Last updated July 5th, 2023.

Startups in Thailand have a lofty goal: to lead innovation in Southeast Asia.

With almost 700 million people and rapid economic growth, Southeast Asia increasingly draws talented entrepreneurs and investors with deep pockets.

Malaysia, Indonesia, Vietnam, the Philippines, and Thailand are all competing to improve their startup ecosystems.

Out of all those countries, Thailand’s startup and venture capital scene is arguably Southeast Asia’s most interesting market.

A main reason is because Thais have great affinity for the entrepreneurial spirit. Simply look at any street in Bangkok and you’ll see tons of vendors with their own businesses.

Startups in Thailand are well-positioned because of the nation’s quality infrastructure, far lower resource and labor costs when compared to China, along with a strategic location in ASEAN’s geographic heart.

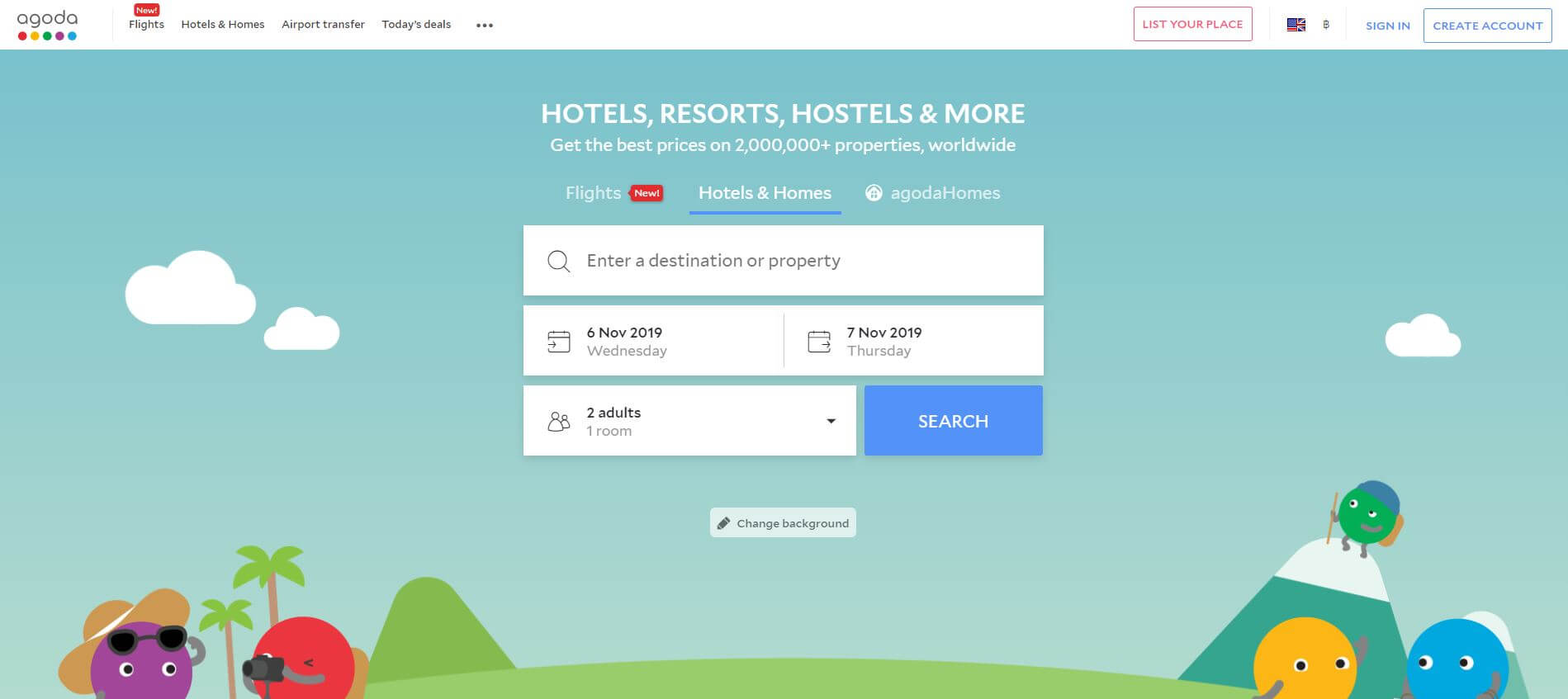

Perhaps the most famous Thai startup, online travel agency Agoda was formed during the late 1990s in Phuket.

Why form a company In Thailand?

