Last updated February 13th, 2025.

As the world’s third largest economy, Japan is one of Asia’s main growth engines. Buying real estate in Japan means investing in one of the most developed and heavily urbanized nations on the planet.

Property in Japan isn’t in the brightest place though. The nation’s GDP growth has stayed in below 3% for practically all of the past three decades.

Furthermore, its rapidly declining population will put pressure on Japan’s existing debt woes.

Public debt in Japan now exceeds 200% of its GDP. Americans complain about “30 trillion dollars”, but proportionately speaking, Japan’s debt issues are much worse. This certainly impacts sentiment for real estate in Tokyo and elsewhere.

Yet despite its longstanding debt problems, depopulation, and a generally stagnant economy, Japan’s property market is reinventing itself like it always has.

Though it became a mainstream discussion topic in the Western world fairly recently, automation has been extremely common in Japan since the 1980s. Vending machines are on every street corner, and remotely ordering food at restaurants is standard.

Japanese factories are also pioneers in robotics and automation, needless to say. Labor efficiency is higher here than in any other country on earth.

Meanwhile, foreigners are visiting and purchasing property in Japan more than ever. The nation was once infamously hard to live in as an expat. But they’ve since taken steps toward opening up to foreign residents as its long-term demographic problems intensify.

Japan is now Asia’s second most popular country to buy property as a foreigner, ranking after Thailand.

In particular, wealthy Chinese buyers are now prominent investors in Tokyo and Osaka’s real estate markets.

You can partially thank a tourism boom for rising demand. Of course, people are more likely to buy property overseas after visiting as a tourist.

Japan has also enacted simpler visa laws in recent years, which does help the country adapt to the 21st century.

Rest assured, however, Japan will continue its role as one of the world’s top cultural and economic centers in the foreseeable future.

Property in Japan remains a relatively stable and safe investment… if done correctly. Just don’t expect rental yields above 5% as you would in Cambodia or the Philippines.

Can Foreigners Own Property in Japan?

Japan allows foreigners to buy not only freehold property but also land. You’ll have the same rights as Japanese citizens when it comes to owning any real estate – whether it’s a house in Tokyo or an apartment in Osaka.

This is a rare attribute in Asian markets. Most countries in the region only let foreigners buy freehold condos outright; others will let foreigners buy houses, but not the land they sit on. Which essentially means you won’t own the real estate you purchased at all.

China and Vietnam, for example, don’t allow anything more than a long-term lease on all kinds of properties.

Because of this, Japan is one of the best countries in Asia to buy real estate as a foreigner – at least from a legal point of view.

There’s practically zero distinction between foreigners and Japanese citizens regarding owning any property.

Japan’s government or land title security is the least of your concerns. If you need to be careful about anything, it’s the real estate agents in Japan – and we’ll tell you precisely why further below!

How Much is Tax on Property in Japan?

Real estate tax in Japan is moderate when looked at within a global context. However, keep in mind that some countries in Asia don’t have property taxes at all.

Consider looking at Thailand, Cambodia, or even Malaysia instead of Japan if low property taxes are a main concern.

Putting that topic aside, real estate owners in Japan must pay annual taxes based on the value of their assets. A flat rate of 1.7% annually, which comes from the 1.4% property tax, along with a 0.3% “city planning tax,” is expected.

1.7% is a relatively substantial burden to carry. It’s worth considering before you buy property in Japan, especially if you’re not living here full-time.

Annual taxes are payable on a property’s government-appraised value. A few deductions might also be available, yet they tend to be minor.

Keep in mind also: while the mid-1% range is a good baseline to expect, taxes are levied on a local basis. Your property’s specific tax rate will depend on its location and the type of real estate (land, apartment, condo, etc.).

Additionally, if you’re renting out your property in Japan, rental income tax will also apply. The amount of rental tax you’ll pay depends on whether you reside in Japan or not.

Calculations for rental income are simple if you aren’t living in Japan. Non-residents, whether foreign nationals or Japanese citizens are taxed a flat 15% rate on their rental income.

Japanese residents pay far less. If you’re living here, rental income tax is based on a ladder system. Either way, rates are significantly lower – only 3.4% at minimum and 5.88% at the highest bracket.

