Last updated February 3rd, 2025.

Malaysia is one of Southeast Asia’s most important banking hubs, outranked only by its much smaller neighbor to the south.

By banking in Malaysia, you’ll have access to several well-capitalized financial institutions. The ringgit also enjoys greater stability than most other exotic currencies in Asia.

What’s the best bank in Malaysia? Well, there isn’t any one-size-fits-all answer. Each company has its own pros and cons, and the ideal bank will depend on your own personal goals.

For example, while one pays high interest on fixed deposits, another may provide better loan terms. Your online banking experience will also vary widely depending on your choice.

Meanwhile, your criteria will change if you’re an expat or a frequent traveler. Plenty of Malaysian banks either have global branches, or are themselves a foreign company.

Picking an international bank that operates in Malaysia, like OCBC or UOB, adds to the accessibility of any foreign clients.

And if we’re talking about Islamic banking in Malaysia, the industry is second-to-none outside of the Gulf. Islamic banks aren’t for everyone though.

To evaluate Malaysia’s best banks, quite a few factors come into play. These include digital capabilities, ATM network, customer service, and overall reputation for both local and expat clients.

Without further ado, and in no specific order, here’s our list of the top 10 banks in Malaysia for this year.

With more than $200 billion of total assets and $20 billion of annual profit, Maybank is unquestionably the biggest bank in Malaysia.

Maybank

By far, Maybank is the largest financial institution in the country in terms of deposits, assets, and practically any other metric.

A crucial strength of Maybank is its flexibility and commitment to a diverse clientele. Between its wide range of personal and corporate banking solutions, Maybank offers practically all types of services and can cater to any scale.

You’ll also find numerous international branches of Maybank all across Southeast Asia, from China to Cambodia. Maybank is truly a global institution and ranked alongside the largest banks in ASEAN.

Beyond its core banking services, Maybank contributes to Malaysia’s economic development and growth through its community projects and Islamic banking practices.

Size isn’t everything. However, if you’re seeking a wide ATM network and the biggest bank in Malaysia, it’s absolutely Maybank!

- Largest Islamic bank in ASEAN in terms of assets

- 2,610 retail branches worldwide

- Represented in 18 countries

- 1 trillion+ MYR of transactions via online banking in 2025

CIMB

CIMB Malaysia has cemented itself as a leading player in the country’s banking sphere. With its extensive regional presence, CIMB markets itself as an “ASEAN Bank”

You’ll indeed find that CIMB has a larger international ATM network compared to any other bank in Malaysia. They even have branches in countries that few other Malaysian banks have expanded into yet such as Thailand, Vietnam, and the Philippines.

Needless to say, CIMB operates in far more common offshore jurisdictions like Singapore and Hong Kong as well.

In all these countries, CIMB offers a diverse product suite catering to both retail and corporate clients, enabling it to satisfy a wider range of financial needs than many banks.

CIMB’s emphasis on innovation and technology has allowed it to stay ahead in an increasingly digital landscape. Cutting-edge solutions, including AI and data analytics, provide an efficient banking experience.

To summarize, CIMB Malaysia is a prominent financial institution that has established itself as a leading player in not the Malaysian bank sector, but also regionally.

- Core net profit of RM6.21 billion

- More than 200 retail branches in Malaysia

- Represented in over a dozen countries

- 9 million digital users in 2025

CIMB tries to cover every country in ASEAN. They’re the only Malaysian bank with consumer services in Thailand, for example.

RHB Bank

RHB is one of the leading banks in Malaysia. Established back in 1997, RHB Bank has grown to become a trusted name in the financial sector.

With a vast presence spanning Southeast Asia, you’ll RHB Bank branches and ATMs all around the region. Laos, Brunei, and Cambodia are just a few of the more obscure countries they do business in.

The bank has invested significantly in digital capabilities including advanced platforms and mobile apps that enable seamless online transactions.

Generally, you’ll have a similar experience with RHB Bank regardless of which country you’re using them in. They’re pretty consistent across all of their international branches.

Like many of the other large banks on this list, RHB Bank emphasizes social responsibility as well, supporting initiatives in education, healthcare and environment.

RHB Bank’s customer focus, diverse offerings, and digital prowess all add to their status as one of the top banks in Malaysia.

- 314 branches or offices across Southeast Asia

- 2,707.7 million in net profit

Public Bank

Public Bank Berhad is a well-established bank in Malaysia. Since its founding back in 1966, it quickly grew into one of the country’s five largest banks in terms of its domestic and global presence.

And no, contrary to its name, Public Bank is not actually public. Other than the fact that it’s a publicly traded company listed on the Malaysian stock exchange.

