Last updated February 2nd, 2025.

Located at the crossroads of the Arabian Sea and Indian Ocean, Oman has rather quickly become a major player in logistics and trade.

Oman is known for its relative political stability and forward-thinking laws. Because of this, investing in Oman is an alluring prospect if you’re looking to expand into the Gulf.

Today, Oman’s economy draws investors with promises of stability, a skilled workforce, and strategic access to the EMEA region.

Multinational firms are indeed choosing to invest in Oman more than ever before!

Our full guide about Oman is mostly geared toward foreigners. Below, we’ll cover several including:

- Buying real estate in Oman (both inside and outside of Muscat)

- How to trade stocks, bonds, and other financial instruments

- Bitcoin in Oman and other types of crypto

- Private equity and venture capital

- Should you even invest in Oman in the first place?

Best Cities to Invest in Oman

Despite its modest size, Oman offers a tapestry of diverse cities and towns, each with its own unique appeal.

Muscat is certainly the most obvious choice. As the capital and largest city, it stands as Oman’s economic epicenter.

Boasting a thriving finance district, luxury hotels, and a flourishing art scene, Muscat is one of the Gulf region’s fastest-growing cities.

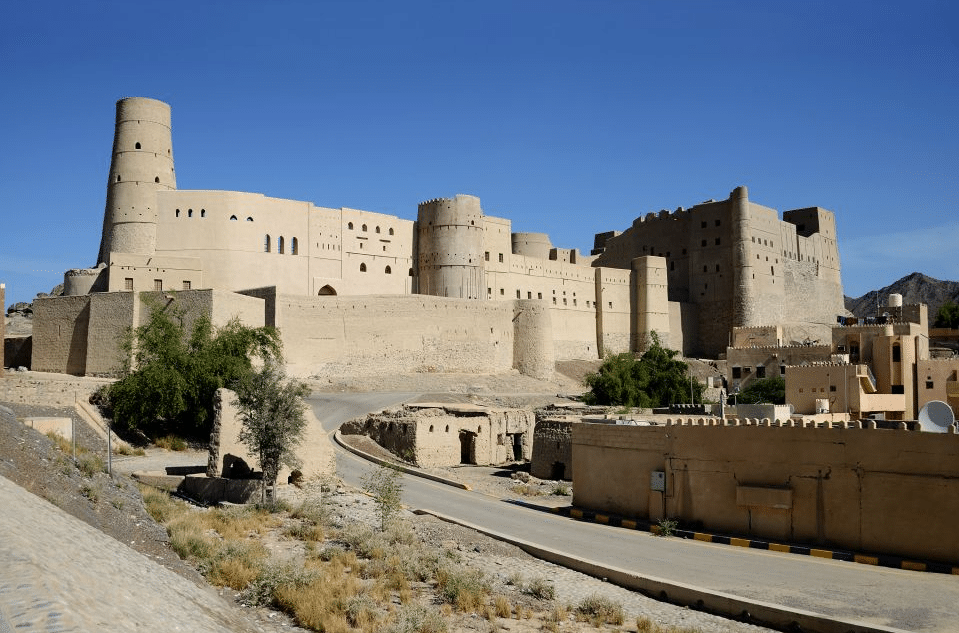

Visitors can journey from Muscat’s bustling traditional souks to UNESCO World Heritage sites like the Bahla Fort.

Bahla Fort is only two hours away from Muscat downtown by car. It’s the first UNESCO World Heritage site in Oman. Today, the country has a total of five properties on the Heritage list.

Looking places to invest outside of Muscat, one rising city in Oman’s tourism sector is Salalah.

Located in the south, Salalah offers a more relaxed environment and unique historical perspective. It’s especially known for lush greenery and a distinctive monsoon season, which makes Salalah the perfect destination for hotel operators.

Sohar is another place to invest in Oman. Positioned on the northern coast, its strategic location on the Gulf makes it a natural hub for logistics and trade.

As Oman’s biggest port and industrial complex, Sohar handles roughly 60 million tons of cargo every year.

The Duqm Special Economic Zone (SEZ) is also getting significant attention. By offering generous tax benefits, Duqm is quickly turning into a focal point for industrial property investment in Oman.

How to Start a Company in Oman

The Omani government has taken many actions to attract foreign capital. You’ll generally find it easier to do business here compared with some of the competitors in the region.

One notable feature is that Oman has no restrictions on flow of capital and repatriation of profits. As such, foreign companies can freely send any profit back to their home country.

Plus, entrepreneurs are eligible for tax exemptions. The first OMR 30,000 of earnings is free of all corporate income tax.

For a maximum of 50 years, businesses in Oman that are registered in free zones are also exempt from corporate tax and customs duties on imports.