Thailand benefits from several huge advantages that will propel its startup environment in the 2020s and beyond.

Compared to neighbors such as Singapore, Thailand offers among the region’s cheapest living costs and office rentals. Bangkok boasts the region’s best cost of living to development ratio as well.

Likewise, the country provides a rich culture, wide assortment of cuisine, and vibrant nightlife. This not only draws more talent into the kingdom, but often makes expats who already live in Thailand want to stay longer.

Plentiful English-language signage and a global atmosphere makes it easier for expats to live in Thailand permanently. Meanwhile, tourist infrastructure is geared toward helping foreigners stay here temporarily.

Furthermore, Thailand enjoys a strategic location in the Asia-Pacific region’s heart. In fact, they share a greater number of land borders than any other ASEAN country except Laos.

With six different international airports, Thailand is certainly an emerging flight hub. Bangkok’s Suvarnabhumi airport is among the few in ASEAN with direct flights to every capital city in Asia and most countries in Western Europe.

Last, and perhaps most importantly, Thailand has one of the highest rates of internet and social media users on the planet.

Thailand’s mobile penetration rate is a staggering 150% – that’s a phone and a half for every single Thai person – despite its status as an upper-middle income economy.

Quick List Of Successful Thai Startups

Many startup success stories originate in Phuket, Chiang Mai, and Bangkok. These range from local startups to firms that large, foreign multinationals later acquired.

Thailand is home to some of the most prominent acquired tech companies in the region. Just a few Thai startups on the list include:

- The online hotel booking website Agoda. Founded in 1997, Priceline.com later acquired them with the intention of strengthening their foothold in Southeast Asia.

- The daily coupon site Ensogo. Created back in 2010, LivingSocial from the United States acquired the company one year later to expand their global presence.

Beyond nurturing companies which were later bought, Thailand also has numerous successful local startups that successfully rose capital from VCs and overseas investors.

A few honorable mentions include:

- Thailand’s very own restaurant review website Wongnai was founded in back 2010 and went through two rounds of fundraising. Both of these rounds were from Japan’s Recruit Strategic Partners, estimated at over US$1.5 million in total.

- The digital publication platform Ookbee. Founded in 2011, its current funding stands above US$10 million.

- E-commerce solutions provider aCommerce. Founded back in 2013, its current funding exceeded at US$20 million from multiple VCs.

Unicorns in Thailand

The first three unicorns in Thailand, defined as a startup with at valuation at US$1 billion or above, each received their status in 2021. Thailand’s unicorn startups are:

- Flash Group, a logistics company founded in 2018. It was valued at over US$1 billion after a round of series D and E+ funding led by SCBX worth US$150 million.

- Ascend Money, the fintech arm of local conglomerate CP Group. The company’s TRUE Money service facilitates US$14 billion worth of payments annually and was valued as Thailand’s second unicorn following an investment led by Alibaba’s Ant Group.

- BitKub, Thailand’s largest cryptocurrency exchange platform. A planned acquisition of 51% of the company by SCB Bank would have turned BitKub into the nation’s third unicorn, but SCB backed out of the arrangement.

Foreign-Owned Startups in Thailand? It’s Possible

But Thailand’s local startups aren’t the only success stories. The country has many prominent foreign-owned startups that are performing strongly.

A few big names include ride-sharing app Grab, restaurant delivery service Foodpanda, and online shopping websites Lazada and Shopee.

Global tech majors Facebook, Google, and Apple each have a regional office located in Bangkok too.

With all that said, creating these tech startups in Thailand wouldn’t have been possible without support from the venture capital companies willing to finance such ambitious projects.

Regarding VC fundraising, Thailand proudly has two local crowdfunding platforms which are popular among individual investors. Plenty of different Thai-based VC firms alongside six foreign ones actively invest in the country as well.

Thailand claims over a dozen different startup incubators and accelerators in total. A few of the nation’s biggest private equity groups are owned by telecom giants DTAC, TRUE, and AIS.

Most of the remaining VC funds in Thailand are owned by its largest banks, including SCBX and Bangkok Bank’s Bualuang Ventures.

With the emergence of countless networking events, incubators, and venture capital firms, the Thai startup ecosystem is maturing at a rate you shouldn’t ignore.

If you’re thinking about investing in Asian startups, you might also consider Vietnam or the Philippines which rank among the region’s top performing startup markets.

Like Thailand, both those economies have wonderful opportunities if you’re a hands-on venture capitalist looking to invest in Asian startups.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.