Public Bank prioritizes excellent service and convenience. Its extensive branch and ATM networks across Malaysia allow easy account access and transactions for customers. They also operate branches outside of Malaysia.

With its relative stability and finance prudence, Public Bank has delivered strong performance to shareholders. The bank’s size has doubled ever since the early-2010s, and its commitment to responsible lending is reflected in their results.

- 500 billion MYR in total assets in 2025

- More than 400 branches across the region

- Broad range of services including personal and business banking, Islamic banking, investments and insurance.

Hong Leong Bank

Hong Leong Bank is a leading Malaysian bank established in 1905, renowned for customer service excellence and innovation compared to some of the larger banks in Malaysia.

With its regional reach, you’ll find branches of Hong Leong in places as far-flung as Australia. They also operate in Vietnam, China, and five other countries – a rather impressive global presence considering it’s a mid-size bank.

Hong Leong Bank has generally embraced digital banking services that allow easy account management and transactions in each country they operate in. You won’t have any issues accessing your account online.

In essence, Hong Leong Bank delivers solid customer service through its digital capabilities and regional branch network. They deserve a mention among the most reputable banks in Malaysia.

- Malaysia’s 5th largest banking group

- Over 250 billion MYR worth of assets in 2025

- Banking services delivered through multiple channels

Hong Leong Bank has small roots in relatively-provincial Sarawak. After nearly 120 years of operation, they now have branches in places as far-flung as Australia.

AmBank

Established in 1975, AmBank has grown to become a trusted name in the banking industry, offering a wide range of financial products and services to individuals, businesses, and corporations.

AmBank provides various banking solutions such as savings accounts, mortgages and investment options.

With its extensive network of branches and ATMs across Malaysia, customers can conveniently access their banking needs wherever they are.

AmBank is committed to delivering exceptional customer service and innovative banking solutions. Through its digital platforms and mobile banking app, customers can manage their finances on-the-go with features like fund transfers and bill payments.

In line with its commitment to corporate social responsibility (CSR), AmBank actively engages in initiatives that promote education for underprivileged children through its “AmAssurance Education” program.

Overall, AmBank continues to play a vital role in Malaysia’s financial landscape by providing reliable services that cater to the diverse needs of individuals and businesses alike.

- 168 branches and over 600 ATMs

- Market cap of 12 billion MYR in 2025

- Specific branches for Islamic, business and weekend banking.

United Overseas Bank (Malaysia)

Singaporean owned UOB, short for United Overseas Bank, is the biggest foreign bank that does business in Malaysia. With its roots tracing back to 1935, UOB Malaysia provides a wide range of services across the entire Southeast Asian region.

Because of UOB’s international presence, they have an extensive branch network across not only in Malaysia but also outside the country. Customers can conveniently access their accounts at numerous UOB branches across the world.

Indeed, UOB has branches everywhere from Thailand, to Hong Kong, to Japan. It’s certainly one of the best banking options in Malaysia if you’re an expat.

As one of the leading banks in Malaysia, UOB offers various products and services tailored to meet the diverse needs of its customers. These include personal banking services such as savings accounts, loans, credit cards, and wealth management solutions.

For Malaysian companies, UOB provides a vast array of solutions that include corporate lending, trade finance facilities, cash management services, and treasury products.

UOB generally embraces digital banking by offering online and mobile platforms that help customers manage their finances anytime. By using the “UOB TMRW” app, customers can process bill payments, international wires, and more.

Combining global expertise with local insights, UOB caters to the evolving needs of customers located not just in Malaysia but also over a dozen markets worldwide.

- Largest foreign bank in Malaysia with 55 branches

- Strong focus on sustainability

- AAA rated by Malaysia’s credit rating agency

Bank Rakyat Malaysia

Bank Rakyat is one of the largest Islamic cooperative banks in Malaysia. Established in 1954, it has grown to become a trusted financial institution that offers a wide range of banking products and services to individuals, businesses, and corporations.

As a cooperative, Bank Rakyat operates on the principles of mutual assistance among members. It aims to provide accessible and affordable financial solutions to empower its customers and contribute to the development of the Malaysian economy.

Bank Rakyat offers various services that include savings accounts, current accounts, fixed deposits, loans, credit cards, and investment products. It also provides Islamic banking solutions that comply with Shariah principles.

In addition to its core services, Bank Rakyat supports charity work and social responsibility. While this won’t help much if you’re simply looking to open a bank account in Malaysia, it’s perhaps good to know.

Overall, Bank Rakyat Malaysia plays a significant role in the Malaysian financial landscape by providing reliable solutions with an emphasis on Islamic principles.

