High inflation, combined with rising interest rates, now ranks among the top concerns that investors have about the global economy.

It’s natural that people want to hold currencies that will maintain their value – whether in Asia or otherwise.

This drives the demands for people to search and find out what is the safest currency in the world they could hold.

Does such thing as “the safest currency” even truly exist though?

To give you a straight answer, let’s make it clear that we don’t believe in a one-size-fits-all theory where one singular currency can rule them all.

You can (and should) reduce risk by diversifying your assets across different currencies. After all, there isn’t any such thing as a “global interest rate.” Inflation and policy rates depend on the specific country and currency we’re talking about.

But, of course, some currencies are safer to hold than others.

Ever since we entered the modern era, there have been regions of the world that have dominated and excelled against the rest during recessions and times of crisis. This is partially because they mastered lessons that put them ahead of the class.

In the 19th century, the future was in Europe with the Industrial Revolution; in the 20th century, the potential was in the United States with Fordism and Taylorism.

Now, in 2025 and beyond, the digital era’s future is in Asia.

With our eyes on the new century, we have to modify our investments to suit the change in demand. Safety lies where there is built-in demand for decades to come and an ecosystem of industries that do business in it.

With that in mind, we will be exploring the five safest currencies in Asia over the last decade as measured by USD and a basket of currencies used by the International Monetary Fund (IMF), which, when packaged together, are known as Special Drawing Rights (XDR).

The reason we will be using these two measures is so that we get a more accurate picture of the currency’s safety.

USD is still the world’s currency, and XDR is a unit of account for the IMF created by blending the monetary value of a basket of currencies.

For reference, an XDR is comprised of USD 43.38%, EUR 29.31%, Renminbi 12.28%, JPY 7.59%, and GBP 7.44% as of the year 2025.

Thus, XDR represents a good baseline to compare to in order to see the true value of the Asian currencies when compared to global purchasing power.

In other words, you’ll be able to see the safety of the currencies, but relative to the world as a whole. A poor USD valuation doesn’t necessarily mean that it’s a badly performing currency when viewed within an international context.

Singapore Dollar (SGD)

