Last updated April 29th, 2024.

Despite the gloom and doom about Japan’s aging population and China’s property bubble, Asia isn’t defined by only two countries. There are almost 50 jurisdictions on the world’s largest continent – from Turkey, to Japan, and everything in between.

You just need to know which specific countries to invest in Asia… and where to look.

Multinational companies have now turned their attention to Southeast Asia it thanks to the region’s booming economy.

In fact, several Southeast Asian countries haven’t experienced a recession in two decades.

Although the entire region is experiencing an economic boom phase, three economies are particularly impressive: Vietnam, the Philippines, and Cambodia.

Specifically, these places have overcome the odds to consistently rank among the world’s top-performing economies in terms of GDP growth and overall performance.

In this article, we’ll take a closer look at these three booming economies, examining their main benefits and challenges going forward.

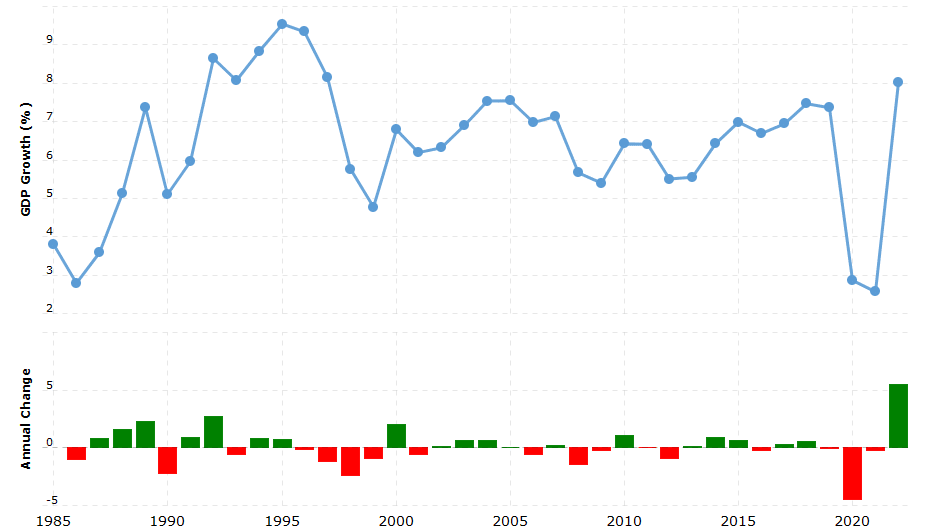

A chart showing Vietnam’s annual GDP growth compared to the world average since 1985. It’s proven almost completely immune to the effects of global economic recession.

Vietnam

Did you know that Vietnam hasn’t experienced an economic recession in over thirty years?

This impressive statistic testifies to the country’s explosive growth over the past few decades. On average, the Vietnamese economy has been growing consistently at a rate of over 6% each year.

One of the main reasons for this is Vietnam’s strong demographic trends. Nearby countries like Thailand are bracing themselves for population declines, yet Vietnam’s population is expected to grow by nearly 20 million by 2040.

This growing population has supported Vietnam’s robust manufacturing sector. Vietnam is quickly becoming one of world’s top exporters, and companies like Nike and Samsung built large manufacturing centers here to take advantage of low labor costs and lax regulations.

Vietnam’s manufacturing sector should expand throughout the coming years. The government continues finding methods to make it easier for both foreign and local companies to thrive.

As a result, Vietnam is becoming a more attractive industrial hub than its neighbor, China. The trade war between the US and China has also increased multinational companies’ interest in Vietnam as a manufacturing hub.

While these two emerging economic giants are shooting themselves in the foot, the little guy (Vietnam in this case, competitively speaking) is coming out on top.

In addition Vietnam’s population growth and strong manufacturing sector, the nation is also home to not just one but two established equity markets. Namely, the Ho Chi Minh Stock Exchange and the Hanoi Stock Exchange – with over 800 companies listed between them.

The future is looking bright for Vietnam in many ways. Unfortunately, the country’s property laws are still holding it back from its full potential.

There are plenty of excellent investment properties in places like Hanoi and Ho Chi Minh, yet Vietnam hasn’t done away with its antiquated property laws, which are a holdover from the communist era.