- Ranked among the top 10 Islamic banks globally

- Over 8 million customers across Malaysia

- Above 100 billion MYR in assets in 2025

OCBC Bank Malaysia

Ranked as Singapore’s second largest financial institution, and also the second biggest foreign bank in Malaysia, OCBC offers a variety of consumer and business services.

OCBC Bank’s local unit was established back in 1932. Since then, it’s grown to become one of the leading foreign banks in Malaysia. It’s part of the OCBC Group, a renowned organization with a global network spanning over 18 countries.

With an extensive branch network across Southeast Asia, customers can easily access their accounts or conduct transactions.

OCBC in Malaysia also offers a convenient digital platform which is generally the same across all countries it does business in. The bank continues to shape not just Malaysia’s financial future, but the entire ASEAN region’s.

You should especially consider opening an account with them if you’re spending time, or are a citizen of nearby countries such as Singapore or Indonesia.

- Established in 1932 with over 400 global branches and offices

- Offers Islamic banking under OCBC Al-Amin Bank Berhad

- Consumer, business and investment banking services

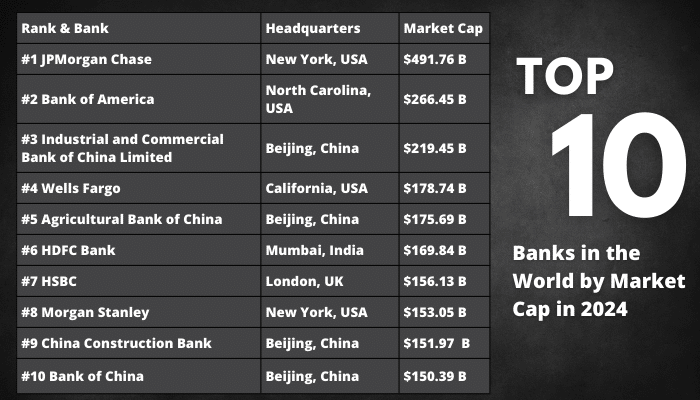

Here’s a list ranking the world’s biggest banks in 2024. You’ll notice that HSBC is firmly planted on the list, and is also the sole European company to make it on there.

HSBC (Malaysia)

With a strong presence in the country for over 140 years, HSBC is one of the leading global banks in Malaysia – and the entire world.

Looking at the full scope of its operations, HSBC Bank serves over forty million customers in 62 different countries. It’s the largest European bank in terms of total assets.

In Malaysia, HSBC places emphasis on digital innovation and constantly invests in new tech. One showcase of these efforts is HSBC’s “Global View” feature. By using this, you’re able to connect accounts in multiple countries for seamless online transfers.

For example, if you open an HSBC account in Malaysia, and additionally have accounts with them in Mexico and the UK, you’re able to link all the accounts together.

This is rather exceptional as far as global banking goes. A vast majority of banks that operate in multiple countries have separate online portals for each unit.

Logging into several different accounts, even though it’s supposedly the same bank, makes it difficult to collect statements. HSBC doesn’t have that problem though.

Due to its sheer size, HSBC provides any type of banking service you could possibly imagine. This includes, but certainly isn’t limited to, wealth management, international mortgages, and relocation services.

- 50 branches in Malaysia including an Islamic banking subsidiary

- First foreign owned bank to be localized in Malaysia

- Globally serves over 39 million customers across 62 countries

Consider This When Banking in Malaysia

One of the most important factors to consider is the stability and trustworthiness of your bank. It is crucial to ensure that the chosen bank has a strong track record and is regulated by reputable authorities.

Another factor to consider is whether the bank has reserve funds or a deposit insurance scheme in place.

This gives an added layer of security for account holders, ensuring that their funds are protected even in the event of a financial crisis.

Easy access to banking services is also very important – especially if you’re a foreign expat. You should assess whether any bank offers convenient online banking options and a large network of ATMs.

Plenty of banks in Malaysia have international branch locations. If possible, pick one with a local subsidiary close to home or where you travel frequently.

In closing, here are a few final tips to remember when opening a bank account in Malaysia:

- If you’re a foreign expat or frequent traveler, choose a bank with international locations.

- Check online and mobile banking capabilities if these are important to you. Leading banks are all investing heavily in digital services.

- Review the product suites like accounts, loans, cards, insurance, investments and wealth management. What bank in Malaysia aligns to your needs?

- Assess fees and charges to maximize affordability. Look for fee waivers if available.

- Consider reputation and financial stability. Established banks with strong ratings may provide more peace of mind.

- Compare Islamic banking options if this is a preference. Most banks in Malaysia offer Islamic products and services.

It’s worth considering all these factors. That way, you can make an informed decision when choosing where to open a bank account in Malaysia.