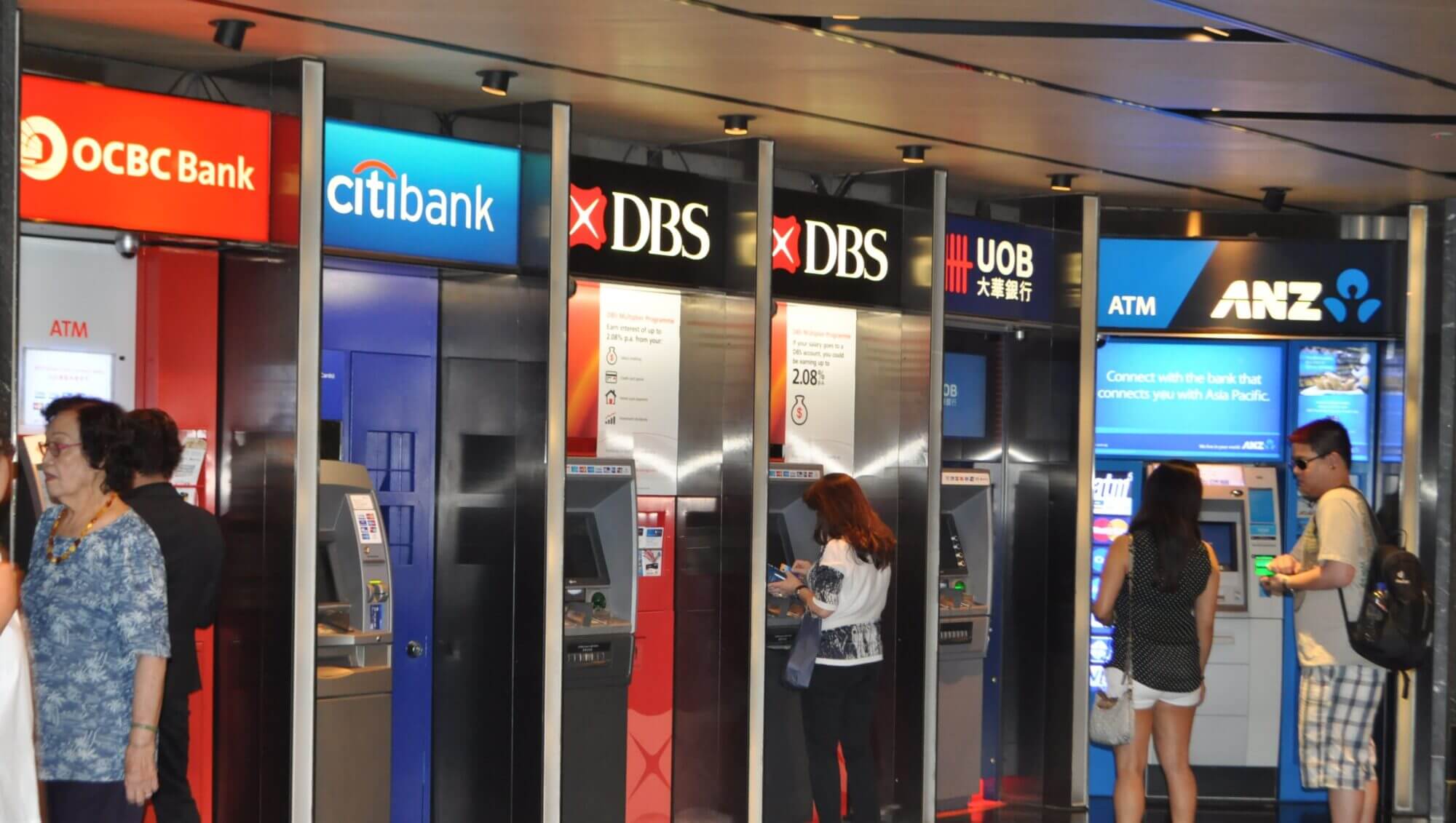

Singapore has been one of world history’s economic miracles, as it went from backwater to top financial center within a lifetime.

Naturally, the Singapore dollar rose along with it. For the most part, it has managed to keep up its value against the USD. In decades prior to this, it appreciated considerably.

Because of this, the Singapore dollar is widely thought of as one of the safest currencies in the world.

Despite the extraordinary appreciation of decades past, price increases are not necessarily desirable in a currency, so the relative stability of the past decade is a good thing.

With price stability comes dependability, allowing a whole ecosystem to grow around it as a consequence. Ultimately, you don’t want your store of value to be volatile, you want it to be reliable.

While Singapore technically shares the spot “most desirable financial center in Asia” with Hong Kong, the SGD today is among the 15 most traded currencies worldwide.

The Singapore dollar is increasingly considered a hedge against major world currencies, for the same reason the currencies of other financial centers (Swiss Franc, Great British Pound) are valued.

Singapore’s focus on banking and wealth management will continue driving demand for its currency. Per capita, Singapore is now the 3rd wealthiest nation in the world.

Furthermore, over the last few decades, Singaporean financial institutions have continued to increase their share of assets under management compared to traditional hubs like Switzerland, which bodes well for investor confidence in SGD and its future prospects.

Looking at the numbers specifically, the SGD fell in price relative to the USD both in the 10-year timeframe and in the 5-year timeframe.

Relatively speaking, the Singapore dollar ranks as one of the safest currencies in the world, not just Asia.

That said, it’s an incomplete story. The SGD isn’t the only safe international currency out there, even if it’s one of the most obvious choices.

You’ll find many other stable currencies in nearby countries.

Korean Won (KRW)

It was only recently that South Korea managed to escape the middle-income trap to join Singapore and Japan as the Asia-Pacific region’s third most developed country. This puts it in a very select list of achieving economies.

Overall, it is a unique mixed economy that still shows great potential for appreciation, especially when we consider the relative stagnancy of its neighbor, Japan.

It bears mentioning that South Korea’s economy is primarily controlled by family-owned conglomerates called chaebols.

Put simply, a considerable portion of the economy’s value remains in illiquid structures that may yet come into play in the stock market in the coming decades.

Given its steady growth and a clear path for development, the Korean Won remains a leading alternative to the Yen for reasons similar to those of the Singapore Dollar.

KRW has fluctuated within a narrow range of 1050 and 1500 to the USD for the past ten years, making it one of the region’s least volatile currencies, and therefore, one of the safest currencies to hold; if stability is what you value, the Korean Won serves that purpose.