Oman has trade agreements with several nations, including the Oman-USA Free Trade Agreement. It permits American investors to have the same legal rights as Omani citizens, including the ability to fully own a company there.

Oman has set up areas like the Duqm SEZ which provide tax incentives and exemptions. Tax holidays, import duty waivers, capital exemptions, and 100% foreign ownership are all permitted in these free trade zones.

Oman’s tax structure is relatively favorable, with a vast majority of businesses enjoying a competitive tax rate of just 15% on corporate income.

Indeed, you’ll find that taxes in Oman are pretty low for individuals and businesses alike.

How to Trade Stocks in Oman

Oman is home to a rather small yet well-regulated financial market.

You won’t find many limits on foreign stock traders here, but may have issues opening a brokerage account if you aren’t a resident of Oman.

The Muscat Securities Market (MSM) serves as the primary stock exchange in Oman with about 50 listed companies across various sectors.

Several stock brokerages in Oman offer remote online account opening services in some cases, thus eliminating the need for a personal visit here. That is, if you qualify in the first place.

Furthermore, institutional investors are allowed to own up to 70% in most types of Omani companies listed on the MSM, subject to regulatory approval.

In reality, that’s unlikely to ever be an issue for the average foreign investor trading stocks in Oman though.

Oman’s ports play an important role in growing the country’s logistics and commerce industry, shifting away its economy from heavily relying on oil and gas.

Oman’s Currency: The Rial (OMR)

With a fixed exchange rate to the US dollar, the Omani rial (OMR) is known for its relative stability when compared to elsewhere in the Gulf region.

The official exchange rate is one OMR to 2.60 USD. It’s worth noting that Oman’s foreign exchange reserves, managed by the Central Bank of Oman, are rather substantial.

While not everyone loves the US dollar (or currencies which are pegged to it), it’s better than the alternatives.

The fact is: the greenback remains more stable than, for example, the Kuwati dinar or any of the Gulf’s other exotic currencies. Oman’s rial is a better choice by comparison.

Doing Business in Oman as a Foreigner

The local economy is closely tied to the oil and gas sector with Petroleum Development Oman (PDO) being central to the nation.

Several other firms in the industry include Oman Oil Marketing Company, Masirah Oil Limited, Shell PLC. Yet none of these are as prominent as the country’s main state-owned oil company.

In recent years, Oman has gone through a large diversification effort, emphasizing sectors like hospitality and logistics. Pivoting toward to downstream industries is indeed crucial to the nation’s economic future.

Oman’s hospitality market now has a compound annual growth rate (CAGR) of 9.5% and is further expected to grow at a CAGR of 8.5% from 2022 to 2027.

Key developments like the Port of Duqm and Salalah Free Zone have enhanced Oman’s role in shipping. Nowadays, these ports are essential for the entire Middle East and North Africa regions.

There’s a lot of work left to diversify Oman’s economy though. Oil still plays an outsized role, and if prices crash, the nation as a whole will almost surely go along with it.

Will Oman ever manage to truly diversify its economy outside the oil and gas sector? Only time will tell.

Trading Bitcoin and Crypto in Oman

Today, cryptocurrency in Oman remains legal but unregulated. However, Oman has been gradually exploring the potential of cryptocurrency and blockchain technology.

While the country hasn’t yet established a legal regulatory framework on owning bitcoin or other forms of crypto, the government taken a strong interest in it.

They’ve directly funded blockchain tech on several occasions, in fact, which gives crypto in Oman de-facto official backing.

The Omani government announced back in 2023 that it’ll invest nearly $800 million more in cryptocurrency mining operations. Additionally, Muscat approved a $370 million farm run by Exahertz International.

On top of this, a $300 million agreement was made recently with the Phoenix Group of Abu Dhabi to build a 150-megawatt cryptocurrency mining farm with Green Data City, Oman’s first licensed crypto mining company in Oman.

If you want to buy crypto in Oman, take special note of ithe country’s notable business-friendliness towards bitcoin and other digital assets.

The government has specifically boosted the crypto industry with billions of dollars while other countries in the region have banned it.

As the sector developers, crypto investors should closely monitor Oman’s evolving stance on bitcoin and other digital assets.

Al Mouj Muscat, Oman’s first Integrated Tourism Complexes (ITC) project. The project boasts itself as a luxurious mixed-use waterfront development with facilities that include a golf course and a marina for its residents.

Buying Real Estate in Oman

Oman’s real estate market has witnessed steady growth. In particular, the government actively encourages foreign investment in free zones and industrial areas by offering zero property taxes.

Foreigners can buy property freehold in Oman in specially designated Integrated Tourism Complexes (ITCs) and certain commercial buildings that have been authorized by the Ministry of Housing.

