Compared to elsewhere in Asia, anyone buying real estate in South Korea saw superior performance over the past few decades.

South Korea is located in a triangle between the Yellow Sea, East China Sea, and the Sea of Japan. Due to its geographic position between Japan and China, Korea was often caught in the unenviable crossfires of the two countries’ power struggles.

The late-twentieth century was no different, yet contrary to all expectations, it was during this time when property values in South Korea started rising significantly and the country became a power unto itself.

South Korea escaped the middle-income trap around the time of the new millennium to join Singapore and Japan as one of the Asia-Pacific region’s most developed nations.

Back in the 1990s it would have been difficult to name one single Korean brand. Today, you’re probably less than 10 meters away from a South Korean product.

In addition, there’s a growing film industry that is hitting the mainstream, and you’ve possibly seen several Korean productions, like Parasite, Squid Game, or Train to Busan.

Not many investments have performed better than real estate in South Korea over the past few decades. In this guide, we’ll cover property investment, the practical aspects of buying a house in Korea, along with several different cities including Seoul.

Can Foreigners Buy Property in South Korea?

Property ownership, and specifically the regulations surrounding it, is one of those topics which tends to be a telltale sign of the underlying legal and philosophical doctrines at work within a country.

To paint a picture in very broad strokes, property rights in Asia tend to be limited. When you buy a property, you might be buying the structure and leasing the land underneath for several decades. Or you might not own anything at all with merely a long-term lease.

In some countries, like the Philippines and Thailand, you are allowed foreign ownership of condo units but you cannot own the land underneath.

Each country has its own particular legal framework and there are bound to be local complications regarding property ownership.

This applies doubly when you’re buying real estate as a foreigner. Oftentimes, expats are barred from owning property outright.

But if you’re buying real estate in South Korea, you won’t face any restrictions as a non-local property buyer. South Korea is one of the rare places in Asia where foreigners can own land under their own name.

A few other countries in the region where you can directly buy land include Malaysia and Japan. By and large though, Asia isn’t an easy continent to own freehold land as a foreign citizen.

This, by itself, is already a fantastic boon, when compared to most Asian countries. The longstanding respect for housing rights and a clear legal framework should perk up any international investor’s ears.

How Much Are South Korean Property Taxes?

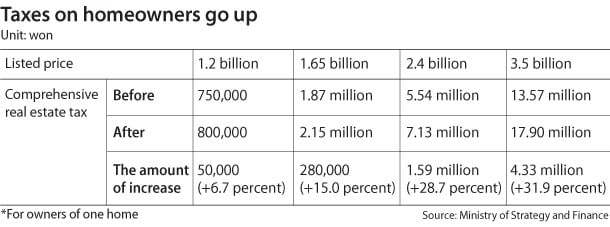

You might be relieved to hear that property tax in South Korea is minimal compared to the standards in many other developed nations.

Nevertheless, they aren’t the lowest rates in the region – this honor goes to Thailand and Cambodia, where real estate taxes are even.

However, despite a recent increase, South Korea’s property tax rates remain the lowest in developed Asia.

House owners in Korea fall into one of four different tax brackets that correspond to the government appraised value of their property. Taxpayers must pay a fixed rate annually depending on their home’s value.

Top Cities to Buy Real Estate in South Korea

Despite being noticeably smaller than the neighboring countries of Japan and China, South Korea is a remarkably varied country.

You’ll find beaches, mountains, forests and large metropolitan areas with thousands of years of history. Of course, this variety is matched by all the different houses for sale in Korea.

Seoul, the capital city, is the fifth-largest urban area on Earth with a population of over 25 million people. You’ll find so many distinct areas that we could easily write an entire guide just about buying property in Seoul.

However, the biggest and most obvious place to consider when buying a house in Korea shouldn’t detract from looking at other cities. Seoul isn’t your only option by any means.

Depending on what you’re after, second-tier cities might even be better places to start investing in Korea when compared to the capital.

In addition to Seoul, there is also Busan, Daejeon, and Daegu, which are fast-growing cities in their own right. Each of these cities have several million inhabitants, giving you plenty of options in general if you’re investing in Korea.

Besides that, there is Jeju Island, which is Korea’s version of Hawaii or Phuket. It is not only beautiful but there are also special incentives to invest here, which we’ll discuss in more depth in the coming sections.

Seoul

Population: 10,000,000

Total GDP: $408 Billion

GDP per Capita: $41,944

Price per Square Meter to Buy Apartment in City Centre: $19,000

Seoul – located in the Northern part of the country and divided in two by the Han River – is the capital city of South Korea. Its urban footprint is among the largest in the world and is also one of East Asia’s most important financial and cultural centers.

The city offers an interesting mixture of old alongside the cutting-edge in technology, city planning and culture. Ancient Buddhist temples can be found close to nightlife districts – it is a city that relishes the incongruity between what Korea was and what it aspires to be.

