Last updated March 13th, 2024.

As Southeast Asia puts its mark on the world, the Laos real estate market is increasingly considered by foreigners as a frontier market investment option.

Indeed, Laos is one of the best economies in ASEAN. At first glance, it may seem like a good idea to invest in the Laos property market.

Strong growth in Laos’ export and service sectors helped the nation sustain positive GDP growth for over three decades straight. Laos has literally skipped every single recession since the 1980s!

The Asian Development Bank predicts even faster GDP growth going forward into 2025 and the remainder of this century.

Meanwhile, foreign investment is surging into Laos. Especially from China, its much bigger neighbor.

China is pouring massive amounts of capital into Asia’s emerging economies through its One Belt One Road initiative, and Laos is among the main beneficiaries of China’s pet project.

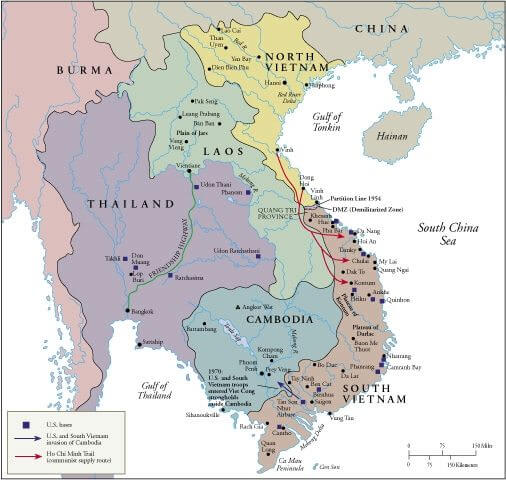

The fact that Laos shares land borders with five other nations, including China, gives them the potential to become a transport hub for the entire Southeast Asia region.

A major example is the recently finished high-speed rail line linking the Lao capital city of Vientiane with Kunming in Southern China. It was financed by Lao PDR’s larger neighbor to the north.

Currently, Laos’ high speed rail links the capital Vientiane with Luang Prabang and will eventually connect Laos to Thailand along with the remainder of Southeast Asia, leading to greater trade and connectivity in the future.

Healthy past economic performance, and possibly even better days predicted ahead, might make you consider investing in Laos.

You probably shouldn’t purchase real estate, stocks, or any other asset here. GDP growth doesn’t tell the whole story, and Laos remains an incredibly difficult place to invest as a foreigner.

Here are a few solid reasons why you shouldn’t invest in Laos – including but not limited to the fact that you can’t even buy a home here.

Foreigners Can’t Buy Property in Laos

Despite a booming economy, it not easy to bring money into Laos and buy property as a foreigner investor.

A country’s strong economic performance doesn’t mean anything if you can’t truly access and profit from real estate or other business opportunities there.

Every plot of land in Laos is technically owned by the state. Foreigners can only lease land for a period of up to 50 years. Strangely enough, you can own houses and other types of real estate in Laos – yet not the land your property is built on.

Do you really want to purchase a home when it’s at the mercy of someone else’s land though?

Similar to other frontier markets, Laos just barely has a stock exchange. You can trade exactly eleven companies on the Lao Securities Exchange.

Most of these are quasi-public corporations including the state-owned oil firm and the electricity provider.

This means starting a business is the sole practical method of investing in Laos as a foreigner. You don’t have many options left in a country that bars foreign ownership and doesn’t have a stock market.

So, what’s the problem with that? Well, doing business in Laos as a foreigner is very difficult too. Forming and maintaining a company is a bureaucratic nightmare.

On top of that, getting a long-term visa to actually live in Laos and manage your business is a complete headache if you’re one of the relatively few foreign investors here.

Quite simply, nearby countries are among the easiest places in the world to invest as a foreigner. Laos is one of the hardest though – certainly if you want to buy property here.

Big Economic Issue: Laos is Landlocked

Geography isn’t something that anyone can change. Yet a nation’s place on the map absolutely defines how easily it can grow.

Having natural resources, access to sea routes, and arable land are all factors that help sustain a country’s positive economic success over a timespan of multiple decades (or even centuries).

Unfortunately, Laos is landlocked, meaning that it’s surrounded by five other nations.

Sharing borders with as many countries as possible is generally positive for exports. However, in the case of Laos, its land connectivity comes at the expense of having no access to the ocean at all.

Life isn’t fair. Certainly not for Laos, which is at an inherent disadvantage simply because of its geographic location on the map.

Being landlocked means Laos will always have a hard time selling their products to the world. After all, they don’t have access to the water and can’t ship by themselves.

Laos will always be dependent on its location. Cooperation from foreign governments and investors based in neighboring countries which border the ocean, like Thailand and Vietnam, is absolutely required to maintain a healthy Lao export sector.

Not only is that inconvenient for Laos, but costly as well. Lao products being exported through Thai ports, for example, are subject to Thai tariffs.

Lao industry is therefore noncompetitive and will face numerous developmental challenges in the future.

Furthermore, Laos itself is difficult to maneuver. Approximately 70% of the country is made up of mountain ranges and highlands while dozens of rivers run throughout its territory.

The nation’s lack navigability costly and inconvenient for both foreign investors and Lao citizens alike.

Taxpayers must their spend money on infrastructure like bridges and tunnels to merely travel across the country. Laos doesn’t have the luxury of building long roads across a flat plain.

As a result, infrastructure in Laos has a higher cost and will likely stay below global standards for a while. That issue is compounded by several other factors in this article (most of them self-imposed) and will deter those wanting to invest in Lao stocks, real estate, or companies.

Laos could potentially turn its location from a negative aspect into a positive one in the future. A rail system could eventually move products between China and Southeast Asia, in addition to people, since Laos is otherwise on a centrally-located piece of land.

Of course, that requires tons of effort, money, time, taxes, and cooperation with Laos’ bordering countries.

Better Options than Laos Real Estate

Nothing stated above means you can’t make a profit by investing in Laos real estate, stocks, or businesses.

Plenty of multinational firms, including ones owned by foreigners, are doing very well here. Smaller firms have found success by investing in Laos as well.

With that said, there are better options right next door to Laos. Vietnam’s stock market is fully functional and doing business is much easier. Meanwhile, Cambodia allows foreign real estate ownership and almost anyone can get a long-term visa.

There’s no reason to burden yourself with paperwork, stress, and bureaucracy in Laos when markets like Cambodia and Vietnam are right next door.

Both those countries are growing at around the same pace as Laos. Yet they have far less of the negative aspects when it comes to buying real estate or other types of investments in Laos as a foreigner.

Asia is the most dynamic continent in the world. If you’re investing in this region in the first place, it’s important to do so correctly and not sell yourself short with the Laos real estate market.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.