Last updated January 12th, 2023.

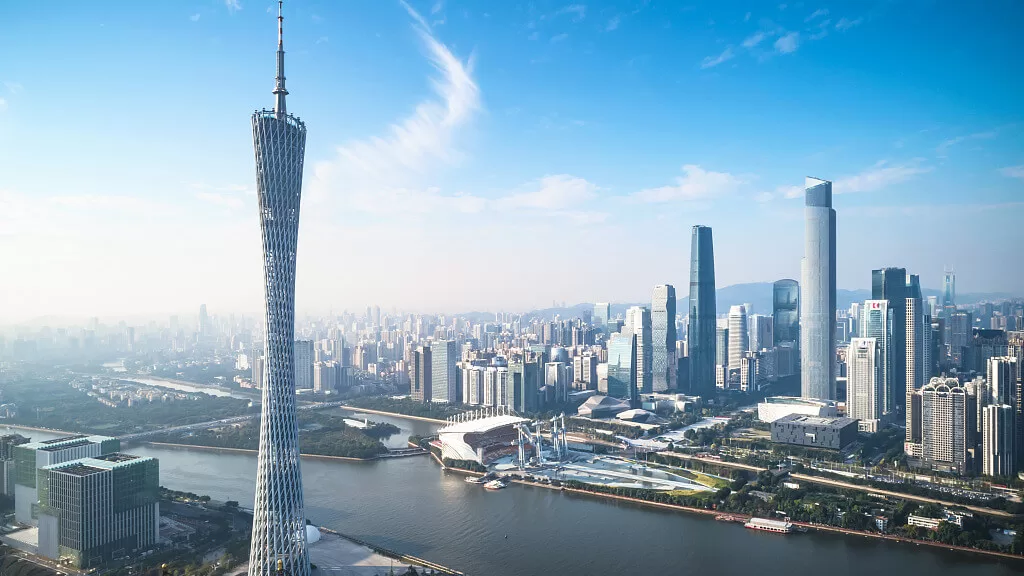

China is the largest country in Asia by far, both in terms of its population size and global economic impact.

Because of this, you would probably guess a website called “InvestAsian” recommends that our readers invest in China. We don’t though.

Most of the easy investment opportunities in China have since come and gone. That’s despite staggering GDP growth exceeding 500% over the past four decades.

Don’t get us wrong – that doesn’t mean you can’t make money in China. Lots of foreigners are still investing here with great success.

Yet increased difficulties for international businesses, a relative lack of competitiveness, and demographic reality will make it a lot harder.

A looming trade war between China and the United States certainly doesn’t help the situation either.

Multinational firms are already starting to leave China. They see the writing on the wall, along with far superior options elsewhere in Asia.

Would you like to see the same clues? Here are several reasons not to invest in China.

China’s Demographic Problems

China will age quickly in the coming decades – and their infamous one-child policy is to blame.

Rapid population growth began straining the Chinese economy’s momentum near the end of the 20th century. Thus, the government put forth a policy that allowed couples to only have a single child because of such an overwhelming birthrate.

The one-child policy officially ended back in 2016. However, it still has ugly consequences will reveal themselves soon.

China’s past decisions will return to haunt its economy approximately ten years.

Every two people in a society must, on average, birth two children to reach a population’s rate of replacement. But those who gave birth under the one child policy are beginning to grow old and die.

A one-child policy which lasted nearly four decades means that China has an entire generation of parents who outnumber their children 2 to 1.

The result will inevitably be an older population, inefficient workforce, and greater need for a welfare state. All those things are horrible for economic growth prospects.

Japan has similar problems that resulted in over two decades of stagnation. But the difference is that China won’t become a developed market until it tackles these issues. It’ll be the first example in modern history of a country growing old before it can grow wealthy.

While the precise ramifications of an “old and poor” China are still unknown, it definitely won’t be a good thing.