Seoul is divided into 25 districts, each of which is comparable in size to cities. And it lends itself to this notion, as each district has its own feel.

But broadly speaking, one can say that Gangbuk, the Northern area of the city is the historical portion; while the South, which is known as Gangnam, is the more modern and wealthier portion.

Incheon

Population: 2,900,000

GDP: $92 Billion

GDP per Capita: $31,286

Price per Square Meter in City Centre: $10,000

Incheon is a city on the coast and immediately to the West of Seoul. Both of their urban sprawls extend so much that they’re only separated by a few dozen miles from each other.

Incheon is a transportation hub by air and sea, given that it has a massive harbor and the Seoul metro area’s main international airport.

The city houses various noteworthy engineering projects. One such project is the 151 Incheon Tower, two 151m tall twin towers connected by three bridges and a common area at the bottom.

The Songdo International Business district, a new master-planned city, is under construction on reclaimed land off Incheon’s eastern part. It’s slated for completion in the coming years.

Songdo stands as a testament to the economic ambitions of Incheon, given that the 6km squared area will host dozens of massive skyscrapers and complexes, each planned with unique characteristics.

Busan

Population: 3,400,000

Total GDP: $92 Billion

GDP per Capita: $27,211

Price per Square Meter in City Centre: $4,500

Located on the Southeastern point of the Korean peninsula, Busan is the second most populous city in the country.

Busan’s primary attractions are its beaches and seafood market, and it’s an increasingly popular location to buy real estate in South Korea as a foreigner.

When compared to Seoul, there’s a more relaxed lifestyle in Busan. It possesses a global as travelers from around the world disembark in the ports, which are the biggest in the country.

Despite Busan’s location at the farthest point from the capital, it’s well connected by rail via the KTX transport network, and the city serves as a local hub for the rail system.

Daegu

Population: 2,400,000

Total GDP: $57 Billion

GDP per Capita: $23,010

Price per Square Meter in City Centre: $5,500

Located in the middle of a valley in the Eastern portion of the nation, Daegu is the fourth largest city in South Korea.

The city takes advantage of its flat terrain, and its subway draws an X shape across it, along with a horizontal line intersecting the North and the South, thus it ensures easy transport across the urban area.

The city is home to 3 US bases – Camp Henry, Camp George (which houses the Daegu American School), and Camp Walker. Hence, the city is home to hundreds of US citizens.

That said, Daegu is primarily a homogeneous Korean town that lacks the international flair of Seoul, or even Busan. Part of this tradition lends itself to the stereotype that other Koreans have about Daeguan people, who are viewed as conservative, modest, and hard-working.

It’s worth highlighting that this city, in terms of regional baseline difference, is the lowest one under our consideration, as it has a -27.75% difference from the national GDP per capita average.

Consequently, one might benefit from giving the economy a look. Primarily, Daegu is a manufacturing city, wherein major participating industries are textiles, metals and machinery.

Major companies, like Daegu Bank, Korea Delphi and Hwasung corp are situated here as well, with its employees bringing much of the local real estate market’s demand.

It used to be the third most productive city in Korea. In 2006, it accounted for as much as 94% of Korea’s trade surplus.

That said, Daegu’s textile industry which is the sector driving the economy, has recently declined and thus the overall economic growth of the city has also fallen.

Buying property in Korea’s smaller, more industrial cities like Daegu also means you’re essentially investing in the local manufacturing industry.

Daejeon

Population: 1,500,000

Total GDP: $41 Billion

GDP per Capita: $27,233

Price per Square Meter in City Centre: $3,000

Daejeon lies at the center of the Western, more developed portion of Korea and acts as a major rail transport hub for the entire country.

Because of this, you can easily travel from your home in Daejeon to Seoul by rail in under an hour.

It’s the nation’s fifth-largest city in terms of population, but while Daejeon is significant from an economic standpoint, it’s still among the less appreciated places to buy property in Korea.

Informally, Daejeon is known as the Silicon Valley of Korea, as it boasts over 200 research institutions and dozens of universities. Many well-known South Korean startups spun off in this city.

The brightest minds in Korea are often to be found here before they’re whisked away to work in the capital. Generally speaking, Daejeon’s real estate market is driven by demand from researchers and tech employees.

Jeju Island

Population: 700,000

Total GDP: $19 Billion

GDP per Capita: $27,799

Price per Square Meter in City Centre: $7,500

Located off the southern shore of the Korean peninsula, Jeju Island is a famed beach resort for Chinese, Japanese, and Korean tourists alike, and there are visitors all year round.

Part of the reason for this is because Jeju island is a special economic zone with various incentives for people to spend their money and find homes for sale here.

For starters, Korea offers visa-free travel to Jeju island specifically. Meaning that wealthy Indian and Chinese visitors, who aren’t otherwise allowed to enter Korea without a visa, are welcomed with open arms there.

In addition, there are long-term real estate investor visa programs that allow you to buy property worth at least one billion won (about $700,000) to qualify for a visa, which can be converted into a long term residency after five years.