Considering the average difference between KRW and USD was under 10% over the course of a decade, it seems to be a rather good diversification hedge if you’re looking to diversify away from the US or European Union.

Thai Baht (THB)

Thailand’s growing economy and middle class make it an attractive place to do business. Partially to blame for this good fortune is the world’s recent diversification away from China and (during normal times) a booming tourism sector.

The Thai Baht is so highly sought after that some investors are increasingly looking at it as an alternative to the Singapore Dollar. Surprisingly, it has maintained less volatility than internationally recognized currencies, like the Japanese Yen.

While we typically refrain from looking at foreign exchanges in year-long timeframes as the volatility often amounts to randomness, the THB did rather well, even against most world currencies, between 2020 and 2025.

That’s particularly noteworthy, considering those weren’t normal years by any measure.

The Thai Baht’s stability over the twenty years has led many investors to consider it Southeast Asia’s second “safe-haven” currency, along with the Singapore dollar.

With that said, Thailand remains a fairly undeveloped economy. Investment sentiment can often get ahead of the on-the-ground realities, and this is reflected in the prices of the past decade.

The THB depreciated by about 10% against the USD over the course of the past decade but appreciated overall within a 5-year timespan.

As for how it is compared to other currencies worldwide, the baht underperformed against XDR on the ten and 5-year timeframes, but these are well within any acceptable volatility range.

In other words, the Thai Baht, at least where currency fluctuations are concerned, punches above its weight classes and is a superior investment compared to other options. We think it’s also one of the safest currencies in Asia.

Japanese Yen (JPY)

Japan was the trendsetter for Asia and started industrialization long before any of its peers – as far back as 1852, it had begun the modernization process.

Unsurprisingly, the Japanese Yen is not only considered one of the safest currencies in Asia but is also the world’s third most heavily traded and liquid currency after the USD and EUR.

This advanced economy, of course, comes at a great price, and it is one of the first economies to suffer from decade-long stagflation. During this time, the economy doesn’t develop, but inflation rises.

Consequently, Japan has debt problems wherein its debt/GDP ratio is over 200%. That’s among the highest in the world – even outdoing the United States.

Nonetheless, the situation is far from being one of doom and gloom! JPY has a long history of relative stability against other major currencies and is backed by a government with an A+ credit rating.

This is reflected fairly well in the international demand against Special Drawing Rights, which has appreciated by over 25% over the course of the last decade and 10% over the last five.

However, we can’t ignore that it has severely underperformed against the US Dollar over a decade (-30%+).

Admittedly, this is a bit of an unfair statement since it was at the highest exchange rate that it’s been in decades. And the situation has become considerably more stable since.

Malaysian Ringgit (MYR)

Malaysia’s economy is the sixth-largest in Southeast Asia. This is, in no small part, because its labor productivity is vastly more developed than in adjacent countries.

Malaysia is increasingly developing knowledge-based industries and is willing to industrialize, hence, prior assessments that it is purely an “oil-linked” currency are outdated.

You can see for yourself that the price of oil fell over the past five years to surprising lows, and yet the MYR performed rather well.

Regarding Special Drawing Rights, which represent most major world currencies, the Malaysian Ringgit generally outperformed, while purely against the USD.

Meanwhile, it underperformed by about -10%, which is comparable to most others on this list, despite being handicapped. This alone should be enough proof to show doubters that there’s much more to Malaysia’s economy than oil exports.

For some investors, the diversification built into Malaysia’s economy has made the Ringgit an attractive alternative to the SGD.

There is one catch, though: it’s illegal to hold MYR in a bank account outside of Malaysia, so you need to have local financial arrangements to invest in it.

Why Hold the Safest Currencies in the World?

A mistake that many people will make when comparing currencies over the course of decades is to look at the relative exchange rate in a vacuum.

In the case that the currencies both fell in value relative to each other, you might initially think your investment performed well. However, when viewed in real terms and against the purchasing power of other currencies, it might paint a different picture.

Remember: the overall goal is to escape the hegemony of the US and diversify away from the USD.

As a hedge, it’s fully expected that you’ll see some relative volatility. But as the economies develop and the USD eventually loses prominence, holding Asia’s, and the world’s safest currencies will be an investment that pays off in the long term.

You certainly won’t be any worse off by holding several of the world’s safest currencies. Having some Thai Baht or Singapore Dollars within an already well-diversified portfolio is always a good idea.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.