Best Cities to Buy Real Estate in Japan

Japan is a large country with over 120 million inhabitants. As such, there are hundreds of different locations you can buy real estate in Japan.

These range from megacities like Tokyo and Osaka to mid-size cities of a few hundred thousand people, to rural villages facing rapid population decline.

For this guide, we’ll be covering Japan’s four largest metropolitan areas: Tokyo, Osaka, Nagoya, and Sapporo. Smaller cities, including Fukuoka or Nara, will not be covered at all – and definitely not rural Japan either.

Keep in mind that Japan’s weak demographics will inevitably put pressure on real estate demand. And while it will take many decades for the nation’s falling population to impact global business centers such as Tokyo and Osaka, the smaller cities are already feeling the negative impact.

Because of all this, we can’t suggest buying property outside of Japan’s major cities in good faith. You would almost surely suffer from low occupancy rates and stagnant prices due to the nation’s rapid and inevitable population decline.

Real estate located in each of the below cities should see some amount of appreciation. Yet we can’t make recommendations in any of Japan’s smaller towns and cities.

Tokyo

With over 30 million people, Tokyo is the world’s largest metropolitan area by far. It would, therefore, make sense that Tokyo has a greater number of housing options than anywhere else on the planet.

Covering every Tokyo neighborhood in a single article wouldn’t be possible. Our guide is about buying property in Japan, not just the capital city of Tokyo.

If we wrote everything we could about housing in Tokyo and all of its neighborhoods, there wouldn’t be any time or space left to cover Japan’s other real estate markets!

You’ll find an overview of the Tokyo real estate market divided into four sections below.

Shibuya, Minato, and Chiyoda are historically considered the city’s central wards. These districts together comprise central Tokyo, which is the first section in our guide.

Likewise, Tokyo’s general east, west, and southwards get a section. West Tokyo consists of Nakano and its surrounding areas, while the eastern wards include Chuo and beyond. The neighborhoods south of Chiyoda and Shibuya are defined as Tokyo’s southern wards.

Yokohama is also included here, despite technically being its own city and not part of Tokyo proper.

After all, Yokohama is mostly swallowed up by its larger neighbor’s dense urban sprawl. Yokohama is indeed closer to Tokyo’s CBD than Narita Airport is.

Here’s a map of Tokyo and its special wards. It’s worth noting that Tokyo’s metropolitan area is noticeably larger than Tokyo proper. 9 million people live in the city of Tokyo, whereas roughly 32 million live in Tokyo’s urbanized metro area.

Shibuya / Minato / Chiyoda (Center Wards)

Property values in Tokyo’s three central wards remain far higher than anywhere else in the country. And the market dynamics here are entirely different than in the rest of the city.

Here’s the good news about owning real estate right in the center of Tokyo: whether it’s land, an apartment, or otherwise, you won’t suffer from any lack of housing demand.

Japan’s population decline is a non-issue for homes in prime, sought-after neighborhoods with limited supply. Places like Shibuya and Chiyoda, the latter which includes Roppongi Hills (the “Beverly Hills” of Tokyo) won’t ever have a shortage of tenants.

The bad news? Rental yields for luxury property in central Tokyo are low, and you’ll pay well above US$10,000 per square meter.

We would argue that buying property in Tokyo’s central business district, while maybe an excellent “trophy asset”, is absolutely not an optimal investment.

You might consider looking at real estate in Tokyo’s outer wards, which are often merely a ten-minute commute to the city center.

Nakano / Suginami / Western Wards

Tokyo’s western wards are a great place to purchase real estate if you’re seeking a combo of reasonable prices and a central location.

Nakano, for example, is a prime area by any definition. It’s only around 10 minutes to Shinjuku via subway. Nonetheless, property values in Nakano are about half the price of what you’ll pay in Tokyo’s inner wards.

Values are even cheaper in neighborhoods beyond Tokyo’s central core, including Kokubunji, Musashino, and Akishima.

Those areas are essentially commuter towns for inner Tokyo, allowing Japanese workforces to trade convenience for affordability. Expect to pay about US$5,000 for property here.

Nonetheless, you’re running a long-term risk buying property further outside of central Tokyo from an investor’s perspective. If and when population decline hits Japan’s larger cities, occupancy rates in their “bedroom communities” will suffer first.