In either case, it is a beautiful island with beaches, hiking trails, and great food, all in the backdrop of the native Jeju culture.

Korean Investment Visa, Residency, and Citizenship

There are various ways in which you can get a residence permit when buying property in South Korea. Here are a few of the available options:

- F-2 Visa – qualifying for this visa depends on the result of a questionnaire, wherein each question is weighted with a particular value. If the end result is superior to 80 points, you qualify for the program. However, many of the requirements rely on having ties to Korea, so you’re unlikely to meet them if you are coming as a fresh expat.

- Immigrant Investor – This is a fairly straightforward residence permit. You need a liquid net worth of 300 million won (~$220,000) in order to qualify.

- Jeju Island Real Estate Investor – To qualify, you need to buy real estate worth 1 billion won (about $720,000). The visa can be converted into permanent residence in Korea after five years.

Each of these options has particular advantages and drawbacks and deserve their own more specific attention. But there are plenty of available options, the one major requirement being that you need to have a considerably higher than average net worth.

In exchange, South Korea is one of few countries in Asia which let you become a citizen. It’s possible to get residence through buying real estate, and in turn, you can eventually get a passport if you’re a long-term resident.

It’s also worth mentioning that, similar to the normal state of affairs in Asia, South Korea doesn’t allow dual nationality though. So you must give up any other citizenships if you ever become a South Korean citizen.

Is Buying Property in Korea a Good Idea?

It’s ne negative part about real estate in South Korea is that the nation’s demographic trends are in a similar place to other countries in East Asia.

Neighboring Japan now suffers a rapid population decline along with an ageing workforce. Meanwhile, China’s population will begin shrinking by around the year 2030 and will almost surely have a similar fate.

Japan had its day in the 80s when commenters were arguing that it was bound to take over the world. Then, it settled down to a more reasonable level as its demographics passed their zenith.

China is currently undergoing such a transformation. Most mainstream commenters foresee its total dominance over the next century, but eventually, it will not be able to escape its demographics.

That said, the Korean real estate market will continue growing during the 21st century.

Over the very long-term, South Korea’s current population of 51 million could feasibly even exceed Japan’s, provided that several factors align.

In real estate investment circles, there’s a truism which is usually attributed to Mark Twain “Buy land, they’re not making it anymore.”

It stands to reason that, because homes in Seoul remain a scarce asset, prices will only appreciate over the long-term. The thing that’s usually taken for granted in this scenario is that demand will increase as well.

Yet unfortunately, South Korea’s population is facing an imminent decline in this regard.

Population decline in Korea will almost certainly affect long-term real estate demand. That said, houses in Seoul and other large cities won’t see these effects from several decades.

South Korea, compared to other developed countries in East Asia, is easier to live in as a long-term expat. Government-sponsored real estate investment visas are available, which give you permanent residence in Korea by owning property here.

Compared to other industrialized first-world nations, South Korea’s housing market flies under the radar.

Quite frankly, Korea’s achievements and influence, despite being vast, are understated and might require some deliberation before they’re recalled.

This is a state of affairs that suits the nation well, given that it has historically been coveted by major powers.

Hence, in this way, South Korea benefits from the best of both worlds: first-class living standards, while avoiding the power jockeying often required to maintain such privileges.

Yet, unlike some of its peers at the top of the league tables, South Korea is not a weary country. Other first world countries have a sense of world-weariness, especially in terms of their real estate market. They’ve seen the boom and bust cycles.

Buying property in South Korea is the polar opposite. The nation’s demographics are slightly better than its neighbors, and some of the world’s largest tech companies do business here.

If you’re considering how to invest in Korea, the most egregious mistake is oftentimes going where everyone else is. On the other hand, there’s risk in blindly wandering into the great unknown.

That’s why real estate in South Korea has a great deal of investment potential left. While not exactly unknown, the country’s vast economic power is still understated.

FAQs

Can Foreigners Buy Property in South Korea?

Yes, South Korea is one of a few of countries in Asia where foreigners can own all types of property on a freehold basis. This means you can own apartments, houses, and even land as a foreigner in Korea.

How Much Does Real Estate in Korea Cost?

The price you'll pay to buy property in South Korea varies widely based on location and many other factors.

You'll easily pay $20,000 per square meter for a luxury house in Seoul, for example, while Korea's second tier cities have plenty of real estate avaialble for below $10,000 per square meter.

South Korea on average though, and especially Seoul, is one of the most expensive places to buy real estate in Asia.

Is the Jeju Island Investor Visa Program Still Active?

Yes, the Jeju Island visa program was extended for another three years until 2026. The minimum purcahse requirement was doubled though.

It's possible to get a Korean residence visa through buying a home on Jeju Island at least 1 billion won.

Can Foreigners Buy Land in South Korea?

Yes, foreigners can generally purchase any type of real estate on the same terms as local citizens. This means you can buy land in Korea as a foreigner, along with houses and other kinds of property that sit on land.