality of their demographics.

What’s the effect from all this? Frontier market equities aren’t nearly as dependent on global markets. They’re less correlated with the NASDAQ index and its daily whims.

These high-growth nations commonly skip global recessions altogether. Cambodia and Vietnam are just a few frontier markets which haven’t entered recession for over two decades… all while increasing their economy’s size by 6% each year.

You shouldn’t paint all frontier markets in the world with a broad brush either though.

Several frontier markets have a solid track record, business-friendly policies, and laws which are pro-foreign investment. The Philippines and Cambodia are two examples of frontier markets which are, relatively speaking, stable and lower risk.

However, places like Myanmar and Laos are difficult – especially the former considering its recent coup.

Doing proper research, exploring alternatives, and knowing the best frontier markets to invest is crucial.

During a typical year, over 2 million tourists visit Angkor Wat which is the world’s biggest temple. Ticket income almost doubled every year in the 2010s.

Frontier Markets vs. Emerging Markets: Which is Better?

Which of these types of economies make a superior investment? It completely depends on your own personal goals and level of risk tolerance.

We never wanted to finish this article with a non-answer. It’s true though, and is the only correct piece of advice.

Both kinds of economies can offer higher returns, along with potentially greater volatility, when compared to developed markets.

Generally, getting any type of international exposure at all to either frontier or emerging markets achieves the goal of diversifying most people’s portfolios.

Emerging markets are better if you value convenience. Buying stocks in China or a condo in Malaysia is much easier than figuring out places like Myanmar.

In contrast, frontier markets are best if you seek low correlation with other investments, possibility for outsized returns, and can tolerate some additional risk.

A major reason why frontier markets have strong growth potential is because few people bother putting forth the type of effort that’s required to discover them.

That’s a positive thing if you’re among the willing. While entry barriers are inconvenient, they also help keep asset valuations fair.

Large money managers spend billions on trading algorithms and well-paid staff. They’ll find any truly undervalued stock before you’re even aware it exists. As such, there aren’t many deals left on major equity exchanges.

Goldman Sachs definitely isn’t looking at frontier market stocks in Vietnam or buying land in Manila though, which leaves a chance for non-institutional investors.

Thus, one major difference between emerging and frontier markets is: less developed nations often lack correlation with the overall global economy.

Simply put, because frontier market usually aren’t much a part of the world economy in the first place, they don’t depend as much on its performance.

By comparison, emerging markets can offer portfolio diversification. But they generally don’t provide lack of correlation with other investments.

Thus, generally speaking, emerging markets aren’t ideal performers in a recession when compared to frontier economies.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.