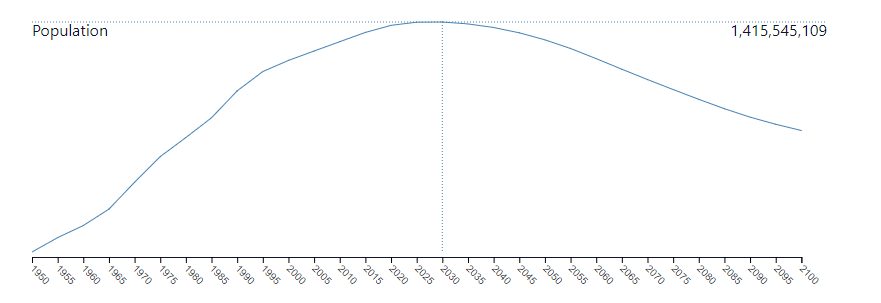

Furthermore, and as a direct result of an older society, China’s population will start to shrink around the year 2030. It will lead the nation to weaker growth and declining influence for the foreseeable future.

It will take time for all this to impact the Chinese economy. With that said, longer-term investors should take China’s future issues into strong consideration.

Here’s a chart of China’s projected population growth throughout the 21st century. It’s expected to peak at about 1.45 billion by 2030.

Rising Labor Costs in China

“Made in China” is often synonymous with cheaper products. However, the truth is that China’s labor and manufacturing costs aren’t the bargains they once were.

A recent report by Oxford Economics found that labor costs in China are just 4% less expensive than in the United States. That’s unadjusted for other factors such as cost of shipping, upkeep, and taxes.

China has grown largely because of its manufacturing industry. But manufacturing can only take an economy so far.

A country must educate its workforce, diversify into the services sector, and create more value in order to grow past the middle income trap.

So far, China has completely failed to accomplish this and international businesses are leaving for this exact reason. They’re headed towards competitors such as Vietnam where labor costs are cheaper, taxes are lower, and running a business is much more straightforward.

This doesn’t simply speak to the cost of doing business in China. It also shows the lack of faith investors now have in the country compared to its frontier market neighbors.

We all see smart money fleeing and interpret that as a stark warning about China’s future.

Investing in China is Difficult

Doing business, living, and investing in China isn’t a simple endeavor at all. The government just makes things too hard if you’re a foreigner.

For example: long-term visas are a total pain to get. You’ll need to form a company and make an investment of either US$500,000 in China’s underdeveloped west, over US$1,000,000 in a central province, or US$2,000,000 in any other region to get a Chinese investment visa.

In addition, you’ll have to get a medical certificate, criminal record check, proof of personal tax payment, and tons of corporate documents such as an annual inspection and asset valuation report.

Foreigners (and locals as well) can’t own freehold property in China. Every plot of land belongs purely to the state and can only be obtained on a 70-year leasehold at maximum. As such, real estate investors should look elsewhere if they want freehold ownership,

Stock investors also face severe restrictions. Foreigners can only buy “A-Shares” via Hong Kong. You’ll need to open a Hong Kong brokerage account to do so directly and with minimal trading fees.

Either that, or you can buy stocks in China which are listed on US exchanges as American Depository Receipts (ADRs). You won’t find many undiscovered opportunities on the New York Stock Exchange though.

With all of the bureaucracy and pure nonsense mentioned above, why should you ever buy stocks or real estate in China?

You Have Greater Opportunity Elsewhere

Perhaps the most important reason you shouldn’t invest in China is because there’s a plethora of better options nearby. Why make things needlessly difficult for yourself?

Cambodia and the Philippines are both growing way faster, for example. They will provide you a long-term visa with little hassle too. Neither of them have demographic problems (in fact, to the contrary) while foreigners can own property in both countries as well.

Quite frankly, there’s an opportunity cost involved if you’re buying Chinese stocks or property. You would be doing so at the expense of not investing in places with higher growth potential, less bureaucracy, and better opportunities.

Asia is the most diverse region on the entire planet. Don’t follow everyone else and go where they are since the best places to invest are rarely the most talked-about.

To summarize: demographic factors, geopolitical issues, rising production costs, and plenty of nearby alternatives in Southeast Asia are all convincing reasons to not invest in China.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.