Last updated February 3rd, 2024.

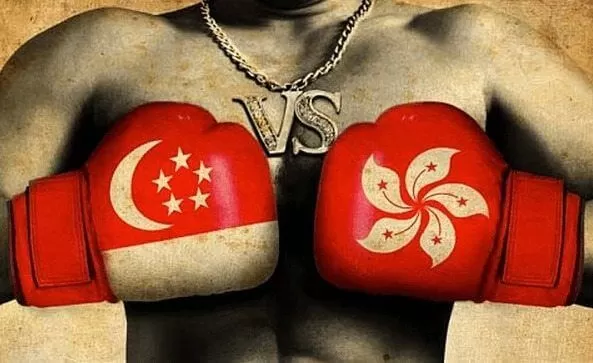

Asia’s population exceeds four billion and will increasingly shape our entire planet. When it comes to Singapore verses Hong Kong, which of these cities is truly at the center of the world’s largest continent?

Not every country will benefit equally from Asia’s rise. The region’s top finance hubs will facilitate capital flow as more money is created and invested across Asia.

Places like Cambodia and Vietnam are growing at a rapid pace, exceeding 7% annually. Yet such frontier markets often lack a robust banking sector or stable rule of law.

Fortunately, that’s where Hong Kong and Singapore come in. Their stable banking sectors complement Asia’s emerging markets with global experience, access to capital, and much-needed stability.

Singapore and Hong Kong are currently top contenders for the title of East Asia’s main finance hub. And the rivalry between them is intense at times.

It’s simple to understand why there’s competition between Singapore vs Hong Kong. After all, Asia is becoming more important on the global stage; population growth in the region leads to an increment in manufacturing and logistics

With such changes inevitable, the new financial hubs of the world are bound to emerge from Asia. No two cities are better equipped for this role than Hong Kong and Singapore are.

Both cities are gateways between the world and their respective regions (Singapore for ASEAN, Hong Kong for Mainland China). Both of them lure an immense amount of foreign investment as well.

Of course, the US-China trade war, alongside mass protests in Hong Kong, might have given Singapore a boost over its rival. But that isn’t the end of our discussion of Hong Kong vs. Singapore, nor is it a nail in the casket.

Singapore boasts the busiest container port in the world by some measures. The Port of Hong Kong held this title not long ago. But the battle of Singapore vs Hong Kong is far from over.

Singapore and Hong Kong: Ranking Near the Top

Hong Kong and Singapore have done many things correctly. Both continuously score near the top of several important rankings too

Singapore has ranked either first or second place in The World Bank’s Ease of Doing Business Index since 2006, while Hong Kong scored in the top four since 2007.

Similarly, and despite Hong Kong and Singapore’s small size, each of them hosts one of the top five busiest container ports in the world.

The total value of Singaporean exports is greater than anywhere else in Southeast Asia. That’s despite being the smallest country in the whole region as far as size is concerned.

Much of Singapore’s success regarding trade is due to its massive re-export sector. Likewise, it has became adept at producing high-value goods, including pharmaceuticals and refined petroleum.

Products such as those are ideal for Singapore’s circumstances and size. Drugs and refined gas simply take up less space on the factory floor when compared to the vast majority of goods.

Of course, this doesn’t conclude the battle of Hong Kong vs Singapore by any means. Hong Kong’s import and export sector contributed over 18% of its GDP last year, the third highest among all sectors, which is still an impressive feat for a city of its size.

Which is Best for Banking and Asset Management?

All prominent financial hubs of the world share several characteristics. They all have excellent banks, skilled market-makers, along with a host of other reputable institutions.

You simply cannot be a financial center without having these qualities, and neither Singapore nor Hong Kong disappoints in that realm.

Singapore and Hong Kong combined have barely more than half a percent of the Earth’s total population. Yet each of them grabbed two spots on the list of strongest banks in the world.

The entire continent of Europe only has three of the world’s best banks, while all of the Asian continent has just six by comparison.

Meanwhile, tax rates in both cities are among the world’s lowest. Offshore companies in Hong Kong or Singapore, if structured correctly, can pay zero percent income tax, assuming they are not serving local customers.

Even if you’re conducting business and paying tax in these two countries, it’s still a rather low rate for individuals and corporations alike. Income tax rates in Singapore and Hong Kong are below 20% in the highest income brackets.

Neither of these jurisdictions has estate or capital gains tax, making both a great choice for investors or wealthy retirees.

Combined with additional factors such as business-friendliness and transparent legal systems, tons of foreign capital is lured into Hong Kong and Singapore – perhaps even too much money at times.

Singapore’s real estate market, for example, required government intervention to cool it down. Property in Singapore is arguably in a bubble.

Singapore vs. Hong Kong? There May Not Be a Fight

Both Hong Kong and Singapore obviously do banking very well. But their similarities lead many to wonder if one is a better place to invest and conduct business in.

Some analysts even think one will eventually overwhelm the other and make it obsolete in the long term.

Yet there’s no easy answer to the question of “which jurisdiction is better?”. It depends entirely on what you’re looking for.

For example, Singapore is a hub for entrepreneurship. It’s easier to navigate for venture capital firms and safer to launch an international startup in.

Singapore’s legal system, which is based on British common law, combined with its availability of native English speakers gives them an edge if you’re an entrepreneur or venture capitalist.

Hong Kong, on the other hand, specializes in investment and finance. Its link with the Shanghai Stock Exchange along with a larger presence of multinational banks and brokerage firms give it an advantage over Singapore in that arena.

Contrasts between Singapore and Hong Kong don’t stop there either. Singapore remains best at wealth management, Hong Kong at investment banking. Singapore when it comes to Forex, Hong Kong for equity trading.

More likely, these two jurisdictions will complement one another (similar to the way Zurich and Frankfurt do) rather than Singapore or Hong Kong “winning”.

Regardless, the world is watching the “fight” between Singapore vs. Hong Kong. They are both perfect examples of Asia’s rise as a whole.

What About Protests and the Trade War?

Large-scale protests in Hong Kong combined with an intensifying trade war between China and the United States are causing a few people to wonder: is Hong Kong now dying? Did Singapore finally win?

Indeed, billions worth of capital fled from Hong Kong to Singapore lately. Political instability is taking its toll on Hong Kong’s reputation as a safe haven… and Singapore stands to gain from its competitor’s loss.

We can’t predict the future. Regardless of what happens though, Hong Kong will probably hang onto a majority of its strong points.

For example, Singapore will never get as close to China as Hong Kong is. Whether we’re talking about in a geographic or political sense.

Hong Kong’s physical proximity to the mainland, direct linkages between Hong Kong, Shanghai, and Shenzhen’s stock exchanges, and the “One Country, Two Systems” principle are all factors that Singapore can’t replicate.

Conversely, because of recent developments, Singapore definitely won’t lose its status as Asia’s wealth management hub anytime soon.

Skip the Next Western Recession

Learn the best places to invest - and where to avoid - by downloading our free Investment Cheat Sheet.