Chuo / Taito / Eastern Wards

Technically, Chuo and Taito aren’t included among Tokyo’s three central wards. Yet you could easily argue that these two districts are equally as convenient when compared to anywhere in Shinjuku or Shibuya.

Chuo and Taito are especially great areas if you are making frequent trips to and from Tokyo-Narita Airport. The Keisei Skyliner, your quickest method of transport between central Tokyo and its main airport, departs from Ueno Station.

Getting out of Japan is easier from Ueno Station, located in Taito Ward, than anywhere else near the city center. And that includes competing transit hubs like Tokyo Station.

Edogawa Ward, albeit slightly further away, is becoming popular among expats, too. It’s about a 20-minute commute to central Tokyo. Property values in Edogawa remain much lower compared to Tokyo’s CBD though.

You can purchase an entire house in Tokyo’s Edogawa Ward for less than a small apartment in Shinjuku. Real estate in the suburbs is noticeably cheaper and more readily-available than in downtown Tokyo.

Shinagawa / Ota / Southern Wards

The south wards are yet another part of the Tokyo metro with an attractive mix of accessibility and affordability.

Much like eastern and western Tokyo, you can buy real estate here for around half the price you would pay in a central ward such as Shibuya or Chiyoda.

It’s also worth noting that Tokyo’s southern wards are the most convenient places to live if you’re frequently traveling and out of Japan. That’s because you’re only a quick drive or metro ride away from Tokyo-Haneda Airport.

Haneda Airport, the metro area’s second-largest, is noticeably closer to the city center than Narita.

Haneda is widely considered by locals as Tokyo’s most convenient airport for traveling out of the country.

If you’re buying real estate in Japan as a foreigner, consider south Tokyo’s accessibility to Haneda Airport, along with its comparatively lower property values.

Yokohama

While Yokohama was assimilated into the “greater Tokyo urban area” decades ago, it is its own city. It’s Japan’s “true” second-largest metro area rather than Osaka, in fact.

Real estate prices in Yokohama are considerably less than in Tokyo proper. In Yokohama, land values hover around ¥250,000 (~$1,600) per square meter on average. That’s compared to above ¥500,000 (~$3,200) in many Tokyo suburbs.

Let’s face it: Yokohama won’t ever become as expensive or desirable compared to Tokyo. Likewise, ongoing population decline will affect the cost of real estate in Japan’s suburbs, villages, and second-tier cities before it impacts central Tokyo or Osaka.

Regardless, you can still make money from Yokohama’s property market. There’s rather strong appreciation potential here.

Yokohama is especially seeing an influx of Chinese investment right now. Nearby Tokyo itself doesn’t even have a Chinatown, and real estate prices there are double!

By comparison, Yokohama is cheap and easier to make friends as a Chinese expat.

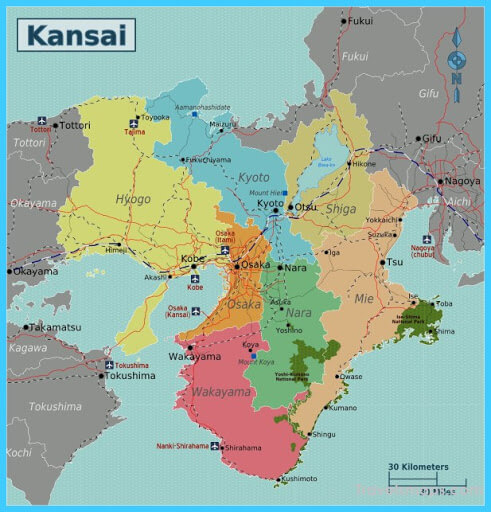

The Kansai region includes, among other places, three of Japan’s most economically prominent prefectures: Osaka, Kobe, and Kyoto.

Osaka / Kobe

Japan’s second-largest urban zone, and the Kansai region’s core, is made up of three cities: Osaka, Kobe, and Kyoto. Together, more than 19 million people live in this metropolitan area that locals call “Keihanshin”.

You might notice, in our analysis of Japan, that we aren’t too bullish on the nation’s property market as a whole. Three decades of weak GDP growth and rapid depopulation, combined with geopolitical and natural disaster risks, are our primary concerns.