Several of the most notable ITC developments include Muscat Hills, Saraya Bandar Jissah, and Shangri-La’s Barr Al Jissah Resort.

In short, buying land in Oman as a foreigner is possible, but you can’t sit on the plot for an extended period of time and “landbank”.

Foreigners can’t indefinitely hold undeveloped land in Oman though, and are generally given four years to start construction.

The Ministry of Housing and Urban Planning may extend this period if needed. However, they’ve been known to put the land up for auction if a foreign buyer doesn’t use it within the allotted four years.

Foreign nationals also aren’t allowed to purchase property in certain restricted locations in Oman either. This includes areas near military bases and historic buildings.

Currently, some of the most popular locations to invest in Oman’s real estate market include Muscat, Salalah, and Sohar.

The cost per square meter in these wealthy neighborhoods range from OMR 300 on the cheapest end to OMR 1000 at the most expensive.

And of course, since it’s Oman’s capital and largest city, buying property in Muscat is far pricier than anywhere else in the country.

The Diplomatic Area is especially prime. In fact, it’s the most expensive place to buy real estate in Oman. Homes for sale near the Muscat Grand Mall is also in very high demand.

Private Equity and Startups in Oman

Oman’s venture capital industry is on the ascent, targeting key sectors such as tech and healthcare.

While private equity in Oman isn’t a huge sector, there’s plenty of support from business and government alike here.

Projects such as the Oman Technology Fund provide incubation and funding to startups.

Granted, the VC sector has slowed down notably since then. But the country is overall home to a vibrant scene for innovators and entrepreneurs. We think it’ll rise again as global risk-appetite returns to normal levels eventually.

Phaze Ventures, the country’s first private VC firm, is particularly worth mentioning when it comes to startups in Oman.

With a heavy focus on automation, nanotech, and the Internet of Things, Phaze Ventures is vital to the industry as a whole. They fund tech incubation both domestically and abroad, building upon its strategic alliance with Petroleum Development Oman (PDO).

Muscat’s lively night scene by the coast is one of the most attractive spots for tourists and locals alike.

Indeed, Oman has made significant strides in building a local venture capital ecosystem driven by government programs and private sector participation.

Is Investing in Oman a Good Idea?

Compared to some of its neighbors, Oman’s record of fiscal responsibility and a currency pegged to the US dollar provides a greater degree of economic stability.

That said, its economy still depends highly on the oil sector. While that isn’t by any means unique for a Gulf nation, it’s nonetheless a problem that must be fixed in the long-term as Oman develops.

Further diversification into non-oil sectors such as finance, tech, and tourism would help Oman out a great deal. It’s happening, but at a slow pace.

On the brighter side, Oman has solid infrastructure and a thriving private equity market. The government is especially friendly to bitcoin and other cryptocurrencies, which sets it apart from most countries in the world… let alone the Gulf!

The ability to buy a house in Oman, including designated zones for foreign real estate ownership and no property taxes, all mean greater opportunity.

Additionally, Oman’s strategic location within the Arabian Peninsula positions it as a gateway to global markets.

Oman’s combo of political stability, investment-friendly policies, and a growing economy makes it a compelling choice as a foreigner seeking opportunity in the Arabian Peninsula.

Do keep in mind though: you’re doing business in a small, oil-reliant country of barely four million inhabitants. Your options in Oman are naturally limited because of this.

You should perhaps consider looking further towards Southeast, or even East Asia, if you want a greater variety of choice.

Within the Gulf region, the UAE and Bahrain also aren’t bad as alternatives to investing in Oman. Comparing your options and doing proper research is crucial.

FAQs: Investment in Oman

Are Foreigners Allowed to Buy Property in Oman?

Yes, foreigners can now purchase real estate in Oman. Freehold ownership is only possible in certain areas called Integrated Tourism Complexes (ITCs) though.

Several examples of these ITCs include Muscat Hills, Saraya Bandar Jissah, and Shangri-La Barr Al Jissah.

Is it Legal to Trade Crypto in Oman?

Technically, there isn't any legal framework for buying bitcoin and other forms of crypto in Oman.

However, the government has directly funded startups related to crypto and blockchain which implies its support.

Oman's government makes no attempt to stop anyone from trading crypto.

Can Foreigners Own a Company in Oman?

Yes, foreigners can start a business here and are allowed to own 100% of shares in almost any type of company in Oman.

How Can I Trade Stocks in Oman?

If you're living in Oman, it's a simple matter of visiting your local bank and opening a brokerage account.

However, it's a lot harder to buy stocks in Oman as a foreigner. Especially if you're non-resident here. Banks and brokers work with wealthy foreign clients on a case-by-case basis.