Because all land plots are technically owned by the state, freehold property ownership isn’t possible for both locals and foreigners. Instead, the government uses a long-term leasing system that allows you to lease property for 70 years at a time.

Despite this potential headache, Vietnamese property laws are slowly liberalizing. You can now buy property with a tourist visa, for instance, whereas you couldn’t only a few years ago.

Hopefully, this trend will continue, and we’ll see the end of Vietnam’s leasing system soon as its real estate market opens up.

Philippines

Despite bad publicity regarding its drug war, the Philippines remains among the top fastest-growing economies in Asia.

In fact, the Philippines hasn’t experienced a year of negative growth since the late 1990s.

Similar to Vietnam, the Philippines has demographics on its side with its population expected to grow by at least 35 million people before 2040. This population growth is expected to keep pushing property values upwards, making it an excellent time to invest in the Philippines.

However, the Philippine population is not only large and continuously growing. It’s also comprised of well-educated, English-speaking people.

A massive, skilled workforce in a low cost country has caught the attention of major tech companies, which have taken interest in the Philippines as an alternative to India.

Google and Microsoft have already made their way to the islands. Likewise, other companies are following suit to invest in this emerging economy.

This multinational migration has fostered the growing Filipino middle class. As always, a rising middle class is an excellent sign of continued, sustainable growth.

With that being said, the Philippines has a few areas for improvement. Its heavy bureaucracy rivals that of Latin America, and foreign investment possibilities are limited.

Buying a condo or stocks in the Philippines isn’t terribly difficult, but foreigners are still unable to own land.

Luckily, these things are fixable, and the Filipino government will hopefully take steps to make it easier for foreigners to invest in the country. However, there is one problem with investing in the Philippines that the government can’t do much to control – natural disasters.

The Philippines is, sadly, one of the most disaster-prone countries in the whole world. Its location makes it prone to typhoons. They can do quite a lot of damage considering that the country is comprised of a series of islands.

It’s also prone to seismic activity thanks to its proximity to fault lines between the Eurasian and Philippine tectonic plates.

Natural disasters such as earthquakes and flooding remain top economic risk factors in the Philippines. That said, personal damage can be mitigated if you have proper insurance.

Response to natural and economic crises in the Philippines will hopefully improve as the nation continues to expand financially.

Cambodia’s urban population is expected to nearly triple within the next two decades. It’s a fact that, by itself, will generate increased demand for real estate and business services.

Cambodia

Cambodia is Southeast Asia’s comeback kid. After the Khmer Rouge decimated the country’s economy and population in a horrific genocide, Cambodia has risen from the ashes to become one of Southeast Asia’s most promising emerging economies.

Like the other countries on this list, Cambodia’s demographics are incredibly promising. Although its population is comparatively small at just 2.5 million, that’s expected to double by 2040.

The country is also urbanizing at a remarkable pace, which bodes well for its future economic prospects.

Cambodia also hasn’t had a single recession in over 25 years. Unlike some of its neighbors, the Asian Financial Crisis and Global Recession had little effect on Cambodia’s consistent growth. It stabilized at an average of about 7% annually for the past 20 years.

Despite how much steam the Cambodian economy is gaining, it remains an undiscovered market compared to neighboring Thailand and even Vietnam.

Meanwhile, property in prime areas of Cambodia’s capital, Phnom Penh, is able to be bought for about $1,000 per square meter.

We consider $1,000 per sqm as a “global floor”. Few capital cities in the world, whether in developed nations or otherwise, are selling below this range.

As such, now is the perfect time to buy Cambodian property. You earn often earn high yields above 6%, but more importantly, there’s great potential for capital appreciation as Cambodia’s cities grow.

Real estate values will rise as a natural consequence of increased demand, propelled by urbanization. Cambodians are moving from rural areas into cities by the millions.

Phnom Penh’s population is roughly 3 million now. Within the next decade, that number will rise to 5 million.

It’s relatively easy to invest in Cambodia’s property market as a foreigner. Furthermore, establishing residency is simple and inexpensive.

The only drawback to Cambodia’s rapidly-developing economy is a large emphasis on development. Infrastructure is still a work-in-progress, especially outside of major cities. Meanwhile, the Cambodian stock exchange is rather small with ten listed firms.

Luckily, over the long-term, Cambodian stock and real estate prices have few places left to go besides upward.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.