However, if you’re already set on investing in Japanese property, the Osaka metro area is probably your best bet outside of Tokyo. Rental demand in these places won’t disappear anytime soon like it will in Japan’s medium and small-sized cities.

As is the case across the rest of Japan, you should certainly focus on a prime, city center area if buying real estate in either Osaka or Kobe.

Limiting your exposure to Japan’s inevitable population decline is a good idea when you’re investing anywhere in the country.

Kyoto

While Kyoto is the smallest out of the Keihanshin area’s three main cities, its population of 3 million isn’t insignificant by any means. It is part of a more extensive metro with almost 20 million people. You’re 30 minutes away from Osaka and Kobe via train.

If you’re set on investing in Kyoto property, it may be an ideal city for an Airbnb rental business. A vast majority of job opportunities in the Keihanshin region are nearer to Osaka.

You’re far more likely to find short-term tourists as tenants than long-term businessmen or retirees. Granted, Airbnb rental businesses in Japan have recently become a lot more challenging to set up.

The government requires all short-term vacation rentals to obtain a hotel license. It’s not exactly an impossible process to go through as a foreign real estate owner, although it’s surely a bureaucratic one!

Putting all that aside (Airbnb investments are an entirely separate topic), Kyoto is undoubtedly one of the most unique cities in Japan. You won’t find anywhere else quite like it.

Many people, Japanese and foreigners alike, feel a particular affinity towards Kyoto and its quaint remnants of imperial Japan.

You might consider buying Kyoto real estate if you’re drawn by the former capital’s charm. Otherwise, much of Kansai’s investment potential lies outside Kyoto in nearby Osaka and Kobe instead.

Sapporo

Japan’s northernmost big city, Sapporo, is separated from the island of Honshu by a 15-kilometer strait of water. Granted, the ocean isn’t stopping a Shinkansen line to Sapporo from being built.

This continuation of Japan’s main Shinkansen line is currently under construction and should be finished by 2030. By the end of this decade, you’ll finally be able to travel from Sapporo all the way down to Tokyo, Kyoto, and most of the rest of Japan.

We think this can boost prices in Sapporo (and indeed, the whole island of Hokkaido) over the short-to-midterm.

Granted, population decline combined with falling real estate demand is a huge concern in Japan’s second-tier cities in the longer term.

Hokkaido’s population is already plummeting. And at the fastest pace out of Japan’s four major islands.

There are a few niche real estate opportunities in Sapporo, especially in the tourist sector as Chinese visitors become an important part of the economy. Otherwise, you’re surely much better off investing in either Tokyo or Osaka.

Nagoya

Nagoya, though just a mid-size city of 3 million people in and of itself, is at the center of Japan’s third-largest metro area.

The Chukyo region consists of Nagoya, along with Komaki, Tokai, and a few other cities, adding up to around 10 million inhabitants.

Unfortunately, Nagoya and its metro area suffers from the same problems as Hokkaido – even if perhaps not quite to the northern Japanese island’s extent. Population decline is well underway in Nagoya.

The worst part about investing in Nagoya’s property market? You’ll pay roughly the same price per square meter compared to, for example, Osaka which enjoys far greater investment potential.

We therefore cannot suggest buying real estate in Nagoya for investment purposes. The city doesn’t have any long-term growth drivers like Tokyo or Osaka… and doesn’t have Sapporo’s strong tourism appeal either.

Finding a Good Real Estate Agent in Japan

If you’re a local, dealing with realtors in Japan is relatively simple. Property agents are ubiquitous across the country. Just step into a realtor’s office located in the area where you want to buy or rent and begin your search from there.

Things change if you’re a foreigner, though, especially if you don’t speak Japanese.The language barrier will not only certainly cause problems, but you’re also likely to face discrimination.

Japan is one of the most nationalist countries in Asia and, to some extent, on Earth. This, in a way, affects the way many of its population treat foreigners.

Though younger generations of Japanese are more adapted to communication in English, the same can’t be said for most older generations.

Despite being one of the most popular tourist destinations, some Ryokan (traditional Japanese inns and hotels) still have a policy to welcome only Japanese-speaking guests.

Although this is a direct form of discrimination, it’s not borne out of racism or ill will; they’re afraid that the language barrier will prevent them from providing you with the best service they can manage.

Still, it is highly recommended that you bring a local friend or hire a lawyer to navigate you through the real estate hunt if you aren’t equipped with the gift of language. It might bruise some people’s ego, but ultimately, saving thousands of dollars will be well worth it.

If you can’t handle it, you’re probably better off staying at home and not doing business in Japan or abroad.

With that said, we’ve purchased and rented properties everywhere, from Bangkok to Shanghai. Yet Japan is the only country where we’ve encountered tenants and realtors “not wanting to deal with non-Japanese.”

You’ll find plenty of English-speaking realtors online, but most are even worse. They won’t refuse your business but may instead rip you off with overpriced nonsense.

How do you find a good real estate agent in Japan as a foreigner, then? Your two best bets are either learning Japanese or asking a trusted friend for help.

While Japan doesn’t rank among Asia’s best places to invest, there isn’t anywhere else quite like it. That’s possibly enough reason to own a house in Japan as a foreigner.

Is Buying Property in Japan a Good Idea?

Now, to the most crucial question: Is buying a house in Japan a good investment?

Japan has its share of problems. A stagnant GDP growth rate and numerous geopolitical issues will weigh heavily on the nation during the 21st century.

Of course, and as mentioned before, Japan is also going through a long-term demographic crisis. This trend will continue for another generation, at the very minimum, and will impact the Japanese real estate market more than just about anything else.

So, is buying a house in Japan a good investment? This depends entirely on where you’re purchasing and how large of an investor you are.

If you own land in one of Tokyo’s central wards, then population decline won’t have much of an effect on you. Plenty of expats and locals alike will continue wanting to live in Tokyo for work opportunities in the foreseeable future.

On the other hand, buying land in a smaller Japanese city like Hokkaido is much riskier even if the minimum entry price is also lower. You might be tempted to “own a part of Japan” for below $100k in a second-tier city such as Hiroshima or Wakayama.

Yet be aware that smaller cities in Japan are a value-trap with limited capital appreciation, few prospective tenants, and barely any resale market if you ever need to sell your asset.

Many foreigners also enjoy Japanese culture and, investment potential aside, want to own property so that they can easily spend time here.

Don’t let us tell you where to buy real estate if your main goal is merely to live in Japan on a long-term basis as a lifestyle decision.

Just understand, in such a case, you would mostly buying a place to live in Japan… not making an investment. You can call it a second home, lifestyle purchase, or a pied-à-terre – but not a superior method of achieving high returns.

This is especially true when comparing real estate in Japan to nearby countries. You can make triple Japan’s rental yields in Southeast Asia’s emerging economies.

Meanwhile, in frontier property markets like Cambodia and Vietnam, capital appreciation prospects are driven by natural demographic factors. Population growth and urbanization are driving up demand in places like these – the complete opposite of Japan.

Your opportunity costs should always be a major consideration when investing offshore. Perhaps owning property in Japan isn’t the greatest idea after all.

FAQs: Investing in Japan Real Estate

Can Foreigners Buy Property in Japan?

Yes, it's legal to own houses and other types of real estate in Japan as a foreigner.

In fact, it's even possible to buy land in Japan as a non-citizen. This makes it one of few countries in Asia where foreigners can own land on a freehold basis.

How Much Does Housing Cost in Japan?

Japan is a very large country, and real estate costs depend on where you're looking. You should expect to buy far above $10,000 per square meter in central Tokyo.

Meanwhile, it's possible to buy a house in Japan's smaller cities like Fukuoka or Nagoya for half the price you'd pay in Tokyo.

If you're looking at villages and rural areas, you'll pay even less for a home. We don't suggest investing in places with population decline though.

Are There Freehold Land Rights in Japan?

Generally, property is owned on a freehold basis here. Land titles in Japan provide permanent ownership to foreigners and locals alike.

Long-term leases between tenants and landlords are also possible. As an investor though, this isn't an ideal method of ownership considering how common freehold property in Japan is.

How High Are Rental Yields in Japan?

Generally, rental yields in Japan are low compared to many other countries in Asia.

The exact numbers will depend on location and the nature of any specific property, but expect gross rental yields of about 4% in central Tokyo.